This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Artificial intelligence (AI) is the single biggest leap in technology since the internet -- or so say its biggest believers. Its effect on the market has been enormous. Led by the poster child of the AI revolution, Nvidia Corp (NASDAQ: NVDA), AI stocks went on a tear over the last few years that made a lot of people a lot of money.

The last month or so hasn't been so kind; the Nasdaq Composite Index (NASDAQ: .IXIC) is down more than 10% since its peak in early July. The majority of big tech players released their earnings for Q2 2024, and although there was a lot of positive news -- Meta Platforms posted 22% year-over-year revenue growth for the quarter -- investors were somewhat spooked by the larger-than-expected spends the companies are planning to make on AI infrastructure.

This, in combination with broader market fears -- here's hoping the Federal Reserve can nail that "soft landing" -- hit Nvidia hard. Its stock is down over 22% since July 10. But you know what? I think this is great news. It's a buying opportunity for those who still believe in the stock, and I do. With the company set to release its Q2 numbers on Aug. 28, here are two reasons to buy before it does.

1. Big tech doesn't plan to slow its spending soon

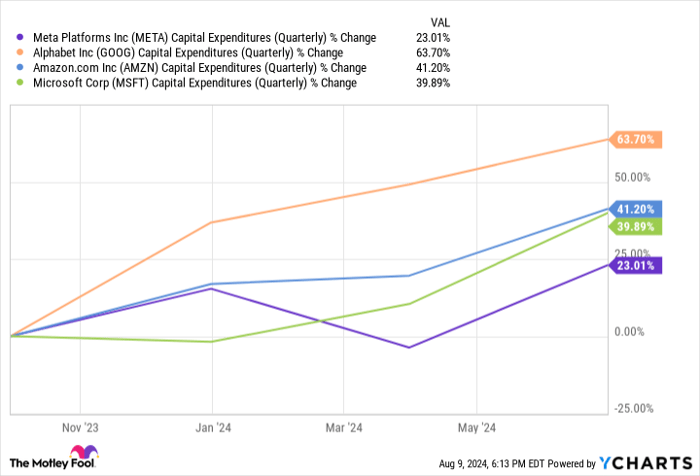

During the latest round of earnings calls, CEOs from the big tech players fueling Nvidia's monster returns fielded questions about their companies' expectations for future capital expenditures (capex), specifically those relating to AI. Alphabet, for instance, spent about $32.3 billion in capex in 2023. This year, the company could hit $50 billion. That's a massive increase, and it's not alone. Check out this chart showing the net change in capital expenditures from Alphabet et al. over the past year.

META Capital Expenditures (Quarterly) data by YCharts

If there is an end to massive spending on AI infrastructure, it is some ways off. AI is too big an opportunity, and no company wants to be left behind. As Alphabet CEO Sundar Pichai put it in the earnings call, "The risk of underinvesting is dramatically greater than the risk of overinvesting for us here." Although there is more to AI infrastructure than the chips Nvidia provides, they are arguably the most essential part, and Nvidia is likely to be flooded with cash for some time. Of course, Nvidia must work to maintain its market share, but it is in a strong position to do so.

2. There are signs that AI is delivering real-world value

But can AI deliver the kind of real-world value that justifies its enormous cost? I think the jury is still out, but Meta's recent earnings make me more confident. As I mentioned earlier, Meta posted 22% revenue growth from a year ago and a whopping 73% jump in earnings per share. During its recent earnings call, CEO Mark Zuckerberg attributed this jump in part to AI. The company used AI to improve its content algorithm, which led to more engagement. This translated into more use, which meant more advertising revenue.

Zuckerberg spoke of his plans to have AI craft entire marketing campaigns -- both strategy and the creative assets themselves -- for advertisers. This could open up a whole new revenue stream for the company. The idea is just one example of the powerful, revenue-generating promise of AI. The more evidence of real-world value, the more companies will be willing to continue to spend on AI, and that is good news for Nvidia.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.