This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Alphabet made headlines toward the end of 2024, with its CEO telling employees to be ready for an important 2025 while also warning that it would be a challenging year.

While it may be a challenging year for the company, this could be the setup for a strong year for its stock.

Let's take a look at what CEO Sundar Pichai had to say about 2025 based on a report from CNBC and why his comments could be good for the stock.

2025 will be a critical year for Alphabet

At its headquarters in Mountain View, California, Pichai addressed employees and explained why 2025 would be a critical year for Alphabet. He noted that the stakes were high with artificial intelligence (AI) and that the company as a whole needed to move faster. He called this a disruptive moment and said that Alphabet needed to be able to use AI to help solve real-world problems.

At the same time, Pichai acknowledged the regulatory pressure the company was under. In 2024, Alphabet lost an antitrust case brought on by the US Department of Justice (DOJ), which ruled that it had a search monopoly.

As a remedy, the DOJ has asked the court to force the company to divest its Chrome browser and even potentially its Android phone operating system, as well as share user and advertiser data. Meanwhile, the DOJ just concluded another case against the company for dominating online ad technology, and the United Kingdom has also announced its objections to Alphabet's ad technology practices.

Focus on AI innovation

Pichai, however, said that this came with the territory, given the company's size, and that it must not get distracted. The company's focus for 2025 will clearly be on AI. The CEO displayed a chart showing how its Gemini 1.5 large language model (LLM) is currently in the lead versus competitors, including ChatGPT, while also predicting that there will be a lot of back-and-forth between which models are the best.

One area where Alphabet appears to have taken a clear lead is in video AI. The company's Veo 2 AI video generator has received rave reviews and is widely considered to greatly outperform OpenAI's Sora video generator, which came out just a few weeks before Veo 2. Veo 2 was trained using Alphabet's YouTube video platform, which could account for its advantages.

Gemini 2.0, Alphabet's newest generation AI LLM, meanwhile, will be incorporated throughout the company's products in 2025. Alphabet is also looking to push its Gemini app, which is not currently as popular as ChatGPT.

The company has seen some strong momentum in the past few months, but it is playing catch-up, as ChatGPT has become synonymous with AI after bursting onto the scene a few years ago. Pichai said, "Scaling Gemini on the consumer side will be our biggest focus next year."

Is Alphabet stock a buy?

Alphabet has sometimes been viewed as bloated and living off its laurels. However, the competitive threat and opportunity with AI have appeared to reinvigorate the company and its innovative juices. Pichai said several times that the company needed to be "scrappy." While competition can be viewed as a bad thing, sometimes it is needed to make a company start picking up its game.

Alphabet appears to be doing just that. This can be seen in its recent breakthrough in quantum computing, as well as with Veo 2. Right now, competition is bringing the best out of the company. And while Veo 2 is superior due to being trained on YouTube, I could see Google's decades of search data being a key differentiator in any future AI search battles.

Meanwhile, I think AI Search Overviews and the Gemini App should eventually lead to new forms of ad monetisation. Currently, Google only monetizes about 20% of its searches, so new AI queries could be a big revenue growth driver at some point in the future.

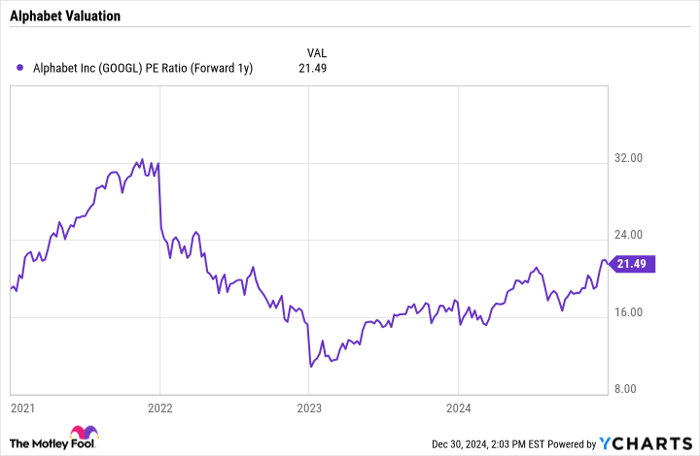

From a valuation standpoint, Alphabet is one of the cheaper mega-cap tech stocks involved in AI, trading at a forward price-to-earnings multiple of about 21.5 based on 2025 estimates.

GOOGL PE Ratio (Forward 1y) data by YCharts

With Alphabet looking focused and ready for the challenges of 2025, I'd buy the stock at current levels. The company is showing its innovation prowess, which I think should help endear the stock to investors.

At the same time, I find its valuation very attractive with a lot of room for expanding its P/E multiple.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.