The S&P/ASX All Ordinaries Index (ASX: XAO) is powering higher this morning, while Sayona Mining Ltd (ASX: SYA) shares sit on the sideline.

Shares in the lithium developer are motionless today, abruptly halting their 15% rally in the last five trading days.

Investors of the Moblan and Authier project owner will undoubtedly hope today's trading halt is in preparation for positive news, considering the company's share price is still down 45% year to date.

The undesirable performance mirrors that of the electrifying material Sayona seeks to produce. Lithium carbonate prices have been slashed in half compared to a year ago.

Why Sayona Mining shares are frozen

Details are sparse at the minute. All we have to go in is a brief release on Sayona's trading halt request.

In correspondence to the Australian Securities Exchange, Sayona made the request in relation to a 'corporate transaction and an associated equity raising'.

Not exactly enlightening, is it?

Coincidentally, fellow ASX lithium developer Piedmont Lithium Inc (ASX: PLL) pulled the handbrake on its share price this morning. Both companies cite the same grounds for halting shares — a corporate transaction and equity raising.

Are the two related?

There's a fair chance the two companies are talking about a common linkage.

Piedmont and Sayona have partnered up on projects such as North American Lithium, Authier, and Tansim Lithium projects. So there's the possibility the equity raising could relate to sourcing funds for further development within its joint venture.

Alternatively, Street Talk has said the deal is Sayona and Piedmont agreeing to merge.

If true, the move would follow in the footsteps of other high-profile mergers in recent history, such as Rio Tinto Ltd (ASX: RIO) and Arcadium Lithium CDI (ASX: LTM).

More equity has its pitfalls

With neither Piedmont nor Sayona yet profitable, the two (possibly combined) are on the hunt for cash.

Rumour has it that $150 million is the target for the equity raising.

Sayona recorded a cash balance of $109 million on 30 June 2024, less than half its annual operating expenses in FY2024. Meanwhile, Piedmont posted a cash pile of US$70.2 million at the end of September, almost double the company's operating expenses.

According to today's release, investors should have more information by Thursday morning, if not sooner. At this point, shareholders will learn how much dilution they're facing from securing more funds.

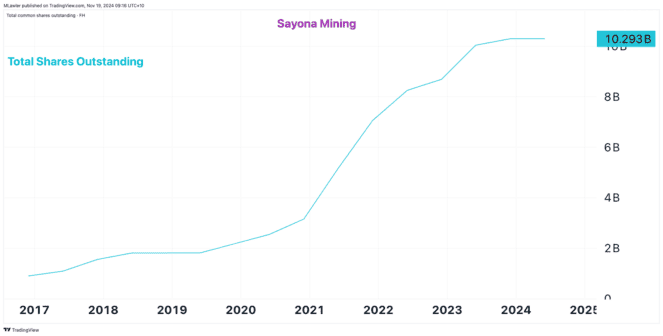

As the chart above shows, the number of Sayona Mining shares more than doubled in the last few years, pulverising future earnings per share (EPS) for its shareholders.

The Piedmont Lithium share price is also down 57% over the last year.