This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

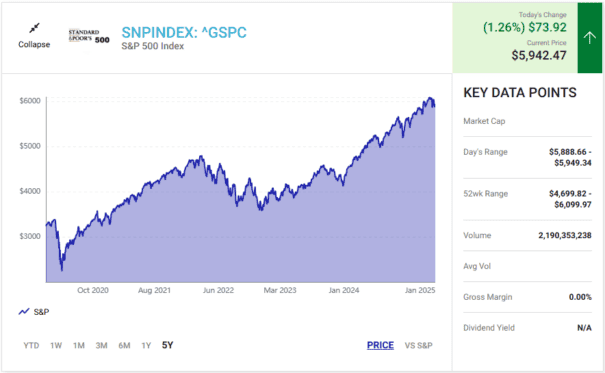

The S&P 500 (SP: .INX) delivered a total return (including dividends) of 25% in 2024, which followed a gain of 26% in 2023.

The index only delivered back-to-back annual returns of at least 25% on one other occasion since it was established in 1957. It soared by 33% in 1997 and then by 29% in 1998, fueled by the dot-com internet bubble, which drove technology stocks to astonishing valuations.

The stock market is more rational this time around, but emerging themes like artificial intelligence (AI) are driving substantial gains in some pockets of the tech sector once again. Based on a mixture of historical data and a series of coming events, here's what might be in store for the S&P 500 this year.

History points to more upside in 2025

Following its strong gains in 1997 and 1998, the S&P 500 soared by a further 21% in 1999. That suggests more upside could be in the cards during 2025, but one data point certainly doesn't make a trend.

After all, the dot-com era was one of the most irrational periods in stock market history. Internet companies were going public without any revenue, and many of them didn't even have a solid business plan, yet investors were pouring money into them anyway.

The AI boom is a little different. Nvidia, for example, is the leading supplier of data centre graphics processing units (GPUs) for AI development, and its annual revenue is on track to grow by 112% during its current fiscal year (which ends this month) to $129 billion. That accounts for the 178% gain in its stock in 2024.

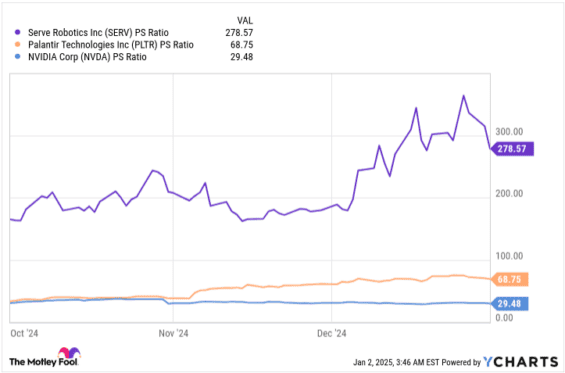

However, there are some pockets of exuberance. Serve Robotics generates a minuscule amount of revenue (just $221,555 in its most recent quarter) yet its market capitalisation has ballooned to more than $600 million. Its price-to-sales (P/S) ratio is a whopping 278 right now.

Then there is Palantir Technologies stock, which soared 350% in 2024. It's more than twice as expensive as Nvidia based on its P/S ratio:

SERV PS Ratio data by YCharts

With that said, both Serve Robotics and Palantir are forecast to generate solid revenue growth in 2025. While that doesn't fully justify their present valuations, at least there is some substance behind their respective gains.

Predicting the end of a speculative frenzy (like the dot-com bubble) is impossible, so the gain in the S&P 500 during 1999 isn't a good indication of what might happen in 2025. However, the S&P could rise this year because AI companies are delivering tangible financial growth.

Stock market valuations are stretched right now

If there is one thing that could prevent further upside in the S&P 500 this year (outside of an unexpected economic shock), it's the index's valuation. It trades at a price-to-earnings (P/E) ratio of 25.2 as of this writing, which is a 38% premium to its average of 18.1 dating back to the 1950s.

But investors shouldn't rush to sell their stocks, because valuation isn't a reliable timing tool. Markets can remain expensive for longer than anybody expects — the S&P reached a P/E ratio of 34 in 1999, which means the index continued to rise despite being overvalued relative to its historical average already.

Of course, exuberant valuations don't last forever. The S&P tumbled for three straight years between 2000 and 2002, and it didn't make a new all-time high until 2007.

The S&P entered 2025 with the wind at its back. The U.S. Federal Reserve cut interest rates three times since September, and is likely to cut at least two more times this year. Lower rates can reduce the yield on risk-free assets like Treasuries and CDs, making growth assets like stocks more attractive. Plus, lower rates let companies borrow more money to fuel their growth, and their interest costs also fall, boosting their earnings.

AI will also remain a tailwind this year. According to Morgan Stanley, four tech giants — Microsoft, Amazon, Alphabet, and Meta Platforms — could spend a combined $300 billion on AI data centers and chips in 2025.

That will benefit S&P 500 companies like Nvidia, Broadcom, Advanced Micro Devices, and more.

Volatility could make a comeback this year

There is a major political shift on the horizon in Washington following Donald Trump's election win in November. He will take office on January 20, and he's bringing a set of economic policies that will differ greatly from the Biden administration's during the past four years. It will take some time for markets to adjust, which could spark short-term volatility.

Trump campaigned on lower corporate taxes and significant deregulation, which are two things the stock market usually likes. But he also plans to impose tariffs on key trading partners like China, Mexico, and even Canada, in order to protect American businesses.

Trump imposed tariffs on steel and aluminium imports from practically every country in the world during his previous term in office. Some countries, including China, retaliated with tariffs of their own, which left investors fearful of an all-out global trade war. That was a key reason the S&P 500 almost slipped into a bear market in 2018.

Given where stock valuations are right now, it won't take much to trigger a meaningful correction in the S&P 500. Technically, the index would still be expensive relative to its history even if it falls by 10% from here. Therefore, I won't be shocked if the stock market moves lower after Trump takes office, even on the mere expectation of disruptive trade policies.

Although corrections can be painful in the short term, they can also be great opportunities to buy high-quality stocks at a discount. If there is a dip, investors should try to avoid panic selling and look for ways to put some money to work instead.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.