This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

During the mid-1990s, the arrival of the internet opened new doors for corporate America and altered its growth trajectory forever. But for more than a quarter of a century, professional and everyday investors have been pondering which transformative innovation would be next to rival what the internet did for businesses. Artificial intelligence (AI) appears to be the anointed answer to this long-standing query.

With AI, software and systems oversee tasks that would previously have been assigned to humans. What gives AI such broad-reaching potential — PwC believes artificial intelligence can add $15.7 trillion to the global economy by 2030 — is the capacity for software and systems to learn and evolve without human intervention.

Although AI stocks have been virtually unstoppable over the last 18 months, a shift in AI euphoria may be brewing, with Nvidia (NASDAQ: NVDA) being the culprit behind it.

Nvidia's operating ramp has been virtually flawless

Before I dig into the negatives, let's give credit where credit is due. Semiconductor titan Nvidia was able to harness its first-mover advantage to become the leading provider of graphics processing units (GPUs) in AI-accelerated data centers.

Based on an analysis from the researchers at TechInsights, Nvidia accounted for 3.76 million of the 3.85 million GPUs that were shipped to enterprise data centers last year. For those of you wondering, this represents a cool 98% market share.

On top of its first-mover advantage, Nvidia holds clear-cut computing advantages over its competition. While Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD) are attempting to play catch-up to Nvidia's in-demand H100 GPU, Nvidia is readying to roll out its next-generation GPU architecture, known as Blackwell. In June, CEO Jensen Huang also teased the successor to Blackwell, known as Rubin, which is expected to hit the market in 2026.

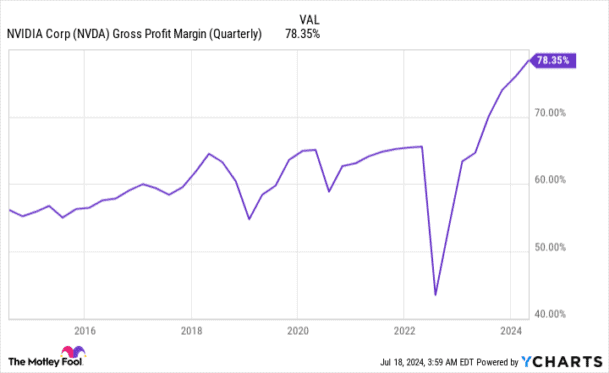

The demand for Nvidia's chips has also overwhelmed their supply. When an in-demand good is in tight supply, it's not unusual for the sales price of said good to meaningfully increase. Nvidia has been able to boost its H100 to (at one point) north of $40,000 per chip. The end result is a notable expansion in the company's adjusted gross margin to 78.35% during the fiscal first quarter (ended April 28).

The AI revolution has lifted Nvidia's shares by 706% since the start of 2023, which has boosted its market cap by more than $2.7 trillion. It's this historic scaling from one of Wall Street's most influential businesses that compelled the company's board to complete a 10-for-1 stock split in June.

However, Nvidia's glory days may prove to be short-lived.

Nvidia's own forecast is an ominous warning of challenges to come

No matter how high the bar has been set, Nvidia has hurdled Wall Street's revenue and profit forecasts in each of the previous five quarters. But the company's adjusted gross margin forecast for the fiscal second quarter provides an ominous warning for Wall Street and investors that shouldn't be ignored.

Nvidia's second-quarter guidance calls for its adjusted gross margin to come in at 75.5%, plus or minus 50 basis points. This would mark a 235 to 335 basis-point decline from the 78.35% adjusted gross margin reported in the fiscal first quarter.

In one respect, a 75.5% adjusted gross margin is about 10 percentage points higher than where things stood in early 2022. A 75% to 76% adjusted gross margin is still phenomenal for a business the size of Nvidia.

NVDA GROSS PROFIT MARGIN (QUARTERLY) DATA BY YCHARTS.

On the other hand, this represents the first expected decline in adjusted gross margin since the summer of 2022. More importantly, it looks to be a clear warning that the otherworldly pricing power Nvidia has enjoyed is beginning to dissipate.

Intel and AMD haven't been shy about their desire to chip away at Nvidia's hardware monopoly in enterprise data centers. Intel unveiled its Gaudi 3 AI accelerator chip in April, with plans of a ramped-up commercial launch during the third quarter. Meanwhile, AMD has been beefing up production of its MI300X AI-GPU, which is considerably cheaper than the H100 GPU.

Although some aspects of the Gaudi 3 and MI300X offer competitive edges over Nvidia's H100, the latter holds a clear-cut compute advantage. The problem for Nvidia is that it's nowhere close to meeting the demand of its customers. As a result, Intel and AMD shouldn't have any trouble finding a strong market for their AI-GPUs in the coming months.

Furthermore, Nvidia's top four customers by net sales — Microsoft, Meta Platforms, Amazon, and Alphabet — are internally developing AI-GPUs for their respective data centers.

Similar to Intel and AMD, these in-house chips are unlikely to rival the compute capacity of Nvidia's H100 or Blackwell architecture. But they are going to take up valuable real estate in AI-accelerated data centers. The development of these AI-GPUs also provides a pretty clear message that America's most influential businesses aim to reduce their reliance on Nvidia's hardware going forward.

The bulk of Nvidia's growth over the last five quarters can be traced to its pricing power. With Intel and AMD set to flood the market with additional chips, and four "Magnificent Seven" companies developing AI chips for internal use, the AI-GPU scarcity that's fueled Nvidia's adjusted margin ramp is going to disappear. Nvidia's forecast decline in adjusted gross margin likely speaks to these pricing pressures, which I believe will only grow stronger in subsequent quarters.

But wait — there's more

In addition to Nvidia's own forecast seemingly portending trouble, history hasn't been all that kind to next-big-thing innovations, technologies, and trends.

When examined over long periods, some hyped trends have made investors considerably richer (e.g., the internet), while others ended up face-planting (e.g., 3D printing and cannabis stocks). But one thing every single next-big-thing innovation or trend has had in common since the mid-1990s is that they all endured a bubble-bursting event early in their existence.

To be clear, there's no way to precisely forecast when the music will stop or the euphoria will fade when it comes to a game-changing technology or buzzy trend. But when looking in the rearview mirror, there hasn't been a single instance for three decades where investors didn't overestimate the adoption and/or utility of a new technology or trend.

While some investors might be of the opinion that artificial intelligence has the ability to buck this unwritten rule, the reality is that most businesses lack a well-defined blueprint for how AI is going to increase sales and profits. This, by definition, demonstrates an overestimation of adoption and/or utility of this game-changing technology.

I strongly believe there's a path for artificial intelligence to meaningfully improve global productivity and provide consumption-side benefits when looking 10 or 20 years into the future. But over the next year or two, I expect it to become painfully apparent to Wall Street and everyday investors that most businesses have no real plan to generate a return on their AI investments.

With history as my guide, and Nvidia's guidance as my confirmation, I fully expect the AI bubble to burst sooner rather than later.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.