This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Investors get a peek into what hedge funds are doing with their money every quarter. The SEC requires institutional investors to file a 13F once they pass $100 million in assets. These reports are released 45 days after the end of the calendar quarter and disclose current positions.

Billionaire hedge fund manager Ray Dalio and his firm Bridgewater Associates made an interesting move during the third quarter. They sold Nvidia (NASDAQ: NVDA) stock. They reduced their position sizing by about a quarter, selling 1.8 million shares, worth around $212 million if the average price for Q3 is used.

Should investors follow in Dalio's footsteps and sell off some of their Nvidia positions? Or is this move being made for different reasons?

Nvidia's stock is up dramatically over the past year

Bridgewater Associates' trend of selling Nvidia stock isn't isolated to just the third quarter. The firm owned more than seven million Nvidia shares at the end of 2023 and has steadily decreased its holdings each quarter of 2024. This activity is fairly common for hedge funds: They want to realise gains.

Unlike individual investors who can watch their portfolios rise and fall with little repercussions, fund managers are graded on their quarterly performance. Individual investors can buy great companies and hold until they're no longer great, with little care of day-to-day movements. This strategy has made the Foolish style of investing successful, but it doesn't work for fund managers.

However, it does remind us that gains aren't realised until you actually sell the stock, which can be difficult when all Nvidia seems to do is go up. Still, even after the sales, Nvidia is Bridgewater's fourth-largest holding. So, Dalio and his firm are trimming a stock that has continued to run so that they are comfortable with the position sizing.

Many investors should consider this, too, as Nvidia has been on a legendary run over the past two years. Nvidia's stock won't keep going up in a near-straight line forever, and realising some of the gains may not be the worst idea, even if Nvidia continues to excel.

Nvidia is still executing at a high level

Although I don't know when it will happen, Nvidia is going to run into some headwinds eventually. Nvidia's graphics processing units (GPUs) are powering the artificial intelligence (AI) arms race, and companies are buying them by the truckload to give themselves all the computing power they need to train the best model possible.

Eventually, these large buyers will have built out what capacity they need, and that could cause Nvidia to struggle once that threshold is met. Now, whether that's one year from now or a decade from now is anyone's guess. Nvidia has displayed its cyclicality multiple times throughout its history on the public markets, and it will eventually see a struggle in the future.

But that's not happening right now. In Q3 (ended Oct. 27), Nvidia's revenue rose 94% year over year to $35 billion. Earnings were even better, with earnings per share increasing 111%. For Q4, it expects revenue of $37.5 billion, indicating 70% revenue growth -- an impressive mark.

Nvidia is clearly crushing it, and that strength should continue throughout 2025. Furthermore, many of its biggest clients indicated on their Q3 conference calls that spending on data centres and AI modelling capabilities is going to increase in 2025, which is a massive benefit to Nvidia.

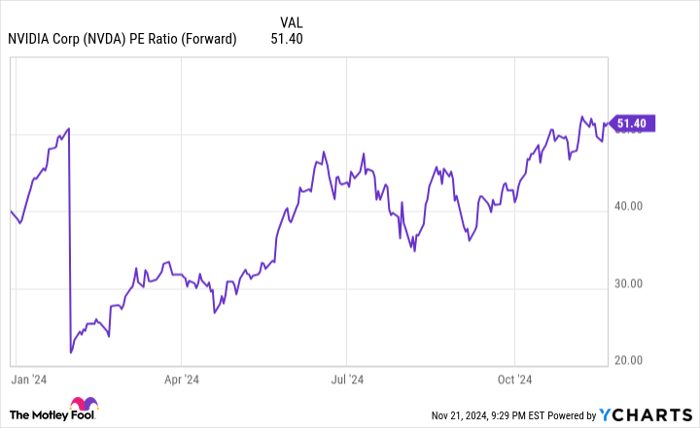

But this success comes at a price. Nvidia's stock isn't cheap by any stretch, trading for 51 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

That indicates extreme expectations, and Nvidia has lived up to them so far. This is an incredible company that has been successful for multiple years in a row, and 2025 looks like more of the same. While I don't think selling all of your Nvidia shares is a good idea, trimming and taking some gains, especially if it has become an outsized part of your portfolio, is likely a smart move.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.