This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Over the last several years, Cathie Wood of Ark Invest has emerged as one of Wall Street's most intriguing personalities.

Most portfolio managers emphasise concepts found in textbooks such as valuation multiples or intrinsic value. Wood is different. Ark Invest offers investors access to a host of exchange-traded funds (ETFs), the majority of which are comprised of emerging technology businesses.

However, to her credit, she balances Ark's portfolio with some exposure to larger, more established opportunities as well. Among Wood's blue-chip holdings are most of the 'Magnificent Seven', many of which are leading the charge in the artificial intelligence (AI) landscape.

And in that segment of her portfolio, her recent sales of Tesla (NASDAQ: TSLA) and purchases of Amazon (NASDAQ: AMZN) look like a savvy shift.

Why might Wood be trimming Ark's Tesla position?

Generally speaking, portfolio managers do not reveal the precise timing of their trades nor discuss the rationale behind their decisions. Sometimes, hedge fund managers will give interviews on financial news programs and discuss their recent investment moves, but oftentimes these revelations come long after any significant buying or selling was made.

But Wood and the Ark Invest team do things a bit differently. Every evening, Ark Invest sends out an email to its followers that breaks down what stocks the funds bought and sold during that day's trading session. Moreover, Wood is often featured on CNBC or Yahoo! Finance, and isn't shy about discussing her high-conviction plays.

For the last two weeks, Wood has consistently been trimming her Tesla position.

| Category | Oct. 24 | Oct. 28 | Oct. 29 | Oct. 30 | Nov. 1 | Nov. 4 | Nov. 5 | Nov. 7 |

|---|---|---|---|---|---|---|---|---|

| Shares of Tesla sold | 85,500 | 120,000 | 13,900 | 62,200 | 30,600 | 9,900 | 2,300 | 85,000 |

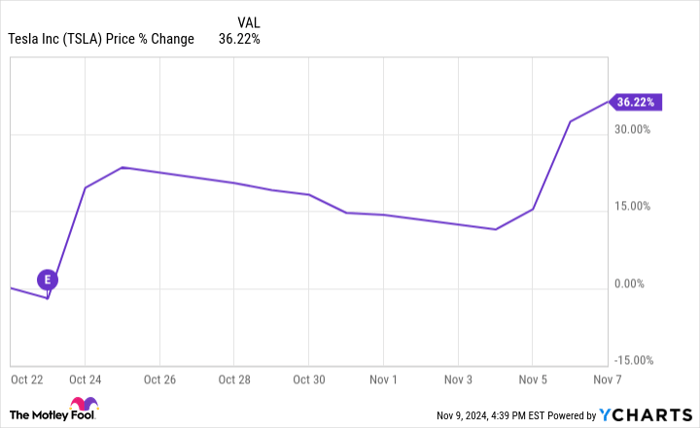

While such consistent sales may give the impression that Wood is running for the hills, there's more here than meets the eye. Since Tesla reported its third-quarter earnings on October 23, its shares have gained more than 30%.

Wood recently explained during a segment on Yahoo! Finance that she sees now as an appropriate time to take some profits and rebalance the Ark funds. Considering how volatile Tesla stock can be, a sell-off could come out of nowhere.

Why Amazon looks like a wise choice

Throughout the month of October, Wood was taking Tesla profits and reinvesting in its megacap tech cohort, Amazon. Between October 8 and November 7, Ark Invest scooped up over 395,000 shares of Amazon.

Amazon's diverse business spanning across e-commerce, cloud computing, advertising, streaming, grocery delivery, and subscription services via its Prime membership program make it a particularly attractive opportunity, regardless of the economic climate.

And now, through a savvy partnership with Anthropic, Amazon has the chance to leverage AI across its entire ecosystem -- bolstering customer engagement across all of its business segments.

This strategy is already beginning to pay off, as Amazon's profit machine is scaling at an unprecedented pace. With $48 billion in trailing-12-month free cash flow and $88 billion of cash and equivalents on the balance sheet, it is more than equipped to continue investing in AI-driven strategies that can accelerate its growth.

The bottom line

The big idea that investors need to keep in mind here is that Wood is still incredibly bullish long-term on Tesla despite her recent profit-taking. Remember, Ark Invest placed a five-year price target of $2,600 on Tesla stock just a few months ago. Moreover, Tesla still remains a core pillar across Ark's funds. I surmise Wood will continue to hold the stock to varying degrees over time.

I see doubling down on Amazon as a particularly smart move right now. Its shares are historically cheap on a price-to-free-cash-flow basis, and I would not be surprised to see Wood scoop up more as the company enters a new phase of growth featuring all things AI.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adam Spatacco has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Amazon and Tesla. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.