This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Warren Buffett's company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), is known for its ability to find value in the markets. That's why when it makes a move to buy a stock, many investors often follow suit, feeling confident that Buffett or Berkshire's other managers saw some considerable value there.

On the flip side, investors may grow concerned when they don't see a lot of buying activity, and Berkshire's cash balance has been growing instead. They may be reading into that trend as a sign of cause for concern in the markets. And with Berkshire's cash balance indeed rising, should investors be worried about the stock market?

Is this a time to sell off your stocks and wait for better economic conditions?

Berkshire's cash reaches a new record

It's no secret that Berkshire Hathaway's cash balance has been growing. Every quarter, it reports on its cash and short-term investments, and in the past Buffett has suggested that he wouldn't be surprised to see the balance continue to rise. And that has indeed been happening -- its cash was at record levels of around $277 billion as of June 30.

BRK.A Cash and Short-Term Investments (Quarterly) data by YCharts.

This sharp increase in Berkshire's cash comes as the company has been selling off shares of multiple companies, including Apple and Bank of America. Tech company and iPhone maker Apple has accounted for close to half of Berkshire's holdings in the past. Today, it makes up a more modest 29% of all investments.

Is this a sign that Buffett is worried about the markets?

Selling shares of some of his top investments may seem alarming to investors, especially with recent concerns of a recession on the rise. Economic conditions are worsening, and now expectations are that the Federal Reserve will cut rates in the near future -- it's just a matter of how steep and how many cuts there will be rather than whether there will be any at all this year.

But Buffett has remained invested in stocks throughout worse and more concerning periods in the past (even wars). He doesn't sell due to economic conditions or forecasts. His stock sale of Apple, for instance, may have more to do with concerns about capital gains taxes increasing and what effect that may have on Berkshire's shareholders than anything else. There's no indication to suggest that he suddenly thinks Apple has become a worse company to invest in or that it has somehow lost its competitive moat and ability to dominate the market. It is, after all, still the top holding in Berkshire's portfolio.

What is notable is that amid all the selling of Apple and, to a lesser extent, Bank of America stock, Berkshire is simply holding onto its cash load; it isn't taking big positions in new companies. It has added Ulta Beauty to its portfolio recently, but for the most part Berkshire hasn't been buying up shares of other stocks. This could be a sign that Buffett isn't seeing tremendous buying opportunities right now, perhaps because valuations have become too inflated.

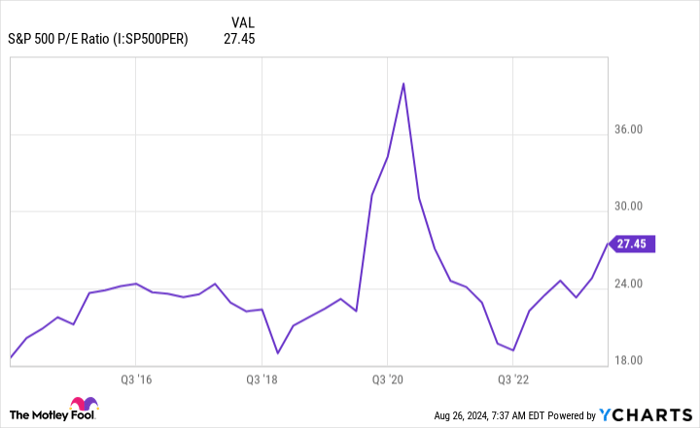

S&P 500 P/E Ratio data by YCharts. P/E = price to earnings.

Aside from 2020, which was an unusual time in the markets due to the emergence of COVID-19, the S&P 500 does appear to be trading at a fairly high valuation today. And if that weren't the case, I would certainly have expected Buffett to be buying up more stocks with all that cash on hand.

Investors shouldn't ignore valuations when picking stocks

Even if you're bullish on a company's long-term prospects, that doesn't mean you should ignore its valuation. A stock that trades at a high premium could mean it takes a while for you to earn a good return on your investment because investors have already paid for and priced a lot of future growth into its valuation. There's also minimal, if any, margin of safety that comes with stocks that are trading at high premiums.

Investors shouldn't try timing the markets or waiting for Berkshire to make big moves before deciding to buy stocks. But it would be prudent and worthwhile to consider the premium you might pay for a stock before adding it to your portfolio. If it looks excessive, it may be better to put that investment on a watchlist rather than buy it.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.