This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

After nearly two years of skyrocketing returns, Nvidia (NASDAQ: NVDA) seems to be finally taking a breather. The stock pulled back after-hours on Wednesday after a robust earnings report. Nvidia beat estimates, but by a more modest margin than investors are used to.

Revenue jumped 122% from the quarter a year ago and 15% sequentially to $30 billion, topping estimates at $28.7 billion. On the bottom line, adjusted earnings per share surged 152% year over year and 11% from the previous quarter to $0.68, ahead of the consensus at $0.64. That was the narrowest earnings beat the company has had since the generative artificial intelligence (AI) boom began.

Nvidia continued to benefit from soaring demand from cloud infrastructure companies, which accounted for 45% of its revenue. Moreover, the broader ramp toward accelerated computing and generative AI continued. The company also gave better-than-expected guidance for the third quarter, calling for revenue of around $32.5 billion, up 79% from the third quarter a year ago.

However, one blemish in the earnings report likely contributed to the sell-off and shouldn't be overlooked by investors.

Nvidia's gross margin takes a step back

One of the most important metrics in the semiconductor industry is gross margin. Unlike software companies, most of the costs facing hardware companies tend to come from costs of goods sold or the direct costs involved in manufacturing chips and components.

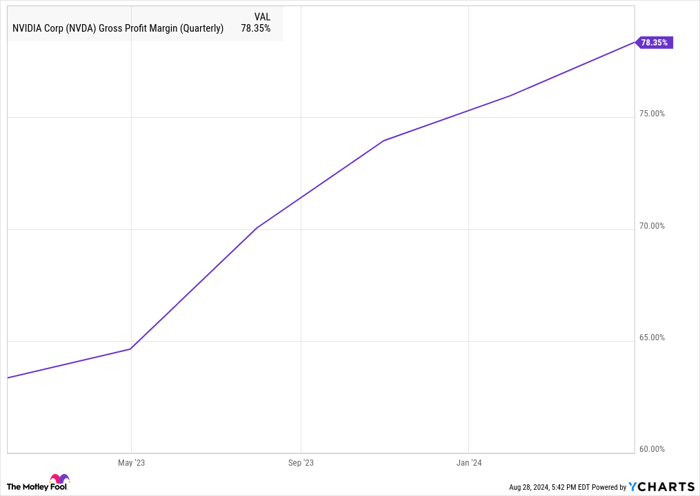

Since the generative AI revolution began, Nvidia's gross margin has rapidly expanded, a sign that the company profits from pricing power and scalability. The chart below shows the company's gross margin through the first quarter of fiscal 2025, which ended in April.

NVDA Gross Profit Margin (Quarterly) data by YCharts.

As you can see, Nvidia's gross margins have soared since the start of the generative AI boom, going from less than 65% before AI demand kicked in to greater than 78% in the fiscal first quarter. However, gross margin pulled back in the second quarter, falling to 75.1% on a generally accepted accounting principles (GAAP) basis.

The company said this was due to a higher mix of new products in the data center segment and inventory write-offs related to the Blackwell launch, but it shows that Nvidia seems to have hit a ceiling with its gross margin expansion. This adds a new risk for the stock, as falling margins would impact profitability. This sequential decline in gross margin translated into slower sequential growth on the bottom line than on the top.

The company expects gross margin to pull back again slightly in the third quarter to 74.4%-75.0% and is targeting the mid-70% range for the full year, possibly implying more weakness in the fourth quarter.

Why gross margin is key

Gross margin is the biggest determinant of overall profitability in the semiconductor industry, and it's a reflection of a company's pricing power and efficiency.

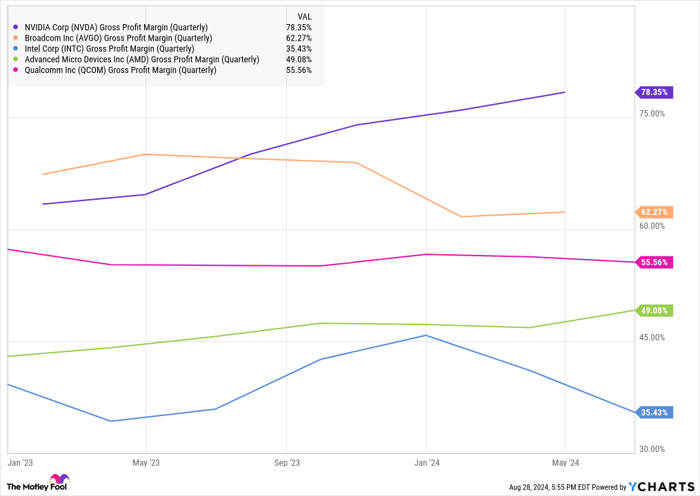

As you can see from the chart below, Nvidia is now significantly ahead of its peers.

NVDA Gross Profit Margin (Quarterly) data by YCharts.

Nvidia's gross margins are a testament to its strength and competitive advantages in AI, but if competition from AMD and others begins to have an impact on Nvidia, it's likely to show up as lower gross margins first.

What it means for investors

Considering Nvidia's overall growth on the top and bottom lines remains strong, even on a sequential basis, and the upcoming launch of its Blackwell platform in the fourth quarter is expected to drive another surge in demand, the decline in gross margin isn't an emergency.

However, investors should be tracking the number in future quarters. If this crucial margin continues to decline, that could precede greater problems in the business.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.