Australian superannuation funds are increasingly investing in international shares and other overseas assets to strengthen diversification and investment returns.

Research from the Association of Superannuation Funds of Australia (ASFA) shows that 49% of all superannuation monies are now allocated to international assets, compared to 35% a decade ago.

In a new report, AFSA explained the trend:

By investing offshore, funds are able to invest in a broader range of assets than is available in Australia.

Offshore investments provide members with exposure to other economies, to specific companies and assets, and to industries that are relatively less prevalent in Australia.

For example, with respect to the latter, IT companies account for around 20% of global stock market capitalisation but only around 5% of the ASX 200.

Broad exposure to offshore investments also provides diversification benefits for portfolios.

AFSA expects superannuation funds to invest increasingly more money into international assets.

This reflects both the concentration risk associated with greater exposure to domestic investments and the diminishing costs and knowledge barriers associated with international investments – reflected in the expansion of funds' offshore investment teams.

That said, the optimal proportion of domestic-to-international assets for a super fund is ultimately an empirical question.

Types of overseas assets that superannuation funds prefer

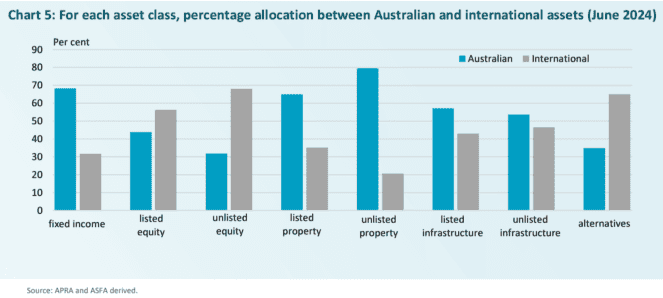

As of June 2024, Australian superannuation funds had allocated more money to international assets in several categories.

The chart below shows that those categories were listed shares, unlisted equities, and alternative assets.

Superannuation funds had higher allocations to Australian assets in the categories of fixed income, listed and unlisted property, and listed and unlisted infrastructure.

Where is our super invested now?

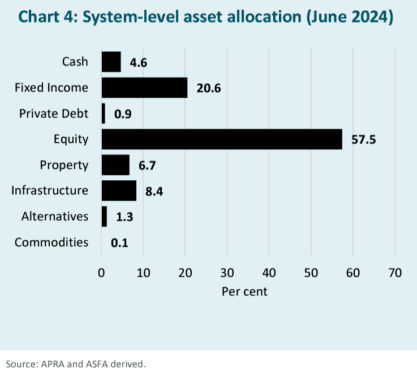

Overall, the dominant asset class for superannuation investment is equities, predominantly listed international shares and ASX shares, with an overall allocation of 57.5%, up from 52% in 2014.

As we've reported, AMP chief economist and head of investment strategy, Dr Shane Oliver, said superannuation funds invest mainly in shares because of their superior long-term performance.

Dr Oliver said:

While growth assets like shares go through bouts of short-term underperformance versus bonds and cash, they provide superior long-term returns.

So, it makes sense that superannuation has a high exposure to them.

Superannuation funds have a strong preference for listed equity (92%) over unlisted equity (8%).

When it comes to property, the reverse is true. The super funds' preference is for unlisted property (62%) — such as real commercial property or residential property — over listed property (38%).

The funds also prefer unlisted infrastructure (84%) to listed infrastructure (16%).

AFSA said:

The relatively high unlisted allocations for property and infrastructure reflect the potential benefits to investment portfolios of such assets – such as illiquidity premia and stable long-run cash flows.

The illiquidity premium is the additional return that compensates investors for holding assets not easily convertible to cash.

Superannuation is an ideal investment vehicle for such assets given its long-term focus.

The chart below shows the APRA-regulated superannuation system's allocation to various asset classes.

How much is Australian superannuation worth?

The total value of investments in APRA-regulated superannuation funds was $2.6 trillion as of 30 June.

It has risen substantially from $1.2 trillion in June 2014.

The average annual growth rate over the past 10 years was 8%.

Quarterly contributions to superannuation total about $45 billion.

Compulsory Super Guarantee (SG) contributions average just under 60% of total quarterly contributions.

Personal contributions – excluding salary sacrifice – average about 20% of total quarterly contributions.

AFSA recommends that Australian workers aim for $100,000 in superannuation by age 67 to fund a 'modest' retirement.

For a 'comfortable' retirement, including overseas travel, singles need $595,000 and couples need $690,000 in superannuation savings by age 67.

Individual investors favouring international shares, too

As we've previously reported, ordinary Aussie investors are increasingly investing in exchange-traded funds (ETFs), and right now ETFs providing exposure to international shares are particularly popular.

New data shows international shares ETFs have attracted more than 56% of total cash investment inflows in 2024.

This follows the strong outperformance of US shares vs. ASX shares in FY24.

In FY24, the S&P 500 Index (SP: .INX) rose by 22.7% and the Nasdaq Composite Index (NASDAQ: .IXIC) rose by 28.61%, while the S&P/ASX 200 Index (ASX: XJO) increased by 7.83%.

However, ASX shares pay much better dividends, which bumped up total returns to 12.1% in FY24.