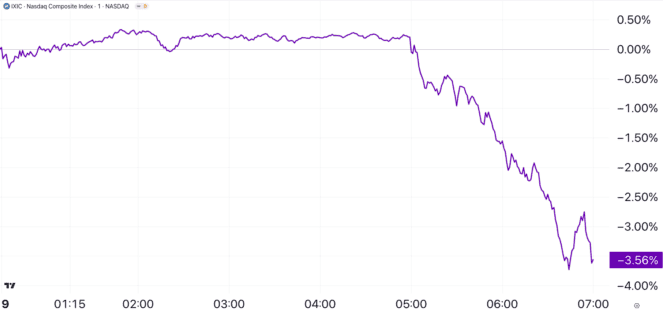

Aussie stocks face a bloodbath today as the S&P/ASX 200 Index (ASX: XJO) dives 2.2%. That's a considerable decline in a single session, but it still falls short of the murderous scene that blanketed the Nasdaq Composite Index (NASDAQ: .IXIC) while we slept.

Home to some of the world's most dominant technological titans — including Apple Inc (NASDAQ: AAPL), Microsoft Corp (NASDAQ: MSFT), Nvidia Corp (NASDAQ: NVDA), and Alphabet Inc (NASDAQ: GOOGL) (NASDAQ: GOOG) — the Nasdaq Composite was calmly humming along until the United States Federal Reserve wedged a stick into the spokes of the stock market.

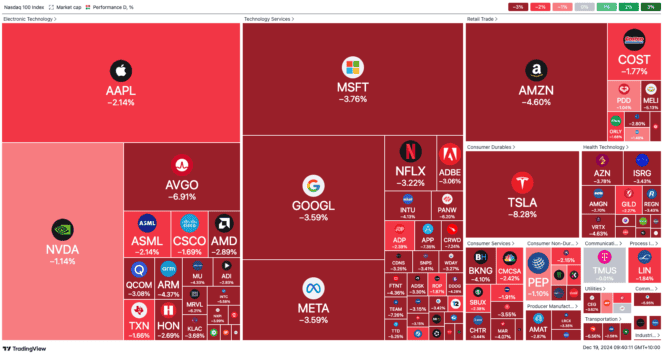

As the above shows, Big Tech was dealt the ole' left, right, goodnight' in the final two hours of trading: The central bank's interest rate decision and guidance. The words leaving Fed Reserve chair Jerome Powell's mouth were not what many had hoped to hear.

Rate cuts to shift down a gear in 2025

In the fleeting hours of US trading, the Federal Reserve Board announced its third rate cut. The decision takes the baseline lending rate to a target range of 4.25% and 4.5%. Justifying the move, the Fed's statement read:

The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

"Aren't lower rates a good thing?" I hear you shout.

Yes, usually. It frees up more consumer spending, makes debt for businesses cheaper, and — due to a lower discount rate — can increase company valuations. If that's the case, then why did the Nasdaq drop like a sack of potatoes from a tall building…

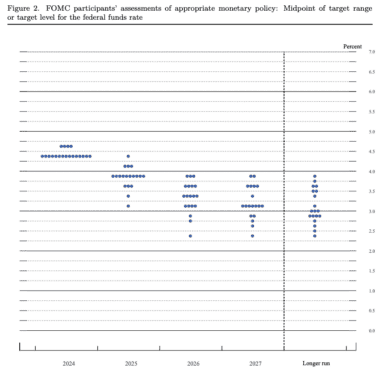

Markets are always looking forward. Where we are going is more important than where we are or have been. So when the Fed cuts rates but cautions of a slower decline in interest rates than previously expected next year, the latter part will carry more weight.

Each dot on the plot above represents a board member's interest rate forecast. The median dot for 2025 now sits at 3.9%, implying only two cuts next year compared to four in the prior forecast. Similarly, each successive year's median forecast has increased from the previous meeting.

Why it pulverised the Nasdaq

Big Tech was not alone last night. The broader S&P 500 Index (SP: .INX) took a nasty 2.95% downward adjustment, but the Nasdaq's decline was a bloodier 3.56%.

The tech-heavy index probably felt the punch more deeply than the S&P 500 for a couple of reasons.

Firstly, many of the largest Nasdaq-listed companies have greater exposure to discretionary spending — Apple with iPhones, Chip makers with PC and phone purchases, and Tesla Inc (NASDAQ: TSLA) with its electric vehicles. If rates are higher for longer, that might mean you and I watch our pockets for longer as well.

Secondly, investors expect these businesses to have high growth in the good times. If those good times don't materialise, then the 'big upside' fades, leaving a glaring hole in the earnings needed for the market capitalisation to make sense.

Despite all the commotion, the Nasdaq Index is up 31.3% year-to-date.