Two years ago, ASX lithium shares were a hotbed for incredible returns. Today, the once dazzling sector is ground zero for some of the poorest performances on the Australian share market over the past year.

The electrifying commodity lithium has experienced an unceremonious price collapse. From its peak in November 2022, the price of lithium carbonate is down roughly 85%, bringing it back in line with prices witnessed in 2021 — a change undoubtedly challenging the economic viability of many recent lithium developments.

Booms and busts are common among commodities. However, the companies involved need to survive if investors are to benefit from lithium prices rising again.

So, how financially insulated are some of the most popular lithium names?

Financial fitness of ASX lithium shares

There is no better position than being a company with positive free cash flows during distressing times — that is, more cash coming in than going out. Realistically, such companies can benefit from weak conditions by making strategic acquisitions while competitors struggle.

Conversely, hard times are the enemy if a company is short on cash and has low cash flows. It can pay to understand which businesses are financially sound and which are possibly limping along.

The table below briefly summarises the financial standing of several popular ASX lithium shares.

| ASX-listed company | Cash and equivalents (millions) | Free cash flow (millions) | Cash runway (months) | Debt-to-equity ratio |

| Mineral Resources Ltd (ASX: MIN) | $1,383.0 | -$1,528.0 | 11 | 113.9% |

| Pilbara Minerals Ltd (ASX: PLS) | $2,144.0 | $677.4 | ∞ | 14.1% |

| IGO Ltd (ASX: IGO) | $353.3 | $1,047.0 | ∞ | 0.0% |

| Liontown Resources Ltd (ASX: LTR) | $516.9 | -$519.1 | 12 | 38.4% |

| Vulcan Energy Resources Ltd (ASX: VUL) | $79.7 | -$117.0 | 8 | 0.0% |

| Core Lithium Ltd (ASX: CXO) | $125.4 | -$98.1 | 15 | 0.0% |

| Patriot Battery Metals Inc (ASX: PMT) | $73.0 | -$107.8 | 8 | 0.0% |

Western Australian mining giant Mineral Resources may look to be in a precarious financial position based on the above. As of 31 December 2023, the iron ore and lithium miner showed a highly indebted balance sheet and negative free cash flows, producing a forecast cash runway of 11 months.

Since then, Mineral Resources has taken action by ceasing operations at its Yilgarn Hub and selling 49% interest in its Onslow Iron project for $1.3 billion. Core Lithium took a similar course of action in January, suspending mining at its Finnis mine to conserve capital.

In comparison, Pilbara Minerals and IGO are still cash flow positive with little or no debt. This may suggest these two ASX lithium shares are better placed to weather extended weakness. However, it's worth noting that even these miners are experiencing declines in their free cash flows.

This year, companies like Liontown Resources, Vulcan Energy Resources, and Patriot Battery Metals have turned to debt and equity markets to shore up their balance sheets. In doing so, they have likely extended their cash runways beyond the figures above.

Is the worst yet to come?

If we can roughly estimate how long a company can sustain itself, the next question to consider is how long the tough times will last.

Unfortunately, none of us are fortune tellers. Nevertheless, analysts have crunched the numbers to obtain a best guess, and the general consensus is bleak.

Analysts from Citi, UBS, and Wood Mackenzie all expect lower lithium prices to come. For example, Wood Mackenzie thinks spodumene could hit rock bottom at around US$1,000 per tonne and stay suppressed until 2028.

If true, even ASX lithium shares with the most fortified financials may face pressure.

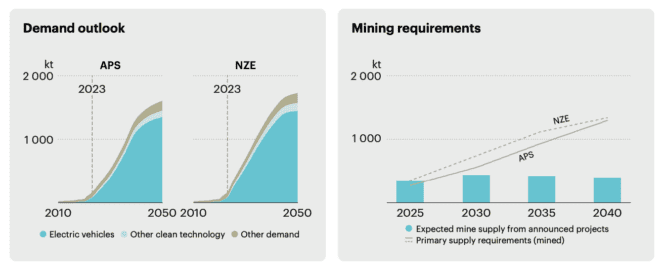

However, if the International Energy Agency's estimates are accurate, the ones that survive could flourish. According to its Global Critical Minerals Outlook 2024 report, a lithium supply deficit is expected by 2030 as demand for electric vehicles takes hold, as shown above.