This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Semiconductor specialist Nvidia (NASDAQ: NVDA) has emerged as the face of the artificial intelligence (AI) revolution. Over the last two years, the company has gained trillions in market cap and now sits behind just Apple and Microsoft as the world's third-most valuable company.

And yet, despite its meteoric rise to the top, some of the world's largest hedge funds have been selling Nvidia stock as of late. Two notable examples include Ken Griffin's Citadel reducing its stake in Nvidia by 79% last quarter and D. E. Shaw trimming its position by about half.

Doesn't it seem odd that big-name investors are selling Nvidia stock on the backdrop of AI being the next big frontier?

To be honest, maybe not. Below, I'll explore three areas that could be convincing billionaires to trim their positions in Nvidia while looking for growth elsewhere.

1. How will competition impact Nvidia?

One of the most integral components of generative AI development is advanced chipsets called graphics processing units (GPUs). While Nvidia is currently the biggest fish in the GPU pond, there is another side to this growth story. Namely, many other companies, including Microsoft, Amazon, Alphabet, Meta Platforms, and even Tesla, are developing their own AI infrastructures.

Many of these companies are already building their own custom chips. This could be an issue because each big tech giant outlined above has long been rumoured to be a major Nvidia customer.

I'll concede that using their own chips will not be the end for Nvidia. These companies will likely remain customers and complement their chips with Nvidia's infrastructure.

With that said, I think Nvidia will gradually lose its commanding pricing power as the GPU market becomes more saturated. Although it will take years, Nvidia will likely begin to witness a decline in revenue growth. As its top line starts to decelerate, I think it's natural that Nvidia's gross margins will tighten, which can significantly reduce the company's overall earnings power.

For these reasons, I think more sophisticated investors are beginning to realise that Nvidia's ability to consistently generate record revenue and profits is shrinking.

2. Will the government come knocking?

At the moment, Nvidia is well ahead of peers, such as Advanced Micro Devices or Intel, in the GPU realm. Perhaps the strongest pillar supporting Nvidia's fortress is the tight integration between the company's hardware and software.

Nvidia's compute unified device architecture (CUDA) software layers on top of the company's GPUs. It is incredibly difficult for developers to use a combination of chips from other companies with Nvidia's CUDA. As a result, companies are opting to train their AI protocols entirely on Nvidia's end-to-end product suite.

This dynamic has helped Nvidia gain an estimated 88% share of the GPU market. What's even more staggering is that the company's next-generation Blackwell GPUs, set to release later this year, could easily help Nvidia gain even further momentum and market share dominance.

While this has played a big role in Nvidia's current trajectory, the momentum could come to a halt. Why? Well, given Nvidia's pseudo-monopoly, it's entirely plausible that the Department of Justice (DOJ) could investigate Nvidia's business practices. In turn, Nvidia could be forced to loosen its ecosystem, which would have implications for the company's growth.

3. Can lightning strike twice?

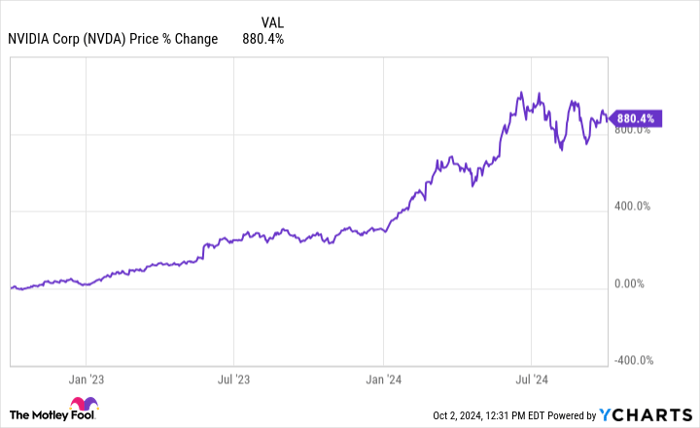

The chart below illustrates Nvidia's stock price over the last two years. With more competition on the horizon and the possibility of government intervention, it's hard to buy into a narrative in which Nvidia stock rises by another 900% over the next two years. I do not think the company has enough catalysts to run at a commensurate pace over the next several years.

The bottom line

There are a lot of unknowns surrounding Nvidia and its future prospects.

Will new chips from other "Magnificent Seven" members be a detriment to Nvidia? Will the DOJ accuse Nvidia of self-dealing and force the company to open up its products to be more congruent with competitor's chips?

What I can say with some confidence is that the probability of Nvidia stock becoming another multibagger anytime soon is slim.

Given the uncertainty surrounding Nvidia, its competitive landscape, and the pulse of the AI market in general, I think selling some stock and taking profits while also keeping some allocation in the company is a prudent strategy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.