The exchange-traded fund (ETF) Betashares Nasdaq 100 ETF (ASX: NDQ) provides a way for Australian investors to gain exposure to the biggest companies listed on the US-based NASDAQ stock exchange.

The ETF seeks to track the performance of the largest 100 stocks by market capitalisation. This group is collectively the NASDAQ-100 Index (NASDAQ: NDX).

When you think of the NASDAQ, the first thing that may come to mind is mega US tech stocks.

That's understandable, given that the NASDAQ is home to the Magnificent Seven, all of which are either technology enterprises themselves or use advanced technology to produce their products and services.

Just to remind you, the Magnificent Seven stocks are Meta Platforms Inc (NASDAQ: META), Amazon.com, Inc. (NASDAQ: AMZN), Apple Inc (NASDAQ: AAPL), Alphabet Inc (NASDAQ: GOOGL) (NASDAQ: GOOG), Nvidia Corp (NASDAQ: NVDA), Microsoft Corp (NASDAQ: MSFT), and Tesla Inc (NASDAQ: TSLA).

The first thing you may not know

While the NASDAQ 100 (and thus, the Betashares Nasdaq 100 ETF) is certainly 'overweight' in tech stocks, there are also many stocks from other sectors.

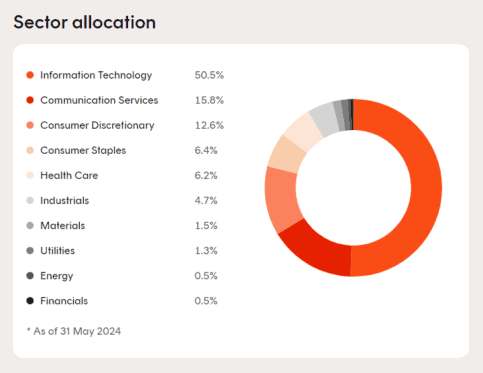

Here is the latest Betashares Nasdaq 100 ETF sector allocation, as published on betashares.com.au.

As you can see, only half the NDQ ETF's allocation is tech stocks.

At the recent ASX Investor Day held in Sydney, Betashares investment strategist Tom Wickenden pointed out that the Betashares Nasdaq 100 ETF was a particularly complementary holding for ASX 200 investors.

One reason is their opposite sector weightings.

The S&P/ASX 200 Index (ASX: XJO) is dominated by banks and major miners, while the NDQ ETF is dominated by tech stocks.

The ASX 200 comprises 30.6% financial shares, 22.7% materials shares, and only 3.2% tech stocks. In contrast, the NDQ ETF has only 1.5% materials shares, 0.5% financial shares, and 50.5% tech stocks.

Furthermore, the NDQ ETF complements ASX 200 shares because it offers geographical diversification beyond Australia — and not just to the US economy, either.

This brings us to the second thing you may not know about the Betashares Nasdaq 100 ETF.

Only 50% of earnings come from the US

Although the NASDAQ is a US-based stock exchange and comprises many big-name US-based companies, NASDAQ 100 businesses tend to be global in nature with a globally diverse customer base.

This means they generate revenue in many different countries and are exposed to many different economies.

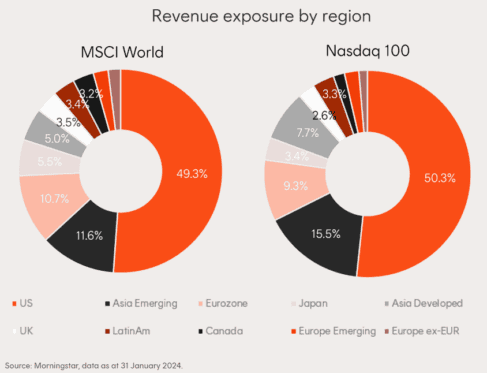

So, while you may initially associate the NASDAQ with the United States, it's worth knowing that only 50.3% of revenue generated by the NASDAQ 100 comes from the US.

The rest comes from various other countries, with a revenue split very similar to the MSCI World Index.

Take a look.

Source: Betashares.com.au

This is notable because investors tend to look to MSCI indexes to attain worldwide diversification for their portfolios.

The MSCI World Index comprises 1,464 stocks across 23 developed countries. According to msci.com, the index "covers approximately 85% of the free float-adjusted market capitalization in each country".

So, it's interesting to note that the Betashares Nasdaq 100 ETF can offer virtually the same geographical earnings diversification, but your investment is more concentrated with just 100 stocks instead of 1,464.

Is that a positive or negative? You decide. We're just letting you know.

An 'investment in innovation'

Wickenden points out that the NASDAQ 100 "is the home of innovation globally" and thereby represents an investment in not just technology but also innovation, which encapsulates so much more than IT.

And 'tis the era, right?

Did someone say electric vehicles? Or green steel?

Wickenden says that of the nine listed companies to ever touch the trillion-dollar mark in market capitalisation, seven have achieved their success through major innovation.

Of course, those seven stocks are the Magnificent Seven.

(Fun fact: The other two stocks that reached US$1 trillion were PetroChina and Saudi Aramco.)

He also says that innovation requires a serious commitment to research and development (R&D), and the NASDAQ 100 (and thus the Betashares Nasdaq 100 ETF) gives investors exposure to such companies.

Wickenden said:

If we look under the hood of the NASDAQ 100, what we find is it's home to some of the most innovative companies in the world and also some of the biggest R&D spenders in the world.

We can see … over the past 10 years huge growth of research and development spending has coincided with huge growth of revenue and ultimately earnings growth for that index compared to other companies globally and especially compared to the Australian market.

Wickenden used Microsoft as a case study.

He said a huge investment in cloud computing many years ago resulted in Microsoft's cloud computing division alone delivering more revenue than Australia's Big Four banks combined last year.

You can check out the NDQ ETF's entire portfolio and weightings here.

The Magnificent Seven's weightings in the NDQ ETF at the time of writing are Apple 8.6%, Microsoft 8.5%, Nividia 8.4%, Alphabet 5.3%, Amazon 4.9%, Meta 4.5%, and Tesla 2.3%.

A short price history on Betashares Nasdaq 100 ETF

The Betashares Nasdaq 100 ETF closed Tuesday's session at $45.60 per unit, up 0.75% for the day.

The NDQ ETF has risen 22% in the year to date and 34% over the past 12 months.