This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) stock has made investors significantly richer in the past three years, turning an investment of $1,000 into more than $4,500 as of this writing. This is thanks to the 354% jump in the company's shares during this period, on account of its dominant position in the lucrative market for artificial intelligence (AI) chips.

It is worth noting that shares of the chipmaker have handsomely outperformed the Nasdaq Composite's (NASDAQ: .IXIC) gains of 23% in the past three years. Nvidia's outstanding stock market returns have been powered by the terrific growth in its revenue and earnings, as customers and governments have been lining up to get their hands on its AI chips to train and deploy AI models.

Now that we are at the beginning of 2025, it would be a good time to take a closer look at Nvidia's prospects for the next three years and see if this high-flying AI stock can continue delivering more upside to investors in the future as well.

Image source: Getty Images

Nvidia's massive addressable opportunity suggests it isn't done growing yet

The size of Nvidia's business has grown immensely over the past three years. The company is on track to finish fiscal 2025 (which will end this month) with revenue of $128.6 billion (calculated by adding its fiscal Q4 revenue forecast of $37.5 billion to the $91.1 billion revenue it has generated in the first nine months of the year).

For comparison, Nvidia ended fiscal year 2022 (which coincided with the majority of 2021) with $26.9 billion in revenue. So, the chipmaker's revenue is on track to increase at a compound annual growth rate (CAGR) of 68% during this three-year period. Investors may be wondering if Nvidia is capable of replicating such stunning revenue growth over the next three years as well.

A 68% CAGR over the next three years would bring Nvidia's top line to almost $610 billion by the end of fiscal 2028. While that figure may seem extremely ambitious at first, investors should note that Nvidia has a huge addressable market opportunity that could indeed allow it to get closer to that figure. For instance, the company sees a $1 trillion revenue opportunity in the data center market alone.

CEO Jensen Huang points out that "every single data center will have GPUs" in the future to enable accelerated computing, which is done through specialised hardware such as graphics cards that Nvidia sells to perform more work in less time. As a result, accelerated computing enables users to get more done while consuming less energy, which is why it is expected to play a central role in keeping data center power consumption in check in the long run.

Moreover, the construction of new data center capacity is going to be another long-term tailwind for Nvidia. McKinsey, for example, estimates that global data center capacity could jump at an annual rate of 19% to 22% through 2030 to support the booming demand for generative AI. All this indicates that Nvidia's data center business still has a lot of room for growth, considering that the company is on track to end fiscal 2025 with just under $100 billion in revenue from this segment.

The $1 trillion opportunity suggested by Nvidia indicates that it has scratched just 10% of the opportunity on offer in this space. Moreover, the company is the leading player in the data center GPU market, with a market share of more than 85%, indicating that the growing adoption of accelerated computing could significantly lift Nvidia's data center revenue over the next three years.

The good part is that Nvidia's growth opportunity isn't limited to just data centers. The company's GPUs are also being used for other purposes as well, such as creating digital twins for industrial applications, powering gaming and AI personal computers (PCs), and in automotive and robotics. Nvidia reported robust growth in these three segments last quarter, generating combined revenue of $4.2 billion. That was a 20% jump over the prior-year period.

These segments should continue to be tailwinds for Nvidia. The gaming GPU market, for instance, is expected to add $49 billion in revenue between 2023 and 2028, growing at a CAGR of 21% during this period, as per TechNavio. Nvidia is the top player in gaming GPUs, with a market share of 90%, according to Jon Peddie Research. This puts the company in a nice position to make the most of the incremental growth opportunity in this space.

Meanwhile, the digital twin market is expected to generate $110 billion in revenue in 2028, as compared to $10 billion in 2023. Nvidia's GPUs support the growth of this market, as they are used for creating virtual models of factories and also for automating workflows in factories to enable higher operating efficiency. Multiple companies such as Foxconn, Reliance, Toyota, and others are using digital twins in their business operations by deploying Nvidia's GPUs.

All this indicates that Nvidia's multiple growth drivers could indeed help it sustain its impressive growth over the next three years.

How much upside can investors expect?

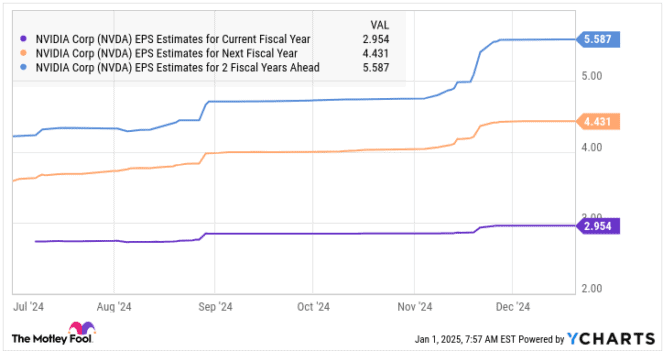

We have seen that Nvidia is indeed capable of sustaining its outstanding revenue growth rate over the next three years. However, to estimate the stock's potential upside, we are going to rely on consensus estimates from YCharts. As the chart shows us, Nvidia's earnings are expected to grow from $2.95 per share in fiscal 2025 to $5.59 in fiscal 2027. That points toward an annual earnings growth rate of 37% for the next two years.

NVDA EPS Estimates for Current Fiscal Year data by YCharts

If we take a conservative view and estimate that Nvidia's earnings grow even 30% in fiscal 2028, its bottom line could hit $7.27 per share. If we multiply the projected earnings after three years with the Nasdaq-100's earnings multiple of 33 (using the index as a proxy for tech stocks), its stock price could hit $240.

That points toward around 66% gains from current levels over the next three years. Given that Nvidia is trading at around 32 times forward earnings right now, investors are getting a good deal on this AI stock, indicating that they can still consider buying it, as it seems to have room for more upside going forward.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.