It's been a year of uncharted territory for the S&P/ASX 200 Index (ASX: XJO). Rising 7.4% year-to-date and setting new records, some investors are contemplating whether ASX shares have blown past the buy zone.

The Australian share market is not alone in its sensational run. On the other side of the globe, United States indices are belting out mind-boggling performances. It almost sounds fictitious, yet without a word of a lie, the S&P 500 — the poster child of corporate America — is up 22% year-to-date.

In times like these, people begin questioning the foundations of the euphoria. It doesn't help that the legendary Warren Buffett appears to be building a cash cathedral US$325.2 billion tall. Such a move may suggest the brain behind Berkshire is struggling to find good deals to deploy capital.

Why, then, do I think there are still good investments available on the ASX?

Pockets of value among ASX shares

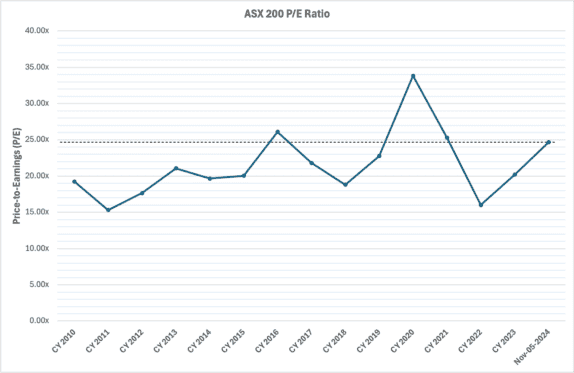

The 200-strong basket of Australia's best companies is objectively priced on the more premium side right now. As the chart below shows, investors are paying roughly 25 times trailing earnings for a slice of Australian excellence — only outdone by the multiples achieved in 2016 and the pandemic period.

The great thing about being a stockpicker is that you don't need to accept the market premium. You can go fishing where the waters are brimming with bites. And I think I know just the spot to land some potentially monster-sized catches.

Let's start with Harvey Norman Holdings Limited (ASX: HVN).

This ASX share is up 10% in 2024, beating out the benchmark index. Yet, the retailing juggernaut only demands a price-to-earnings (P/E) ratio of 17 times earnings — a relatively palatable valuation considering we're dealing with a founder-led company with substantial brand recognition.

What about gaming goliath Aristocrat Leisure Limited (ASX: ALL)?

A P/E ratio of roughly 27 times earnings doesn't exactly scream value. However, I think Aristocrat has enormous growth potential in the years to come. The company has cultivated enviable gaming titles, such as Dragon Link and Lightning Link, that are crowd favourites. With more markets in the US to breach, Aristocrat's content excellence could boost the bottom line tremendously.

I believe these two ASX shares are far away from the realm of frothiness.

Cinch option to invest

But let's say the idea of buying shares in individual companies just isn't a vibe… too stressful, too hands-on, too concentrated.

If that were me, I'd then take a different approach — one that is dead simple but maybe not intuitive.

I'd just accept the possibility of 'frothiness'.

Yup, it would be as simple as buying an exchange-traded fund (ETF) like the iShares S&P 500 AUD ETF (ASX: IVV) and calling it a day.

It might mean I'd be buying into the US market at a rich valuation. However, assuming I keep buying with a dollar-cost averaging approach, what I pay today wouldn't really even matter. It's a simple way to invest without needing to worry about whether the market is expensive or cheap.

Still, as a stockpicker, I personally favour ASX shares like Harvey Norman and Aristocrat over a benchmark index.