Sitting on a year-to-date return of 37.2%, 2024 has certainly been a cracker of a year for my stock portfolio, which includes a mix of handpicked ASX and US companies. For reference, the S&P/ASX 200 Index (ASX: XJO) is up 8.8%, and the S&P 500 Index (SP: .INX) is 25.9% higher.

My portfolio isn't without its blemishes this year. Not every holding is worth more today than at the end of 2023, and neither does it need to be when taking a long-term approach. However, some companies have admittedly fallen short of my immediate expectations.

Let's just say neither of these ASX stocks will get my Christmas money this year.

More of a fizzle than a profit pop

It pains me to throw this company into the naughty bucket for 2024 after I've been an ardent backer of it. In fact, I even doubled down on this Aussie blue chip in January, doing absolutely no favours for my portfolio in the time since.

Sonic Healthcare Ltd (ASX: SHL) continues to grapple with right-sizing from the temporary pandemic-era boom. The overhang from the company's COVID-19 testing segment has dropped an anchor on earnings for longer than I had expected.

Another factor shuffling Sonic from my good books is the underwhelming benefit from recent acquisitions to date. The company is quickly regearing (i.e. adding more debt) to its balance sheet by buying other diagnostic and/or pathology businesses.

I'm beginning to think Sonic would have been better off getting its core business back on track before adding more complexity. Management could be spreading itself too thin through a surge in takeovers, leading to inadequate oversight for delivering results.

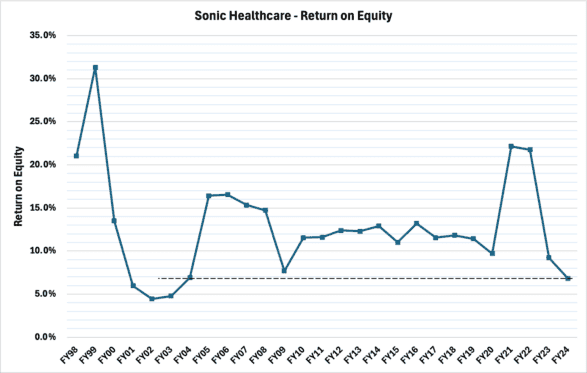

Sonic's return on equity, a way of measuring profitability, is the lowest it's been since FY2003, as shown above. Management will need to turn this around if shareholders hope to earn decent annualised returns over time.

Booted from my ASX stock portfolio

While Sonic Healthcare still holds a spot in my portfolio, the same can't be said for the other company on my naughty list this year.

Duxton Water Ltd (ASX: D2O) was ousted from my holdings in July this year. I was no longer happy to house the water entitlement manager with its mountainous debt balance. The straw to break the back of this investment was the sale of water entitlements (the company's key asset) to pay down debts.

In my books, you've made some extremely poor business decisions if forced to liquidate your prized assets with future income-producing capability to pay off short-term debts. There was no way I could consider this company a potential compounding investment with such a business approach.

Fortunately, I put the cash to good use elsewhere.

This year, I've twice topped up my position in quality ASX stock Resmed (ASX: RMD). Touting a year-to-date gain of 47%, the sleep device maker is definitely on my good list this Christmas.