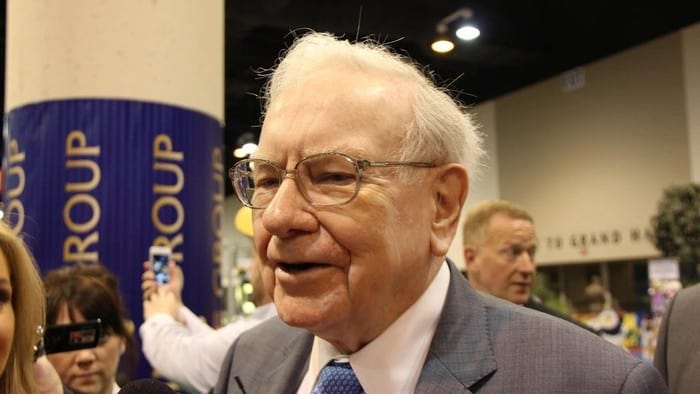

Investors, including US legend Warren Buffett, want to make returns. But, it may be harder to justify an investment at the current market prices because of how high the S&P/ASX 200 Index (ASX: XJO) is. Just look at the chart below from the last 10 years, it's not far off its all-time high.

Yet there are so many things to worry about. Inflation hasn't been completely tamed (particularly US inflation), interest rates remain quite high, geopolitical tensions are still there, there are question marks about the demand for iron ore and how tariffs will affect China, and so on.

How are investors supposed to know if this is a good time to invest?

I'd refer to some wise words from the leader of Berkshire Hathaway, Warren Buffett. He has invested through a number of economic challenges, such as the GFC. Times obviously aren't as bad as the GFC right now, but his wisdom is just as useful.

Buy wonderful businesses

Warren Buffett has made several very successful investment choices over the years, such as buying insurance business GEICO outright and investing in names like Coca-Cola, American Express, Apple, BYD, Bank of America, and major Japanese trading companies.

Those investments were made at various times over the years, during good times and bad, at higher or lower valuations.

I'd imagine Warren Buffett would say that they are all very good companies. But would he still invest in those businesses at higher valuations? Well, he once said:

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

The best businesses, such as Berkshire Hathaway, are likely to keep producing compelling results over the long term, whereas a 'fair' company may be a bit 'hit and miss' at best.

Warren Buffett once made a comparison between investing and a famous baseball batter called Ted Williams. Choosing when to invest is like deciding to wait for the right pitch. According to CNBC, Buffett said:

If he waited for the pitch that was really in his sweet spot, he would bat .400. If he had to swing at something on the lower corner, he would probably bat .235.

The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, 'Swing, you bum!,' ignore them.

Some ASX 200 shares may seem expensive today, but they could grow materially in five or ten years, making today's thoughts on valuation seem irrelevant.

So, as long as the valuation doesn't seem ridiculous, I plan to keep buying quality businesses that have growth potential.