This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Tesla (NASDAQ: TSLA) stock gained in Thursday's daily trading session, with the electric vehicle (EV) innovator's share price up almost 3% as of the close.

Tesla stock gained ground following indications that CEO Elon Musk's latest compensation package is likely to be approved. After the market closed yesterday, Musk indicated that shareholders were poised to give the green light for a hotly contested pay package valued at roughly $56 billion. He also indicated that shareholders were voting in favor of moving the company's place of incorporation from Delaware to Texas. Wall Street is apparently feeling bullish about both news items.

Musk's big payday moves closer to reality, but there's a catch

In 2018, Tesla board members approved a performance-based compensation package that would potentially award Musk with as much as $56 billion worth of company stock. But a Delaware judge struck down the pay package this January on the grounds that the company's board had not shown that the compensation was fair or provided evidence that they had engaged in meaningful negotiations about the CEO's pay. Shareholders have been voting on whether to reauthorize the deal.

While most of the votes on Musk's pay package were submitted yesterday, a small remainder will be submitted later today. The pay package appears likely to pass, but some legal experts think that the Tesla CEO's compensation will once again wind up being challenged in court.

What comes next for Musk and Tesla stock?

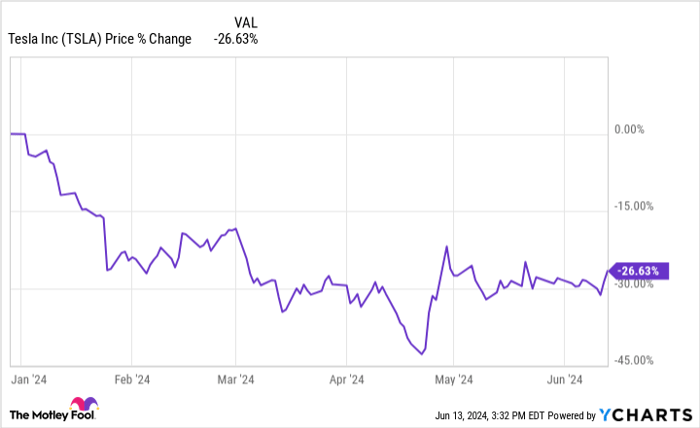

There's no doubt that Musk's leadership has been instrumental in Tesla's incredible rise and stock performance. On the other hand, the EV company has been facing some significant challenges lately. Further complicating the question of Musk's compensation, Tesla stock has seen big sell-offs this year despite an overall bullish backdrop that has powered explosive gains for many tech stocks.

Valued at roughly 72 times this year's expected earnings, Tesla continues to trade at highly growth-dependent multiples despite somewhat sluggish performance for the business. With the company facing pressure from the rise of Chinese EV makers and other players in the space, it may be hard to justify the company's valuation when viewing it through the lens of a traditional automobile maker. But Musk has continued to invest heavily in innovation initiatives, and some investors are willing to assign a premium to the stock based on his vision and the company's track record of disruption.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.