This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) earnings have become quite the event for investors. Given the company's growth over the past two years, observers are curious about what each quarterly result will bring. Nvidia's rise has been a significant driving force behind the growth of the broader stock market, so continued success is key for every investor.

The third quarter of fiscal 2025 (ended Oct. 27) didn't disappoint, and I think there's a key figure here that could excite investors all over again.

Demand for Nvidia's GPUs has never been higher

Nvidia's primary product is the graphics processing unit (GPU), which is often deployed in situations where extreme computing capacity is required. Its ability to process multiple calculations in parallel sets it apart from other computational devices and makes it a clear choice for workloads that require massive amounts of computing power, like training an artificial intelligence (AI) model.

Demand for its GPUs has skyrocketed ever since the AI arms race kicked off, and Nvidia has benefitted more than any other company in the market.

This was on full display in Q3, as revenue rose 94% year over year to $35 billion, significantly beating management's own expectations. They only expected $32.5 billion in Q3, which would have been 80% growth. This is an unbelievable metric to focus on, but the future also looks bright. For Q4, management expects $37.5 billion, indicating 70% growth.

Although that's starting to trend down, it still is an incredible figure. Management has a consistent history of beating revenue expectations, so the real figure is likely a bit higher than that. I wouldn't be surprised if Nvidia continues to deliver strong guidance beats like that throughout 2025, as it has many tailwinds blowing in its favour.

2025 is looking like another strong year for Nvidia

One risk with Nvidia is that a significant chunk of its revenue is concentrated among a few customers. Four customers, unnamed by Nvidia, made up around 40% of Nvidia's total revenue in Q3. If these clients stop spending, it could spell disaster for Nvidia. However, it's not hard to figure out who these companies might be, and they all indicate that spending will only increase throughout 2025.

One candidate for these mystery clients is Meta Platforms, which indicated that there would be "significant capital expenditures growth in 2025." This spending mostly pertains to increased computing capacity, benefiting Nvidia. Other likely large clients, like Amazon and Microsoft, have also indicated that AI-related computing expenses will rise in 2025. As of right now, this concentration isn't a problem for Nvidia; it's a boost.

Another tailwind for Nvidia in 2025 is the launch of its Blackwell architecture. The performance boost of this new product versus the existing Hopper architecture is incredible. Blackwell provides four times the performance as Hopper, as it only requires 64 Blackwell GPUs to run a benchmark test versus 256 Hopper GPUs. Blackwell production is in full swing and continues to ramp up. Management stated that demand greatly exceeds supply, and revenue is already exceeding expectations.

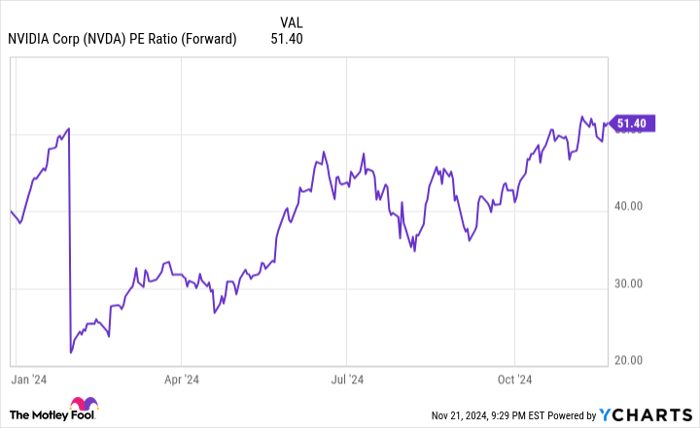

These are two huge tailwinds for Nvidia and present a pretty good case for buying the stock, at least on the growth side. However, the stock is still quite expensive overall, and investors need to familiarise themselves with this risk. Nvidia stock trades for 51 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

That's not a cheap figure by any means, and it projects multiple years of strong earnings growth into the stock price. If Nvidia keeps growing at its current pace, the price you pay today isn't that expensive. But if it sees struggles toward the end of 2025, it could become an issue.

It all boils down to how far along you think the AI buildout is. If it has run its course, then Nvidia isn't a buy. But it can still make for a viable investment if it's just getting started. There are plenty of indications that we're just scratching the surface of what's possible with AI, which will drive more spending with Nvidia, especially as Blackwell architecture rolls out.

While I think Nvidia won't have a repeat of its 2024 performance in 2025, I still think there's enough of a case here for Nvidia to continue to beat the markets moving forward.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.