Numerous influential figures have shaped the investing world throughout history, their strategies and insights continuing to guide modern investors. By studying their successes and failures, contemporary investors can glean invaluable lessons in risk management, market analysis, and long-term planning. These timeless principles, forged through decades of experience, remain relevant in navigating the complexities of today's financial landscape.

In this article, we delve into the story of 'The Witch of Wall Street', Hetty Green, a formidable and pioneering figure in American finance during the late 19th and early 20th centuries whose unwavering commitment to frugality and financial gain attracted admiration and criticism.

Premium content from our Investing Team

Hetty Howland Robinson Green was born in 1834 and died in 1916 at the age of 81. At the time of her death, she had a net worth of approximately $100 million, or $2.5 billion in today's dollars, making her the world's wealthiest woman at the time.

Though Hetty can thank an impressive inheritance for much of her early wealth (her grandfather and father were business partners in a whaling fleet, which they evolved to focus on shipping cargo), her savvy financial behaviour and decisions absolutely helped. She began reading financial reports in the newspaper by the age of six, opened a bank account for her saved nickels by the time she was eight, and soon learned how to trade shares.

Hetty became incredibly business savvy by observing how her father conducted business and negotiated deals. She developed a smart investment strategy for the portion of her wealth that she had control over (with much of her inheritance held in trust, and thus outside her control), and conducted extensive research into investment opportunities with a particular interest in railroads, real estate and government bonds.

Here's what the Smithsonian Magazine had to say about Hetty:

"Her handwriting was sloppy and riddled with misspellings, but she surely knew her numbers. More importantly, she knew how to increase them. She oversaw tremendous real estate deals, bought and sold railroads, and made loans. She was particularly adept at prospering during the downfall of others; buying falling stocks, foreclosing properties, and even holding entire banks, entire cities, at her mercy through enormous loans. Depending who you asked, she was either a brilliant strategist or a ruthless loan shark."

Though her success is undeniable, her financial story (summarised above) is somewhat straightforward. What isn't so straightforward is her absolute fixation on making and maintaining money in her personal life.

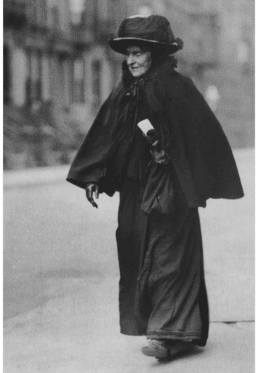

Despite her enormous wealth, she refused to seek medical attention for herself or her children because of the cost. Some reports suggest that her own son's leg had to be amputated due to infection because she refused to bring him to the doctor, while she personally endured a painful hernia for 20 years before finally agreeing to pay $150 to have it surgically repaired. The clothes she wore were fully black, which some reports suggest she wore until they turned mouldy, and she wore these even while brokering broker business deals. It was this behaviour and appearance that earned her the nickname "The Witch of Wall Street".

Source: HeadStuff

In other circles, she was also known as "The Queen of Wall Street" as both men and women sought her guidance in an otherwise male-dominated world of business and finance.

According to Lighting The Way: Historic Women of the SouthCoast, Hetty considered her most valuable gifts to be the jobs that her wealth created through her investments in the United States.

Finding Balance

More than 100 years after Hetty Green's passing, many families today face significant financial challenges due to high interest rates and rising living costs. These economic pressures can make it difficult to find a balance between saving and investing, but also still enjoying life. Though noble, Hetty's personal sacrifices can be considered nothing short of obsessive and highlight that extreme frugality isn't the only path to financial health nor success.

Here are some of the things that individuals and families today can do to navigate these challenging times, without sacrificing your quality of life.

First, prioritise essential spending. Things like food, healthcare (we're also very lucky to have free access to quality healthcare here in Australia) and housing are unavoidable, although you may be able to find ways to reduce those costs.

On a personal note, my family subscribes to Woolworths (ASX: WOW) Everyday Extra service which costs us $70 per year but gives us 10% off one shop each month. My wife, who typically does the shopping, does one large shop each month (and three smaller ones), and can save around $45 each month following this strategy. Over the course of a year, that's $540 saved by paying just $70 initially (Please note, I am not receiving any kickback or compensation for mentioning this service).

Second, budget wisely. Create a budget that accounts for your current financial situation, and identify areas where you can cut unnecessary spending. At the same time, allocate a portion of your budget for leisure and enjoyment. You might need to cut back (e.g. dinner and a movie night once a month rather than once a fortnight, for example) but it's important to still enjoy life.

Third, continue to invest for the future. Granted, this can be difficult when other costs are going up, but it's crucial to invest even small amounts to build it into a habit. Consistent, disciplined investing can yield significant long-term benefits (that's likely why you're a member of The Motley Fool, after all)!

Fourth, build an emergency fund. Even if you can only afford small contributions for now, it's necessary to have a financial cushion to provide peace of mind in case of a crisis. You may even want to consider seeking professional advice from someone who is licensed to provide advice at the personal level (our financial licence allows us to provide general advice only).

Foolish Bottom Line

You don't need to live like Hetty Green in order to set yourself up for tomorrow. By prioritising essentials, budgeting wisely, investing consistently and maintaining an emergency fund, we can build a secure financial future while still enjoying the present.

Indeed, the goal of investing and saving is to enhance our lives, not to restrict them.