Unfortunately, ASX shares have taken a major hit in recent weeks, with volatility rattling investors and pushing prices significantly lower.

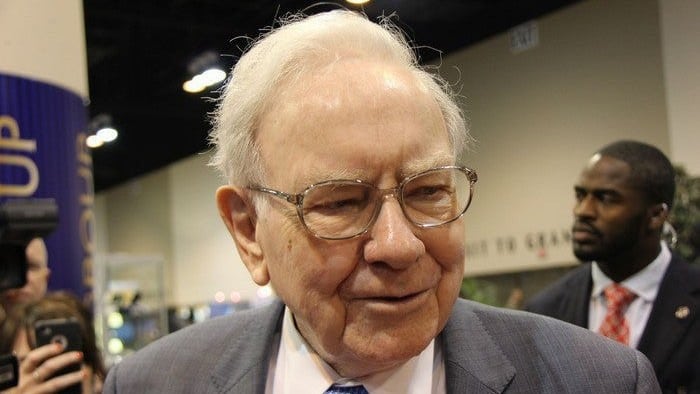

But as legendary investor Warren Buffett once said, "Price is what you pay, value is what you get."

For long-term investors, market dips can be golden opportunities to buy quality ASX shares at a discount.

Instead of fearing falling prices, investors should focus on underlying business fundamentals. After all, a company's true value doesn't change overnight just because its share price drops.

With that in mind, let's take a closer look at why market pullbacks can be a chance to build wealth and how investors can take advantage of the recent ASX share weakness.

Market dips vs. business fundamentals

Short-term market movements are often driven by emotions and uncertainty. However, great businesses remain great despite short-term fluctuations.

Warren Buffett's philosophy is to invest in high-quality companies that generate strong cash flows, have sustainable competitive advantages, and are run by a strong management team.

If a company with a dominant market position and strong earnings power suddenly sees its share price fall due to broader market fears, that doesn't necessarily mean the business itself is in trouble. More often than not, it presents an opportunity to buy a great ASX share at a discount to what investors were willing to pay just a short time ago.

The power of patience in investing

One of Warren Buffett's key principles is patience. While the market can be unpredictable in the short term, history has shown that quality ASX shares tend to recover and deliver strong long-term returns.

Trying to perfectly time the market is nearly impossible, but buying when prices are low and holding through cycles has proven to be a winning strategy.

For example, during market downturns in the past, investors who held onto high-quality ASX stocks such as Goodman Group (ASX: GMG), Macquarie Group Ltd (ASX: MQG), and Xero Ltd (ASX: XRO) have been rewarded when sentiment improves.

In fact, over the past five years, these shares are up 170%, 130%, and 155%, respectively, since being dragged lower by the COVID-19 market selloff.

How to approach the current ASX share dip

If you're considering buying the dip, here are some key things to keep in mind:

The first thing is to focus on fundamentals. Look for businesses with strong financials, competitive advantages, and resilient earnings.

It is also important to think long-term. Avoid short-term panic and instead invest with a multi-year time horizon.

Diversify by spreading investments across different sectors, which can help manage risk, and stick to a strategy. Whether it's dollar-cost averaging or value investing, having a clear plan can help you navigate market swings.

Foolish takeaway

Warren Buffett's advice has stood the test of time and there's nothing to stop ASX share investors from following in his footsteps. Let's now finish with another quote from the Oracle of Omaha.

He once quipped: "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."