This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Once again, investors couldn't get enough of artificial intelligence (AI) stocks last year. Obvious opportunities among the "Magnificent Seven" remained some of Wall Street's highest conviction choices.

However, one megacap technology stock that lagged for most of 2024 was Tesla (NASDAQ: TSLA).

Below, I'm going to detail the volatility seen in Tesla stock last year and explore why shares are currently selling off. Is now an opportunity to buy the dip, or should investors stay away?

Tesla's turbulent 2024

Between January and October 2024, Tesla stock experienced some pronounced ebbs and flows. But on a net basis, shares were actually completely flat during these 10 months.

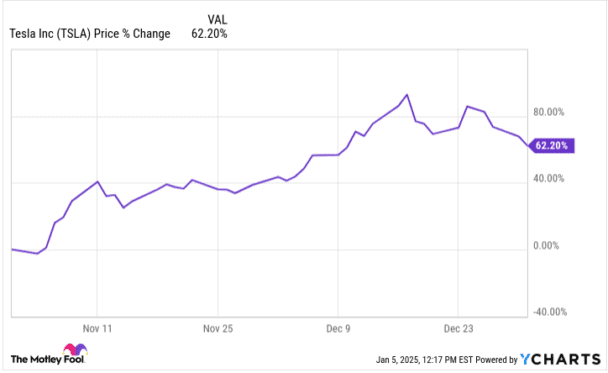

However, between November and December, Tesla stock kicked into a new gear — soaring by more than 60% and reaching new all-time highs.

What happened during this time frame that caused Tesla shares to skyrocket?

The surface-level answer is that the U.S. completed its presidential election, with Republican candidate Donald Trump winning the race and returning to Washington for a second stint in the Oval Office. However, the more nuanced answer lies in Tesla CEO Elon Musk's newfound relationship with president-elect Trump.

Wedbush Securities equity research analyst Dan Ives has suggested that Musk's relationship with President-elect Trump could be seen as a bullish signal for Tesla's future. Specifically, the new administration could pave the way for faster regulatory processes that are needed in order for Tesla to commercialise its next big campaign — namely, large-scale fleets of autonomous taxis on the road.

Nevertheless, the euphoric reaction in Tesla stock following the election seems to have come to a screeching halt. As the chart above illustrates, shares of Tesla have been steadily declining since the middle of December. Let's explore what could be causing the sell-off, and assess if investors should be worried.

Why caused Tesla's latest sell-off?

All told, 2024 was a terrific year for stocks. The S&P 500 gained 23% while the Nasdaq Composite rose by 29%.

However, the month of December in particular didn't fare so well. While the Nasdaq was essentially flat in December, the S&P 500 dropped by about 2.5%.

Such dynamics are not unusual. At the end of the year, investors may choose to lock in gains in stocks that have run up significantly (i.e., Tesla) while also trimming or exiting money-losing positions entirely in an effort to offset capital gains taxes. This is a strategy known as tax loss harvesting.

Given Tesla's rapid ascent during the final two months of 2024, I think a pullback was bound to happen. Unfortunately, the sell-off in Tesla stock has carried over in 2025. So, what's going on?

Well, last week Tesla released fourth-quarter delivery and production stats for its electric vehicles (EV). In summary, Tesla fell short of Wall Street's expectations.

Missing expectations in itself usually gives investors a fleeting reason to sour on a stock. But with Tesla in particular, the miss could lead some investors to believe that demand for the company's EVs isn't where it needs to be. Alternatively, some investors may view the economy as less robust than expected, possibly resulting in additional headwinds for Tesla's future progress.

Remember to keep the long-term picture in focus

Despite missing expectations, there were still some positive takeaways from Tesla's Q4 production and delivery figures.

First, the company's 495,570 delivered vehicles was a record. Moreover, early indications suggest that Tesla's figures in China were quite strong, too. This is a particularly good sign considering the economic picture in China has remained pretty cloudy for some time now.

While I would not say that Tesla is out of the woods, I think the company's Q4 delivery and production figures were positive overall. For now, I view Musk's relationship with the president-elect as beneficial, hoping it will accelerate the company's autonomous driving ambitions.

I think the sell-off is an opportunity to buy the dip in Tesla stock right now for investors with a long-term time horizon.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.