Investing the easy way with a simple 'buy and hold' strategy on high-quality shares vs. property can lead to exceptional capital gains for patient investors.

In this article, we will present data on both asset classes to demonstrate how you can make great capital gains if you buy and hold high-quality real estate investments and/or ASX growth shares.

Let's get started.

Shares vs. property: Patience is a virtue

Let's begin with property.

In CoreLogic's latest Pain and Gain report, we see how capital gains can improve over time.

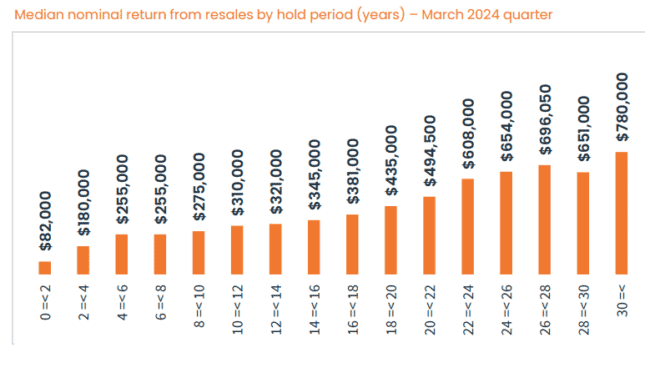

The following chart shows the median capital gains of approximately 85,000 homes resold in the March 2024 quarter. The longer a property was held, the higher the capital gain tended to be in dollar terms.

Source: CoreLogic

CoreLogic's Head of Research, Eliza Owen, commented:

Time in the market rather than timing the market is critical to maximising returns for most resales.

Generally, the longer a vendor holds a property the higher the returns with vendors selling after 30 or more years attracting the largest median gain of $780,000.

In the March quarter, 94.3% of the 85,000 resales were profitable. That's the highest profitability rate since July 2010 and reflects strong market conditions in most states and territories today.

The median capital gain per profitable resale was $265,000.

However, it's worth noting that the data is based on the difference between sale and purchase prices alone. It does not take into account the trading and holding costs of homes or real estate investments.

Now let's turn to ASX growth shares.

Here are some examples of growth stocks that have delivered impressive share price gains (dividends not included) over recent decades.

Pro Medicus Limited (ASX: PME)

Pre Medicus shares have screamed 14,765% higher over the past 10 years.

CSL Ltd (ASX: CSL)

The CSL share price has ascended about 7,040% over the past 25 years.

Cochlear Limited (ASX: COH)

The Cochlear share price has increased by about 2,465% over the past 25 years.

REA Group Ltd (ASX: REA)

The REA share price has risen by almost 2,300% over the past two decades.

Macquarie Group Ltd (ASX: MQG)

The Macquarie share price has ascended by about 945% over the past 25 years.

Xero Limited (ASX: XRO)

The Xero share price has risen by about 520% over the past 10 years.

Commonwealth Bank of Australia (ASX: CBA)

CBA shares have increased by about 450% over the past 25 years.

Shares vs. property: Which performs best over the long term?

If you've grappled with the choice between buying shares vs. property for investment, it may be comforting to learn that both have delivered very similar long-term returns.

In a blog, AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver said $100 invested in either shares vs. property in 1926 would be worth just over $1.6 million today (assuming dividends and rent after costs were reinvested).

ASX shares have delivered an average 11.2% per annum return vs. property at 10.9% per annum, he said.

Further reading

Find out whether shares or property delivered the best growth in FY24, as well as which individual ASX stocks vs. residential suburbs recorded the most capital gains in FY24.