This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The very idea of investing during a recession might seem counterintuitive, but believe it or not, recessions can end up being incredibly lucrative opportunities. Why? Well, not all businesses are as sensitive to recessions as you might think. For example, I see these two artificial intelligence (AI) stocks as essentially recession-proof businesses thanks to their high levels of resiliency.

1. Microsoft

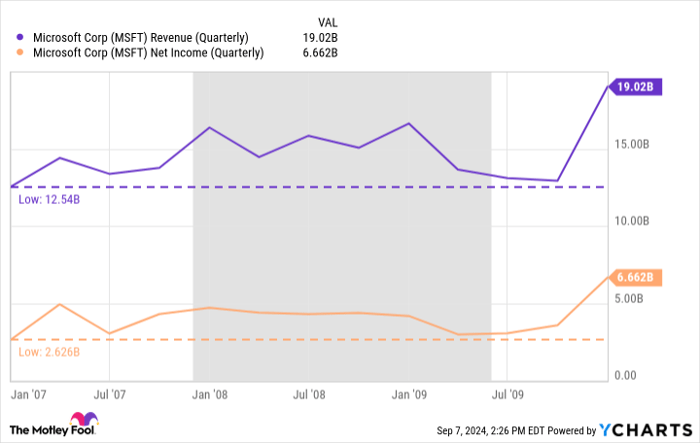

The chart below highlights Microsoft's (NASDAQ: MSFT) revenue and net income trends between January 2007 and December 2009. I deliberately chose this period because it shows the picture before, during, and after the Great Recession, which ran from December 2007 to June 2009 (the grey-shaded area of the chart).

Do you notice anything a little peculiar about Microsoft's business trends during the Great Recession?

MSFT Revenue (Quarterly) data by YCharts.

Although its revenue experienced some noticeable volatility throughout the Great Recession, Microsoft's sales actually remained higher during most quarters of that downturn than they were just prior to it. More importantly, its profitability did not take an overly pronounced hit either.

The only real blemish on Microsoft's business during that period came in the form of a sharp downturn in the quarter that ended June 30, 2009 -- right around the conclusion of the Great Recession. But it rebounded spectacularly just six months later when it generated $19 billion in sales and $6.7 billion of profit in its fiscal 2010's second quarter. That was thanks in part to its successful launch of Windows 7.

Microsoft's ability to generate growth even during times of widespread economic crisis and come out the other side stronger underscores the company's success in its relentless pursuit of innovation. Over the last several decades, Microsoft has evolved from a PC software powerhouse into a much more diversified business with segments spanning hardware devices, workplace productivity software, cloud computing, gaming, social media, and AI.

To me, Microsoft is one of the best stock picks in the tech sector, and would still be a prudent choice for investors to buy even during a recessionary period.

2. CrowdStrike

I'd understand if you're scratching your head at the notion that a volatile growth stock such as CrowdStrike (NASDAQ: CRWD) could be considered recession-proof. But one way to help identify recession-proof businesses is to look at what a company actually sells. For example, does it sell things people actually need or are its wares merely nice to have?

I'd argue that CrowdStrike's services fit squarely into the "something people need" category. Businesses can't really afford to disengage from data and identity protection or network security just because there is an economic downturn.

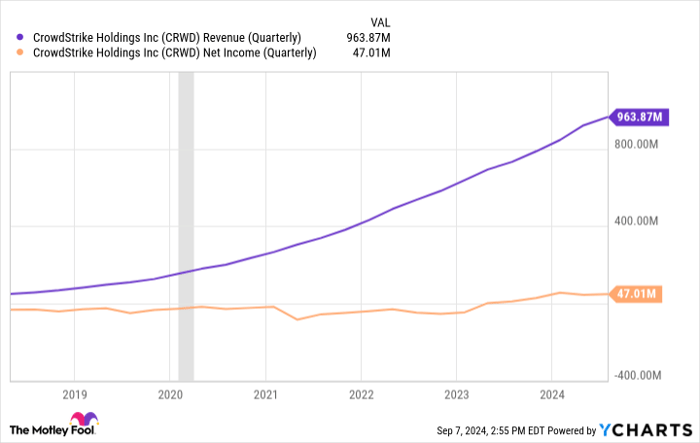

This makes cybersecurity platforms such as CrowdStrike more resistant to economic downturns than other areas of the software market. Need some proof? The narrow grey-shaded column in the graph below illustrates the COVID-19 recession -- which lasted from February 2020 to April 2020.

CRWD Revenue (Quarterly) data by YCharts.

Right around the onset of the pandemic, CrowdStrike began a period of accelerating sales growth. Of course, a big influence was that organizations had a heightened need for stronger cybersecurity as employees around the world traded office cubicles for work-from-home situations. Yet even several years after the crisis phase of the pandemic ended and social distancing efforts faded, CrowdStrike's revenue continued to soar, and the company is now consistently profitable.

Consider as well CrowdStrike's recent software update glitch, which caused major IT outages for many of its customers globally. For weeks, the company featured in media headlines, and the storylines weren't pretty. But last week, investors learned just how much of a toll the IT outage took on CrowdStrike.

As it turns out, CrowdStrike swiftly implemented strategies including flexible payment packages to encourage customer retention. All told, management is forecasting a $60 million impact to revenue as a result of these retention packages. Considering that CrowdStrike boasts $3.9 billion in annual recurring revenue (ARR), I wouldn't be too worried about a $60 million headwind. I think this speaks volumes about both the need for cybersecurity services generally and CrowdStrike's capabilities specifically.

Given that CrowdStrike has managed to navigate two Black Swan-style events in recent years and maintain healthy levels of revenue and profit, I see the stock as a solid opportunity even during times of economic uncertainty.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.