This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Volatility continued for Nvidia Corp (NASDAQ: NVDA) stock in Thursday's trading. The artificial intelligence (AI) leader's share ended the daily session down 6.7%, according to data from S&P Global Market Intelligence.

After posting big gains Wednesday, Nvidia stock initially looked poised to see another day of gains thanks to strong demand indicators following the publication of Meta Platforms' Q2 results and guidance. However, macroeconomic concerns took centre stage for the broader stock market, and the highlighting of related risk factors drove big sell-offs for the chip specialist.

Nvidia stock has been in topsy-turvy mode lately

Nvidia's latest pullback comes on the heels of even bigger gains on Wednesday. Microsoft issued encouraging capital expenditures and AI investment guidance with its recent quarterly report. Advanced Micro Devices also published Q2 results that showed demand for data centre processors was high.

Investors were also feeling bullish ahead of expectations that yesterday's Federal Reserve meeting would signal that an interest rate cut is coming in September. In response, Nvidia's market capitalisation increased $330 billion on Wednesday — the biggest-ever daily gain for a company.

The rally almost looked poised to continue Thursday. Encouraging capex guidance and commentary from Meta Platforms gave Nvidia stock a boost in pre-market and early daily trading, but the gains faded as an uptick in bearish sentiment for the overall stock market took hold.

While the Fed's July meeting signalled that the much-anticipated interest rate cut would likely arrive next month, some economists are seeing an increased risk of recession due to a recent increase in jobless claims and other factors. The S&P 500 Index (SP: .INX), Nasdaq Composite Index (NASDAQ: .IXIC), and Dow Jones Industrial Average Index (DJX: .DJI) fell roughly 1.4%, 2.3, and 1.2%, respectively.

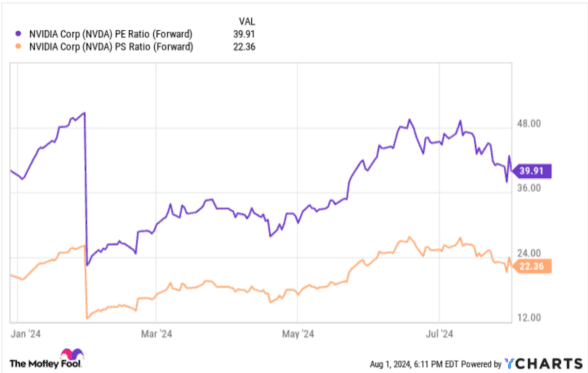

NVDA PE Ratio (Forward) data by YCharts

After Thursday's sell-off, Nvidia is trading at roughly 40 times this year's expected earnings and 22 times expected sales. Notably, the company's price-to-earnings ratio is less than two times the company's price-to-sales ratio, which reflects the stellar profit margins the business has been serving up lately. But it's still a high-risk, high-reward stock.

Aided by ongoing demand for AI technologies, Nvidia will likely continue to post strong sales and earnings growth for the rest of the year and in 2025 — but the outlook is a bit murkier further out. The company's business has historically been shaped by cyclical trends, and it's not entirely clear what stage we're at in the current artificial intelligence investment cycle, and what macro backdrop will emerge.

On the other hand, the long-term outlook for AI-related hardware and services demand remains incredibly promising. If you're looking to build positions in artificial intelligence and are willing to embrace near-term volatility, taking advantage of pullbacks in Nvidia could be worthwhile.