Holding onto an ASX stock for a tenfold return requires two indispensable ingredients: a company of exceptional quality and a host of uncommon psychological traits — antifragility, emotional control, patience, and… inertia?

Time and time again, renowned investors label selling too soon as their greatest investing mistake. The formidable fund manager turned philanthropist Peter Lynch states this as he writes, "I sold way too early on Home Depot. I sold too early on Dunkin' Donuts. Why did I do that? I was dumb. With great companies, the passage of time is a major positive."

Inaction is sometimes the greatest offence for wealth creation.

In March 2019, I invested in Pro Medicus Limited (ASX: PME) after recognising its potential as the Netflix of medical file streaming. Since adding the software company to my portfolio, I've sat on my hands for five years and seven months.

The Pro Medicus share price has increased by 1,053% during this time, as shown below, more than 10x. An initial investment of $5,000 would now be worth $57,650.

Such an enormous return is tempting to cash in on. It could pay down a mortgage, pay off a HECS debt, or provide extra cushioning through some difficult times. And yet, while the value has gradually lifted like an ocean tide, I've refrained from selling a single share.

You're probably channelling your best Backstreet Boys impression… Tell me why?

Why I've held on all these years

It would seem logical to sell at a 100% gain, or 300%, or 500%.

Some might say that's good enough.

This is where looking at shares as simply a stock price that goes up or down falls short. Knowing the shares are up 500% gives me none of the actual information I would need to determine whether it is time to sell.

It's the business that matters.

While I endured share price pullbacks of 40%+ twice, the business never gave me any reason to worry.

In FY19, Pro Medicus generated revenue of $50.1 million and a net profit of $19.1 million. Each succeeding year has resulted in a substantial increase in both of these figures, climbing to revenue of $161.5 million and net profit of $82.8 million in FY24.

The ASX stock has consistently reflected a number of other desirable qualities throughout this time. For example, it retained a debt-free balance sheet, remained founder-led with high insider ownership, and refrained from unfettered acquisitions that could have destroyed shareholder value.

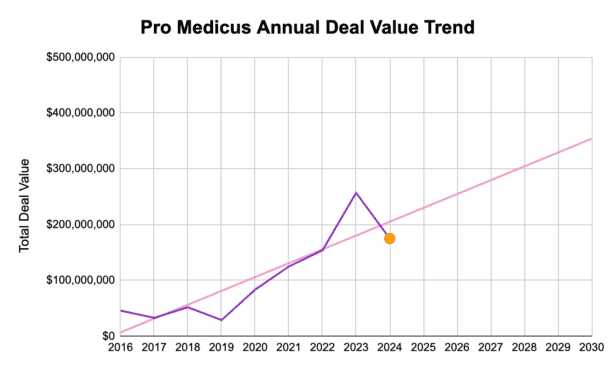

Another useful metric for tracking the progression of Pro Medicus' business is its annual deal value. I keep tabs on this by adding to a spreadsheet each time the company secures a new deal for its software.

As shown above, the company has dramatically increased its annual deal value each year since 2019. Although the current year is lower than the last, the overall direction of the trend is positive.

By most measures, Pro Medicus has only improved in quality since I originally invested. So I've never had a good reason to sell.

Surely I'm ready to sell this ASX stock now, right?

Here we are. A return of more than 10x from a company that now trades on a price-to-earnings (P/E) ratio of 259 times. It's obviously time to count my blessings and take my winnings. I mean what justification is there to hold onto this ASX stock still?

I bolded the good in good reason earlier.

This may anger the value investing purists out there. I consider a rich valuation one of the weakest reasons to sell out of a quality company. A 259 times P/E in isolation doesn't tell me much, quite honestly.

In fact, Pro Medicus' earnings multiple has been above 90 times the entire time I've owned a slice of the business, as displayed below.

At the very beginning of this article, I mentioned inertia. Let me explain what I mean by this.

My default is a steady state. I don't take action on my portfolio without a strong external force. There needs to be a meaningful change in the directional force of a company to disrupt my resting condition. An excessive valuation is not enough. I need a collapse in the quality of the business to teeter my inertia towards selling.

The reason I take this approach is because humans — myself included — nearly always fail to comprehend the true magnitude of potential for a great business.

Few ever imagined Apple in the early iMac days being more than a maker of PCs. No one dreamt that Netflix would evolve from a DVD-by-mail movie rental business pre-2007. There are many examples.

My point is, even now, I have no valid reason to sell Pro Medicus shares as a long-term investor. Maybe that will make me look like a goose in hindsight. So be it. That's the price of being an optimist.