Champion Iron Ltd (ASX: CIA) Share Price and News

Price

–

Movement

– ( )

(20 mins delayed)

52 Week Range

– - –

1 Year Return

Champion Iron Ltd Chart and Price Data

Fundamentals Data provided by Morningstar.

Data provided by Morningstar.Share Price

–

Day Change

– ( )

52 Week Range

– - –

Yesterday's Close

–

Today's Open

–

Days Range

– - –

Volume

–

Avg. Volume (1 month)

–

Turnover

–

Champion Iron Ltd (ASX: CIA)

Latest News

Share Gainers

Here are the top 10 ASX 200 shares today

Share Gainers

Here are the top 10 ASX 200 shares today

Resources Shares

What's the outlook for iron ore prices in 2025?

Share Gainers

Here are the top 10 ASX 200 shares today

Resources Shares

Why is the Fortescue share price tanking 7% this week?

Share Fallers

Why Champion Iron, Endeavour, Infomedia, and Resolute Mining shares are sinking today

Dividend Investing

4 ASX All Ords shares with ex-dividend dates next week

Materials Shares

Forget Fortescue and buy this ASX mining stock for a 30%+ return

Share Gainers

Here are the top 10 ASX 200 shares today

Bank Shares

Will the rotation out of ASX 200 bank shares into the miners continue?

Resources Shares

Is the rally in ASX 200 iron ore stocks just a short-term bounce?

Share Market News

Here's how the ASX 200 market sectors stacked up last week

Frequently Asked Questions

-

Yes, Champion Iron paid has paid unfranked shareholder dividends in its recent history.

-

Champion Iron is listed on the ASX and the Toronto Stock Exchange (TSX) in Ontario, Canada.

-

Champion Iron listed on the ASX on 8 June 2007.

Dividend Payment History Data provided by Morningstar.

| Ex-Date | Amount | Franking | Type | Payable |

|---|---|---|---|---|

| 12 Jun 2025 | $0.1124 | 0.00% | Final | 10 Jul 2025 |

| 11 Nov 2024 | $0.1100 | 0.00% | Interim | 28 Nov 2024 |

| 13 Jun 2024 | $0.1102 | 0.00% | Final | 03 Jul 2024 |

| 06 Nov 2023 | $0.1112 | 0.00% | Interim | 28 Nov 2023 |

| 13 Jun 2023 | $0.1135 | 0.00% | Final | 05 Jul 2023 |

| 07 Nov 2022 | $0.1125 | 0.00% | Interim | 29 Nov 2022 |

| 06 Jun 2022 | $0.1109 | 0.00% | Final | 28 Jun 2022 |

| 07 Feb 2022 | $0.1087 | 0.00% | Interim | 01 Mar 2022 |

CIA ASX Announcements

An announcement is considered as "Price Sensitive" if it is thought that it may have an impact on the price of the security.

| Date | Announcement | Price Sensitive? | Time | No. of Pages | File Size |

|---|

About Champion Iron Ltd

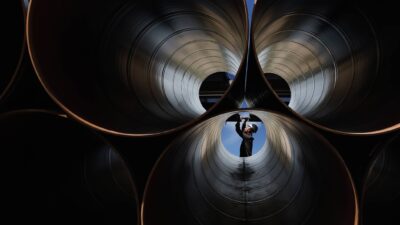

Champion Iron Ltd (ASX: CIA) is an iron ore miner, explorer, and developer operating in Quebec, Canada. The company currently owns and operates the Bloom Lake open-pit mine which exports high-grade, low-contaminant iron ore globally. This operation generates the vast majority of the company's revenue.

Champion also owns a portfolio of eight other exploration and development sites in the same region, including the Kamistiatusset project and Fire Lake North. Its portfolio also includes the Powderhorne zinc and copper project in Newfoundland, Canada.

CIA Share Price History Data provided by Morningstar.

| Date | Close | Change | % Change | Volume | Open | High | Low |

|---|---|---|---|---|---|---|---|

| 02 Jul 2025 | $4.28 | $0.08 | 1.90% | 1,492,650 | $4.25 | $4.31 | $4.22 |

| 01 Jul 2025 | $4.20 | $0.03 | 0.72% | 1,314,950 | $4.10 | $4.20 | $4.06 |

| 30 Jun 2025 | $4.17 | $-0.11 | -2.57% | 1,882,583 | $4.28 | $4.29 | $4.07 |

| 27 Jun 2025 | $4.28 | $0.21 | 5.16% | 1,599,260 | $4.19 | $4.31 | $4.16 |

| 26 Jun 2025 | $4.07 | $-0.02 | -0.49% | 1,382,099 | $4.04 | $4.11 | $4.01 |

| 25 Jun 2025 | $4.09 | $0.00 | 0.00% | 1,539,305 | $4.10 | $4.16 | $4.05 |

| 24 Jun 2025 | $4.09 | $0.14 | 3.54% | 4,918,037 | $4.07 | $4.11 | $4.01 |

| 23 Jun 2025 | $3.95 | $-0.12 | -2.95% | 2,457,622 | $4.08 | $4.08 | $3.90 |

| 20 Jun 2025 | $4.07 | $-0.11 | -2.63% | 5,527,676 | $4.15 | $4.18 | $4.03 |

| 19 Jun 2025 | $4.18 | $-0.15 | -3.46% | 2,013,921 | $4.30 | $4.34 | $4.07 |

| 18 Jun 2025 | $4.33 | $-0.07 | -1.59% | 1,484,118 | $4.38 | $4.38 | $4.31 |

| 17 Jun 2025 | $4.40 | $0.02 | 0.46% | 1,219,076 | $4.38 | $4.44 | $4.31 |

| 16 Jun 2025 | $4.38 | $0.17 | 4.04% | 2,767,971 | $4.28 | $4.40 | $4.27 |

| 13 Jun 2025 | $4.21 | $0.00 | 0.00% | 1,606,302 | $4.23 | $4.25 | $4.07 |

| 12 Jun 2025 | $4.21 | $-0.28 | -6.24% | 2,058,367 | $4.35 | $4.38 | $4.21 |

| 11 Jun 2025 | $4.49 | $0.07 | 1.58% | 1,207,490 | $4.50 | $4.57 | $4.47 |

| 10 Jun 2025 | $4.42 | $0.00 | 0.00% | 1,028,708 | $4.42 | $4.50 | $4.42 |

| 06 Jun 2025 | $4.42 | $-0.03 | -0.67% | 810,158 | $4.45 | $4.46 | $4.39 |

| 05 Jun 2025 | $4.45 | $0.15 | 3.49% | 1,701,551 | $4.29 | $4.45 | $4.26 |

| 04 Jun 2025 | $4.30 | $0.13 | 3.12% | 1,704,527 | $4.21 | $4.38 | $4.17 |

| 03 Jun 2025 | $4.17 | $-0.13 | -3.02% | 1,311,395 | $4.32 | $4.34 | $4.16 |

Director Transactions Data provided by Morningstar.

| Date | Director | Type | Amount | Value | Notes |

|---|---|---|---|---|---|

| 12 Jun 2025 | David Cataford | Exercise | 325,899 | $1,251,452 |

As advised by the company. CAD, 1,952,469 PSUs and RSUs, Settlement of Vested PSUs and RSUs for cash

|

| 31 Mar 2025 | Louise Grondin | Issued | 13,383 | $62,498 |

Issue of securities. CAD 118,092 DSU

|

| 31 Mar 2025 | Jessica McDonald | Issued | 15,134 | $70,675 |

Issue of securities. CAD 47,260 DSU

|

| 31 Mar 2025 | Ronald (Ronnie) Beevor | Issued | 19,378 | $102,122 |

Issue of securities. 46,987 DSU

|

| 31 Mar 2025 | Gary Lawler | Issued | 18,840 | $99,286 |

Issue of securities. 149,867 DSU

|

| 31 Mar 2025 | Michelle Cormier | Issued | 16,060 | $75,000 |

Issue of securities. CAD 129,621 DSU

|

| 25 Feb 2025 | William O'Keeffe | Buy | 100,000 | $568,816 |

On-market trade.

|

| 28 Nov 2024 | Ronald (Ronnie) Beevor | Issued | 501 | $2,980 |

Issue of securities. DSUs (direct): 27,609

|

| 28 Nov 2024 | Gary Lawler | Issued | 2,378 | $14,149 |

Issue of securities. Deferred share units: 131,027

|

| 28 Nov 2024 | Michelle Cormier | Issued | 2,003 | $11,156 |

Issue of securities. Deferred Share Units 113,561

|

| 28 Nov 2024 | David Cataford | Issued | 26,060 | $145,154 |

Issue of securities.

|

| 28 Nov 2024 | Jessica McDonald | Issued | 567 | $3,158 |

Issue of securities. CAD, Deferred Share Units 32,126

|

| 28 Nov 2024 | Louise Grondin | Issued | 1,847 | $10,287 |

Issue of securities. Deferred Share Units 104,709

|

| 30 Sep 2024 | Louise Grondin | Issued | 10,064 | $62,497 |

Issue of securities. Deferred Share Units 102,862

|

| 30 Sep 2024 | Jessica McDonald | Issued | 11,381 | $70,676 |

Issue of securities. cad$, Deferred Share Units 31,559

|

| 30 Sep 2024 | Michelle Cormier | Issued | 8,052 | $50,002 |

Issue of securities. Deferred Share Units 111,558, cad

|

| 30 Sep 2024 | Gary Lawler | Issued | 15,021 | $99,288 |

Issue of securities. Deferred share units: 128,649

|

| 30 Sep 2024 | Ronald (Ronnie) Beevor | Issued | 15,450 | $102,124 |

Issue of securities. DSUs (direct): 27,108

|

| 24 Sep 2024 | David Cataford | Sell | 37,500 | $217,125 |

On-market trade.

|

| 24 Sep 2024 | David Cataford | Exercise | 37,500 | $187,500 |

Exercise of options. CAD

|

| 24 Sep 2024 | David Cataford | Buy | 37,500 | $187,500 |

Exercise of options.

|

| 05 Aug 2024 | David Cataford | Issued | 23,718 | $142,782 |

Issue of securities. CAD, 1,451,566 RSU and PSU

|

| 05 Aug 2024 | Ronald (Ronnie) Beevor | Issued | 192 | $1,263 |

Issue of securities. 11,658 DSU

|

| 05 Aug 2024 | Gary Lawler | Issued | 1,872 | $12,317 |

Issue of securities. 113,628 DSU

|

| 05 Aug 2024 | Michelle Cormier | Issued | 1,691 | $10,179 |

Issue of securities. CAD, 103,506 DSU

|

| 05 Aug 2024 | Jessica McDonald | Issued | 330 | $1,986 |

Issue of securities. CAD, 20,178 DSU

|

| 05 Aug 2024 | Louise Grondin | Issued | 1,516 | $9,126 |

Issue of securities. 92,798 DSU, CAD

|

Directors & Management Data provided by Morningstar.

| Name | Title | Start Date | Profile |

|---|---|---|---|

| Mr Ronald (Ronnie) Hugh Beevor | Non-Executive Director | Mar 2024 |

Mr Beevor has over 40 years of experience in investment banking and the mining sector, including as Chair and non-executive director of several mining companies in Australia and internationally. He is presently Chairman of Felix Gold, which has gold exploration properties in Alaska, director of Mont Royal Resources and director of Lucapa Diamond Company Limited, an international producer of high value diamonds. He recently retired as Chairman of Bannerman Energy Limited, owner of the Etango uranium deposit in Namibia. Previously, Mr. Beevor served as head of investment banking at Rothschild Australia, Chair of EMED Mining, which acquired, developed and operated the Rio Tinto copper mine in Southern Spain. Mr. Beevor also served on the board of Oxiana Limited, which developed gold and copper operations in Laos, acquired the Golden Grove polymetallic mine in Western Australia, developed the Prominent Hill mine in South Australia and merged with Zinifex Limited to form OZ Minerals, which was acquired in 2023 by BHP Group Limited for A$9.5 billion. He is a member of the People and Governance Committee.

|

| Mr William Michael O'Keeffe | Executive ChairmanExecutive Director | Aug 2013 |

Mr O'Keeffe began his career in 1975 with MIM Holdings, where he held several senior operating positions and advanced to Executive Management in commercial activities. In 1995, he became Managing Director of Glencore Australia (Pty) Limited, a position he held until July 2004. Mr. O'Keeffe was also the founder and Executive Chairman of Riversdale Mining Limited and currently serves as a member of the Board of Directors for Burgundy Diamond Mines Ltd.

|

| Mr Jyothish Devina George | Non-Executive Director | Oct 2017 |

Mr George is currently Head of Copper Marketing at Glencore. Immediately prior to his current role, Mr. George served as head of marketing for iron ore at Glencore. Prior to that he was the Chief Risk Officer of Glencore. He earlier held several roles at Glencore's head office in Baar, Switzerland, and from 2009 onwards focused on iron ore, nickel and ferroalloys physical and derivatives trading, and has been involved with iron ore marketing since its inception at Glencore. Mr. George joined Glencore in 2006 in London. He was previously a Principal at Admiral Capital Management in Greenwich, Connecticut, a Vice-President in equity derivatives trading at Morgan Stanley in New York and started his career at Wachovia Securities in New York as a Vice-President in convertible bonds trading.

|

| Mr Gary Lawler | Non-Executive Director | Apr 2014 |

Mr Lawler worked as an Australian corporate lawyer specializing in mergers and acquisitions for 45 years, during which time he was a partner in several Australian law firms. Mr. Lawler is also the Chairman of Mont Royal Resources Limited. He has previously held board positions with Dominion Mining Limited, Riversdale Mining Limited, Riversdale Resources Limited and Cartier Iron Corporation, and brings legal, governance and business experience to the Board. He is a Chair of the People and Governance Committee.

|

| Ms Michelle Cormier | Non-Executive Director | Apr 2016 |

Ms Cormier is a senior-level executive with experience in management, including financial management, corporate finance, turnaround and strategic advisory situations and human resources. She has a capital markets background, with experience in public companies listed in the United States and Canada. She has experience in corporate governance, having served on several boards of directors of publicly listed and privately held companies as well as government-owned institutions and not-for-profit organizations. Ms. Cormier has been a consultant to Wynnchurch Capital Canada, Ltd. since 2014. Previously, she spent 13 years in senior management and as Chief Financial Officer of a large North American forest products company, and eight years in various senior management positions at Alcan Aluminum Limited (Rio Tinto). Ms. Cormier articled with Ernst & Young. She currently serves on the Board of Directors of Cascades Inc. She is a member of the People and Governance Committee.

|

| Mr David Cataford | Chief Executive OfficerExecutive Director | Apr 2019 |

Mr Cataford steered the recovery of assets, the restart of the Bloom Lake Mine and today, with the support of a team of over 1,300 employees. Prior to joining Champion Iron, he held various management positions with other mining companies operating in the Labrador Trough, including Cliffs Natural Resources Inc. and ArcelorMittal. He was also co-founder and president of the North Shore and Labrador Mineral Processing Society.

|

| Ms Louise Grondin | Non-Executive Director | Aug 2020 |

Ms Grondin retired as Senior Vice-President of Human Resources and Culture for Agnico Eagle Mines Limited, an international gold producer based in Canada, in January 2021. Joining Agnico Eagle in 2001, Ms. Grondin has held various management positions, including Senior Vice-President of Environment, Sustainable Development and Human Resources and Senior Vice-President of Environment and Sustainable Development. Prior to working with Agnico Eagle, Ms. Grondin was Director of Environment, Human Resources and Safety for Billiton Canada Ltd. She also sits on the Board of Wesdome Gold Mines Ltd. She is a member of the People and Governance Committee.

|

| Ms Jessica McDonald | Non-Executive Director | Aug 2023 |

Ms McDonald has been a corporate director since 2014 and has been certified by the Institute of Corporate Directors since 2017. She is currently a member of the board of directors of GFL Environmental Inc. and Foran Mining Corporation. Ms. McDonald was also a director of Coeur Mining, Inc. from 2018 to 2023, a director of Hydro One Limited from 2018 to 2022 and a director and chair of Trevali Mining Corporation between 2017 and 2020. She acted as interim President and Chief Executive Officer of Canada Post Corporation from April 2018 to March 2019 and was the chair of its board of directors between 2017 and 2020. Ms. McDonald served as the Chair of Powertech Labs, testing and research laboratories in North America and a director of Powerex, an energy trading company. Ms. McDonald has government experience, including serving as Deputy Minister to the Premier and Head of the BC Public Service.

|

| Mr William Michael Hundy | Company Secretary | Jan 2023 |

-

|

| Mr Steve Boucratie | General Counsel and Corporate SecretaryVice President | Jun 2019 |

-

|

| Donald Tremblay | Chief Financial Officer |

-

|

|

| Alexandre Belleau | Chief Operating Officer |

-

|

|

| William Michael Hundy | Company Secretary |

-

|

|

| Steve Boucratie | General Counsel and Corporate SecretaryVice President |

-

|

|

| Michael Marcotte | Senior Vice President Corporate Development and Capital Markets |

-

|

|

| Angela Kourouklis | Senior Vice President Human Resources |

-

|

|

| Francois Lavoie | Senior Vice President Sales Technical Marketing and Product Development |

-

|

Top Shareholders Data provided by Morningstar.

| Name | Shares | Capital |

|---|---|---|

| HSBC Custody Nominee Aust Ltd | 79,560,617 | 15.35% |

| JP Morgan Nom Aust PL | 64,683,112 | 12.48% |

| Citicorp Nom PTY Ltd | 45,338,634 | 8.75% |

| Investissement Qubec | 43,500,000 | 8.39% |

| WC Strategic Opportunity LP | 41,944,444 | 8.09% |

| Prospect AG Trading PL | 34,362,930 | 6.63% |

| Blackrock Group | 27,944,212 | 5.39% |

| Vanguard Group | 25,966,079 | 5.01% |

| Metech Super PL | 10,600,000 | 2.05% |

| Mr. Michael O'Keeffe | 6,851,900 | 1.32% |

| BNP Paribas Nominees Pty Ltd | 4,415,887 | 0.85% |

| National Nominees LTD | 3,648,290 | 0.70% |

| HSBC Custody Nominees Aust Ltd (Commonwealth Super Corp) | 2,318,950 | 0.45% |

| BNP Paribas Nominees PTY LTD Custodial Serv LTD DRP | 2,252,104 | 0.43% |

| BNP Paribas Nominees PTY LTD Global Markets | 2,248,552 | 0.43% |

| Mr. David Cataford | 2,244,999 | 0.43% |

| HSBC Custody Nominees Aust Ltd AC2 | 2,215,086 | 0.43% |

| BNP Paribas Nominees PTY LTD Agency Lending | 2,019,163 | 0.39% |

| Bass Family Foundation PTY LTD | 1,510,000 | 0.29% |

| HSBC Custody Nominees Aust Ltd | 1,323,948 | 0.26% |