This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Investment firms managing over $100 million in stocks are required to file a form 13F with the Securities and Exchange Commission (SEC) once quarterly. These filings can be helpful as they provide a glimpse into what the companies' sophisticated investors, such as hedge fund managers, are buying and selling.

One investor I enjoy following is Steven Cohen of Point72 Asset Management. Last quarter, Point72 sold about 600,000 shares of Amazon (NASDAQ: AMZN) stock -- reducing its stake by 16%. At the same time, the hedge fund initiated a position in another "Magnificent Seven" stock, Apple (NASDAQ: AAPL), buying almost 1.6 million shares.

Let's dig into what may have driven these moves and assess whether Apple deserves a spot in your portfolio as well.

Why sell Amazon stock right now?

Although Amazon is known for its e-commerce marketplace and cloud computing enterprise, its ecosystem also spans advertising, streaming and entertainment, subscription services, and so much more. Considering generative artificial intelligence (AI) applications have the potential to upend so many different end markets, it's not surprising to see that Amazon is emerging at the forefront of the AI conversation.

Simply put, the technology has a chance to ignite all sorts of new growth opportunities for one of the world's largest and most diversified businesses -- and Amazon is making a lot of moves. For example, it invested $4 billion in a start-up called Anthropic. A cornerstone of this relationship is that Anthropic will train future versions of its large language models (LLM) on Amazon's in-house Trainium and Inferentia semiconductor chips.

On top of that, Amazon recently announced an $11 billion infrastructure investment to build its own data centers in Indiana. This investment comes on the heels of Amazon's acquisition of a nuclear-powered data center back in March.

All told, Amazon is spending a lot of money on various AI initiatives. While I can't say for certain what drove Cohen and his team's calculus to trim the position in Amazon, it could be that the company's aggressive spending across the AI realm has inspired some questions regarding the return on these investments.

Why buy Apple stock right now?

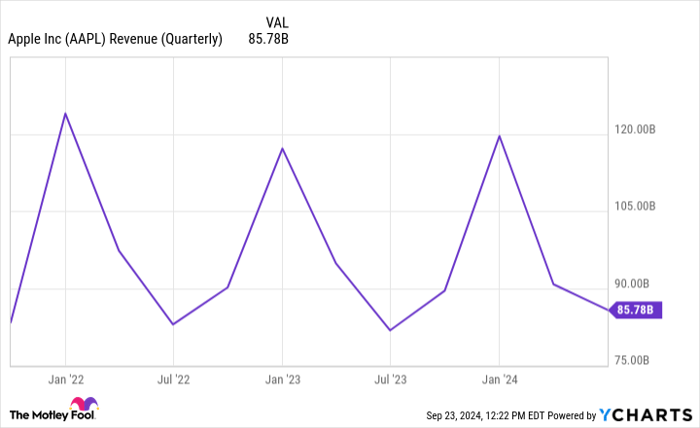

For more than a year, Apple has struggled to demonstrate consistent revenue growth across both its line-up of products and in different geographic markets. While this dynamic has caused some to doubt Apple's growth prospects, I'd say the company's financial trends make some sense from a macro standpoint.

High levels of inflation and a rising interest rate environment have caused consumers in the U.S. to scale back on spending over the last couple of years. Moreover, a sluggish economy in China -- one of Apple's largest markets -- has been a theme from a global perspective that's impacted the company.

AAPL Revenue (Quarterly) data by YCharts.

However, all hope is not lost for Apple. In fact, the company could be looking at a couple of different catalysts right now.

For starters, the iPhone 16 launch is currently underway. Recent cuts to interest rates from the Federal Reserve could spark some newfound spending from rejuvenated consumers. In turn, Apple users may choose to upgrade their old iPhones -- leading to a so-called "supercycle" event for the company.

Moreover, as Apple continues integrating more features leveraging OpenAI and AI technology into its products, demand for the company's newer hardware could witness a surge.

Should you follow Cohen's moves?

Here's the most important thing to note from Cohen's recent moves: Point72 still owns a lot of Amazon stock. In fact, even after trimming its position, Amazon remains Point72's largest position, comprising about 2% of the total portfolio.

I think Cohen's purchase of Apple stock is a savvy move for a couple of reasons. First, adding Apple to the Point72 portfolio provides additional exposure and diversification among mega cap AI players.

While companies such as Amazon have been making moves in the AI realm for some time now, Apple's initiatives have followed a slower pace. For this reason, there's an argument to be made that the AI narrative is less baked into Apple's stock price compared to Amazon's valuation.

Moreover, the iPhone 16 launch and new AI integrations throughout the iOS ecosystem could spark some near-term sales growth, leading to longer-term tailwinds for Apple over time. This could make the timing of Cohen's Apple purchase a particularly smart move.

At the end of the day, I think Cohen is merely hedging his various positions and diversifying his exposure to AI more broadly. Personally, I see both Amazon and Apple as rock-solid choices in a crowded AI landscape. I think Cohen's diversification strategy is a good one to replicate, especially for investors with a long-run time horizon.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.