Diversification has been described as 'the only free lunch in investing'. However, Warren Buffett has warned against the dilutive effect of over-diversifying.

Given this dilemma, how many stocks should investors own? Is there a magic number?

Diversification vs Concentration

The trade-off between diversification and concentration has long been a subject of debate.

Diversification mitigates risk by spreading investments across several asset classes, sectors, and geographies. Having too much in one investment can be disastrous if you get it wrong. In some cases, investors can take years to recover from a poor investment choice.

However, over-diversification (many stocks) also diminishes an investor's chance of beating the market. This is because their portfolio can resemble the wider index after so many stocks are added.

Alternatively, holding a more concentrated portfolio (less stocks) puts investors in a good position to beat the market if their stock picks are successful. It allows their big winners to really make a difference.

So, what's the right balance? Let's see what the world's most successful stock picker has to say.

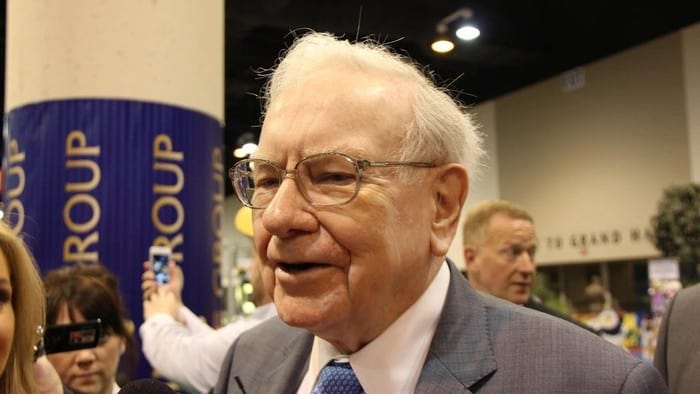

Warren Buffett's approach

During Berkshire Hathaway's 1996 annual meeting, Warren Buffett told investors:

You know, we think diversification is – as practiced generally – makes very little sense for anyone who knows what they're doing.

If you know how to analyze businesses and value businesses, it's crazy to own 50 stocks or 40 stocks or 30 stocks, probably, because there aren't that many wonderful businesses that are understandable to a single human being, in all likelihood.

While warning against holding above 30 stocks, Buffett also raised an interesting point regarding time management.

Holding a large number of stocks is also time-consuming. It requires a lot of time and effort to know a business really well and follow it closely. Above a certain number of stocks, it becomes impossible to remain up to speed on a company's latest initiatives. Missing these key details can impact investment decisions when trying to beat the market.

The size is more important than the number

The number of stocks matters far less than the position size of an investor's top holdings.

While Buffett, in fact, does own around 50 stocks, his top 10 holdings make up around 80% of Berkshire's portfolio. These include Apple, American Express, Bank of America, and Coca-Cola. If any of these investments were to go south, it would be a major drag on Berkshire's return.

Hence, it is important for investors to pay attention to the percentage size of each stock that makes up their overall portfolio.

Smart diversification

Adding extra stocks to your portfolio does not always reduce risk. Investors should be selective about any additional stocks they introduce into their portfolios.

In his best-selling novel One Up on Wall Street, fund manager Peter Lynch explains:

There is no use diversifying into unknown companies for the sake of diversity. A foolish diversity is the hobogoblin of small investors.

Foolish Takeaway

Although many experts suggest owning 20-25 stocks to maximise diversification benefits, there is no magic number. The position size of an investor's top holdings matters far more than their total holdings.

Warren Buffett has achieved great success by adopting a more concentrated approach. However, investors must reflect on their individual circumstances before deciding what is right for them. This includes their risk tolerance, market knowledge, and time horizon.