This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

In theory, a company's size shouldn't matter. A stock's potential return on any amount of capital invested in it should be investors' chief concern.

In reality, however, the market's biggest companies are also often the market's most rewarding tickers. That's how they became the biggest names, after all. That's certainly been the case with Nvidia (NASDAQ: NVDA). It was already a $360 billion company at the end of 2022, but two years of triple-digit gains have turned it into a $3.4 trillion titan.

The question is, can the stock repeat that feat in 2025?

How Nvidia got here in the first place

It's not the stock market's biggest company right now -- that honour belongs to Apple once again, which is worth $3.7 trillion as of this writing. But Nvidia currently occupies second-place, according to The Motley Fool's in-house research, and Microsoft is in third with a market cap of about $3.2 trillion.

Regardless, a company's size isn't nearly as important to an investor as its stock's potential upside is. So, where does Nvidia stand in that regard?

The foundation of its recent outperformance and outlook is artificial intelligence (AI). Although the technology giant makes graphics cards for gaming, illustrative and design work, and automotive and robotic applications, its biggest business right now is AI data centres. This segment now consistently accounts for more than 80% of the company's top line, and data centre sales in the most recent quarter (fiscal 2025 Q3) grew by more than 100% year over year to $30.8 billion.

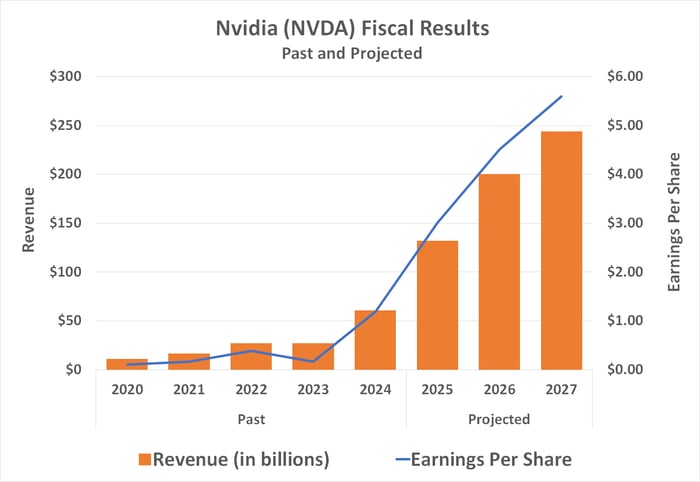

That's a tough act to follow, and mathematically speaking, such triple-digit growth is unlikely to continue for much longer. Although the analyst community is calling for top-line growth of 112% for Nvidia's fiscal 2025, revenue is expected to increase 52% next year.

Data source: StockAnalysis.com. Chart by author.

That's still rapid growth to be sure, bolstered by earnings growth that's apt to be just as brisk. With the stock already priced at more than 50 times its trailing per-share profits and more than 30 times estimates for fiscal 2026, however, would-be buyers of the stock may be balking at the frothy valuation.

The thing is, those hesitant investors may be looking right past a couple of important -- and bullish -- realities.

Don't ignore either of these two things

First, the artificial intelligence revolution is still nowhere near its end. It's arguably still in its earliest stages. For hardware providers like Nvidia, market research outfit Mordor Intelligence puts the industry's potential growth in perspective, calling for average annualised AI hardware revenue growth of 26% through 2030, jibing with expectations from Precedence Research. Market.Us puts the figure closer to 32% through 2033.

Given that Nvidia supplies the vast majority of the processors used by AI data centre owners and operators, it stands to gain the most from this continued market growth.

Competition is coming to be sure. Apple is working with Arm Holdings to develop a chip that's just as AI-capable as any of Nvidia's tech, for instance. But for every poke a competitor takes at Nvidia's dominance of the artificial intelligence hardware market, however, the company seems to counter with something even better. As an example, Nvidia's recently unveiled NIM microservices allow seemingly ordinary desktop computers to function as personal supercomputers capable of handling even the toughest inference or generative AI workloads.

And the second critical reality investors must consider? As richly as Nvidia stock may be priced at this time, that's nothing unusual for this ticker. Nvidia's trailing 12-month price-to-earnings (P/E) ratio has averaged above 80 in the past five years.

The analyst community isn't deterred either. The vast majority of analysts still consider Nvidia shares a strong buy despite its steep valuation, giving the stock a consensus price target of $174.60, or 25% above its present price.

Future growth remains the key

None of this inherently means Nvidia will be the market's top-performing stock in 2025, even among the so-called "Magnificent Seven" companies that already boast massive market caps.

But by supplying the foundation for artificial intelligence technology that's still in huge demand -- and that's apt to remain in heavy demand for years to come -- Nvidia is well positioned to remain one of the market's biggest companies.

Even so, that's not the chief reason you'd want to own a piece of the company. The bull case here remains rooted in Nvidia's strong top- and bottom-line growth prospects.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.