This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Helping build Berkshire Hathaway into a near-trillion-dollar enterprise and co-founding the Giving Pledge charity are just a couple of things Warren Buffett is known for.

Despite his prolific career, one thing that Buffett is not really known to be is a technology investor. In fact, many of his most famous and lucrative investments came from simple businesses across financial services and consumer goods.

However, Buffett has been a staunch supporter of Apple (NASDAQ: AAPL) for almost a decade. Today, Apple represents Berkshire's largest position -- comprising roughly 30% of its portfolio.

Although Apple stock has posted significant gains since Berkshire's initial purchase in 2016, some on Wall Street are calling for even further share price appreciation. In particular, Dan Ives of Wedbush Securities has a $300 price target on Apple stock -- implying 32% upside as of the market close on Sept. 24.

Let's explore some catalysts that could fuel Apple stock and assess if there is a good opportunity to buy the stock now.

Positive macro indicators

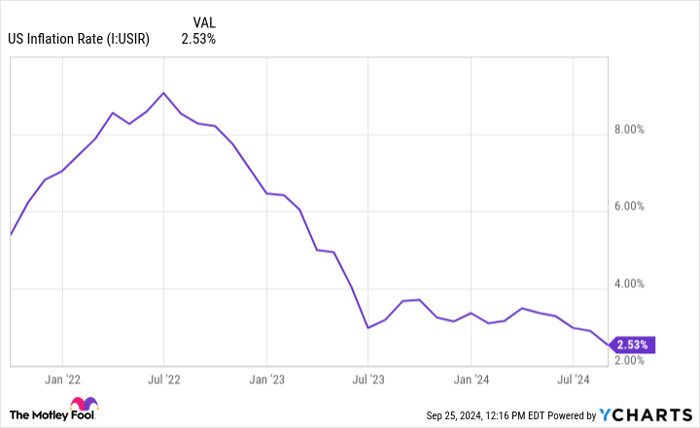

For the last couple of years, high inflation and rising interest rates have daunted the macroeconomy in the U.S. Moreover, as a global enterprise, Apple has also not been immune to some of the factors slowing down other major geographic regions such as China.

In turn, consumers and businesses have tightened budgets and spending habits have changed. People have been more cost-conscious over the last couple of years, opting to forgo expensive new iPhones or MacBooks.

US Inflation Rate data by YCharts

However, as inflation levels show signs of decelerating and interest rate tapering from the Federal Reserve begins, consumer purchasing power should start to strengthen.

Did someone say artificial intelligence?

For the last few years, several megacap technology companies have made big splashes in the artificial intelligence (AI) arena. Apple has not been one of these companies.

However, during a recent segment on CNBC, Dan Ives proclaimed that Apple is about to enter a "renaissance." I agree.

For starters, Apple's new iPhone 16 hit the shelves last week. As I alluded to above, a lot of users in the Apple ecosystem have not been upgrading their devices over the last couple of years. But with signs of economic improvement on the horizon, I think Apple is set to recognize some deferred demand in its new hardware.

Furthermore, I think Apple's recent collaboration with OpenAI will bring two additional catalysts to the company.

First, integrating OpenAI's capabilities into its products has helped spur the creation of Apple Intelligence. As the company begins to roll out new AI-powered services, I think consumers will be inspired to upgrade and purchase Apple's new line of products.

Moreover, Ives is predicting that the relationship with OpenAI will be just the first in a series of AI-inspired partnerships for Apple. In particular, Ives is calling for a deal between Apple and Baidu. Baidu can be thought of as the Google-equivalent in China. Such a deal could help reignite demand for Apple products overseas, particularly in China.

Whether or not a specific deal with Baidu comes to fruition is less important to me. At a higher level, I am aligned with Ives' thinking that OpenAI will be just one in a series of partnerships that Apple strikes as it finally begins penetrating the AI market.

All of these factors could create a tailwind for Apple, which Ives calls a "supercycle." In my eyes, Apple's entrance into the AI realm could represent a pivotal growth arc for the company.

Should you buy Apple stock right now?

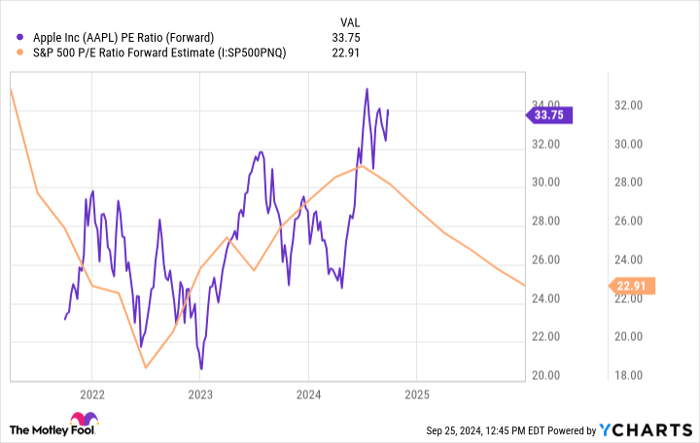

One drawback with Apple stock is that it is pricey at the moment. Right now, Apple's forward price-to-earnings (P/E) ratio of 33.7 sits at a significant premium to the S&P 500's forward P/E of 22.9.

Furthermore, forward P/E trends for the S&P 500 have been normalizing for some time. By contrast, Apple has been experiencing notable valuation expansion.

AAPL PE Ratio (Forward) data by YCharts

I bring all of this up because investors should understand that Apple stock has become more expensive, despite its delayed entrance into the technology industry's newest frontier: AI. There is a fair argument to be made that some of the AI-driven growth is already baked into Apple's share price.

Despite this narrative, I think the company's growth from the new iPhone and from Apple Intelligence more broadly is too tough to call one way or the other right now. For these reasons, I would not underestimate Apple's ability to command reignited growth thanks to a resilient and restored consumer.

In the long run, I still see Apple as a compelling opportunity and think shares are worth a close look right now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.