ASX materials shares led the ASX 200 market sectors last week with a sensational 9.37% gain over the five trading days.

Investors' buy-up of ASX 200 mining stocks was the primary driver of the sector's surge following China's announcement of new economic stimulus measures on Tuesday.

This also drove a sell-down of ASX 200 bank shares, with the financials sector losing 4.42% last week.

The S&P/ASX 200 Index (ASX: XJO) lifted 0.68% to close out the week at 8,212.2 points.

Only four of the 11 market sectors finished the week in the green.

Let's recap.

Materials shares led the ASX sectors last week

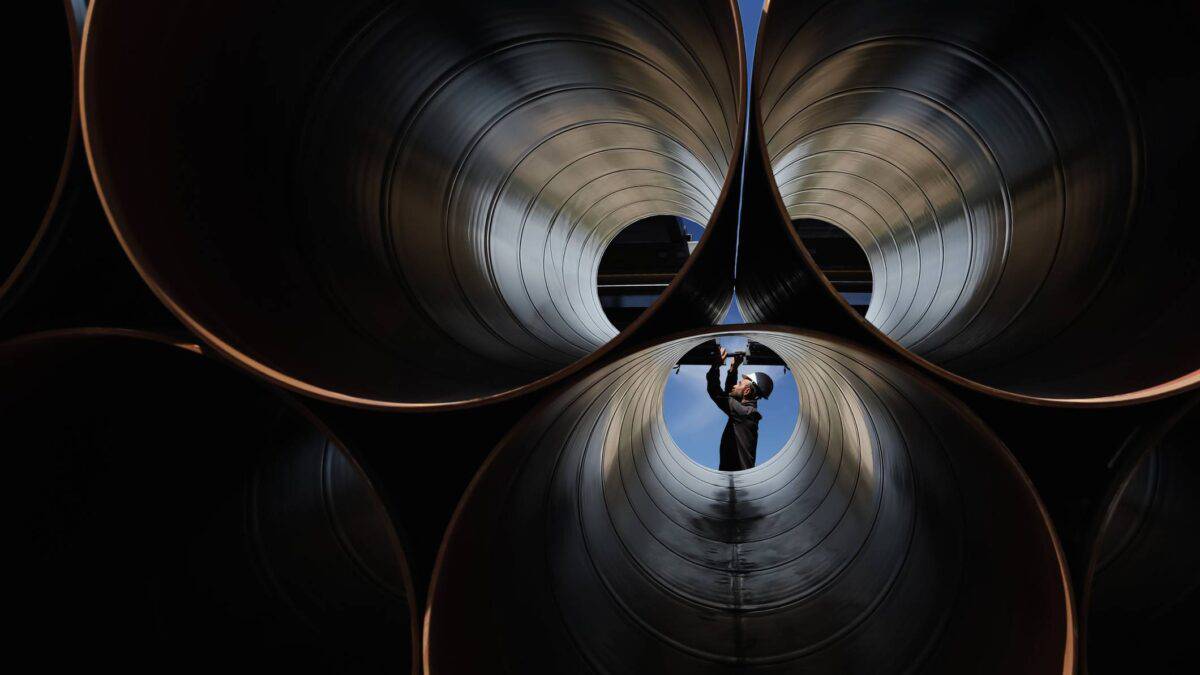

The materials sector incorporates ASX mining shares as well as businesses supplying building materials, chemicals, industrial gases, product packaging, and paper products.

Last week, the ASX miners left most other materials shares in the dust. Rising commodity prices drove the mining stocks up amid anticipation of higher Chinese demand for various metals and minerals.

Among the pure-play ASX iron ore stocks, Champion Iron Ltd (ASX: CIA) shares smashed it with a 29.2% increase in the share price to $7.30 over the week.

Fortescue Ltd (ASX: FMG) shares lifted 15.82% to $20.10. The Fortescue share price was also buoyed by the announcement of a major green partnership between the miner and global equipment manufacturer Liebherr to develop and validate a range of zero-emission mining solutions.

The diversified miners also did well.

The Mineral Resources Ltd (ASX: MIN) share price skyrocketed by 39.56% to close at $49.14 on Friday. The company's completed sale of a 49% interest in its Onslow Iron haul road also boosted the stock.

Shares in BHP Group Ltd (ASX: BHP) surged 13.38% to close at $44.74. Rio Tinto Ltd (ASX: RIO) shares rose 14.22% to $127.45.

ASX 200 copper stock Sandfire Resources Ltd (ASX: SFR) lifted 18.53% to $10.68. ASX 200 aluminium share Alcoa Corporation CDI (ASX: AAI) rose by 15.34% to $57.23.

The share price of copper and aluminium producer South32 Ltd (ASX: S32) rose by 15.81% to $3.70.

Shares in rare earths miner Lynas Rare Earths Ltd (ASX: LYC) lifted 11.98% to close at $7.76 on Friday.

ASX gold miners lifted modestly last week as the gold price reached a new high of almost US$2,670 per ounce on Friday.

Newmont Corporation CDI (ASX: NEM) shares rose by 2.21% to $55.53. The Northern Star Resources Ltd (ASX: NST) share price increased by 0.62% to close at $16.23 on Friday.

Perseus Mining Limited (ASX: PRU) shares rose by 1.33% to $2.67. The De Grey Mining Limited (ASX: DEG) share price increased by 2.21% to $1.39.

What about the non-miners?

Now let's look at some of the non-mining ASX materials shares.

Shares in construction materials supplier James Hardie Industries plc (ASX: JHX) fell by 3.02% to $56.49.

The share price of steel manufacturer BlueScope Steel Limited (ASX: BSL) rose by 6.83% to $21.90.

Shares in plastics packaging company Amcor CDI (ASX: AMC) lifted 2.24% to $16.42.

Shares in fertiliser supplier Incitec Pivot Ltd (ASX: IPL) moved 1.13% higher to $3.13.

ASX 200 market sector snapshot

Here's how the 11 market sectors stacked up last week, according to CommSec data.

Over the five trading days:

| S&P/ASX 200 market sector | Change last week |

| Materials (ASX: XMJ) | 9.37% |

| Information Technology (ASX: XIJ) | 1.7% |

| Energy (ASX: XEJ) | 1.27% |

| Utilities (ASX: XUJ) | 0.51% |

| Consumer Discretionary (ASX: XDJ) | (0.34%) |

| Industrials (ASX: XNJ) | (0.42%) |

| Communication (ASX: XTJ) | (0.85%) |

| A-REIT (ASX: XPJ) | (1.1%) |

| Healthcare (ASX: XHJ) | (1.5%) |

| Consumer Staples (ASX: XSJ) | (1.99%) |

| Financials (ASX: XFJ) | (4.42%) |