This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia's (NASDAQ: NVDA) performance has been nothing short of remarkable of late. I'm talking about Nvidia the stock and Nvidia the company. The stock's performance speaks for itself. Shares have exploded higher by about 725% since January 2023.

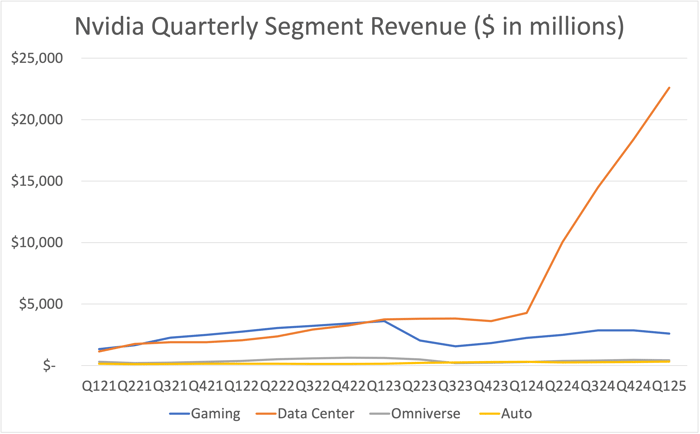

But that surge in price wasn't just driven by overexuberant investors. Nvidia's business itself has exploded -- and its data center business, in particular. Revenue from that segment has more than quintupled in the past year, helping to drive Nvidia's net income up by more than 600%. Growth from sales of the company's artificial intelligence (AI) chips to data centers hasn't yet peaked, but there are already indications of what could drive Nvidia stock's next big move higher.

Explosive growth in data center sales

Nvidia's recent good fortune didn't come by chance. Many years of research and development allowed it to create the most technologically advanced graphics processing units (GPUs) in the industry, and have them available for customers just when the need for that type of computing power skyrocketed. Now, even as it works to accelerate its manufacturing to catch up with current demand, Nvidia already has its next-generation Blackwell chip series in production.

Beyond that, CEO Jensen Huang has also unveiled a new AI chip that it intends to bring to market in 2026. The Rubin platform will succeed the Blackwell, and will include GPUs as well as a new central processing unit (CPU). That will offer customers a more complete data center server system. The already-massive volume of data center spending is reflected in Nvidia's quarterly segment revenue.

Data source: Nvidia.

But while data center revenue has gone parabolic, another Nvidia business segment is operating under investors' radar right now. After all, it wasn't just Nvidia's R&D advancements that led to the growing uses of generative AI and other artificial intelligence applications.

There are now multiple companies that are working to put self-driving cars on the road or use computing power to improve existing vehicles' performance. And there are signs that Nvidia's automotive business could be its next big revenue driver.

Nvidia's next major catalyst

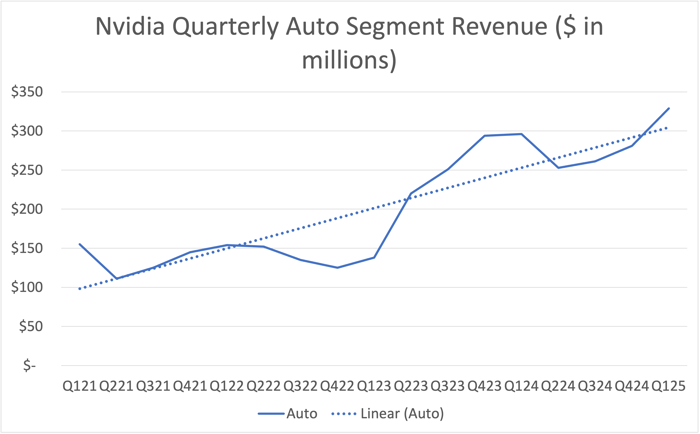

While its auto segment numbers pale in comparison to data center sales right now, there's a trending increase in revenue there as well. Sales growth is already coming as automakers work to improve their vehicles' performance. Electric vehicle (EV) maker Rivian Automotive just announced it would be using Nvidia chips to enhance computing power and improve the range and performance of its R1 platform vehicles.

Data source: Nvidia.

Rivian says it will have 10 times more computing power using Nvidia's DRIVE Orin processors. Nvidia calls its Orin system on a chip the central computer for intelligent vehicles. Other automotive companies partnering with Nvidia include Chinese EV makers BYD, Nio, and XPeng. In addition, Volvo, its subsidiary Polestar, and Mercedes-Benz are among the global automakers that use Nvidia's autonomous driving system.

Nvidia's DRIVE Orin system on a chip is being used by more and more automakers.

Self-driving cars could be Nvidia's next bonanza

That helps explain the recent sales growth for Nvidia's automotive segment. However, consider what might come next as more and more self-driving vehicles are being launched. Much attention is given to Tesla and its plans for robotaxi fleets. It has said it will update investors in August on the progress of its self-driving vehicle efforts. But other companies are a step ahead of the EV leader in autonomous driving, and already have vehicles on the road.

Alphabet's Waymo is expanding its operations as it trains its systems. In May, the company said it was performing 50,000 rides per week in San Francisco, Los Angeles, and Phoenix. Amazon owns self-driving car company Zoox, and it has plans to test vehicles in Austin and Miami.

To be sure, regulatory hurdles remain, and data will be needed to prove that the technology is safe and advantageous for consumers. But investors who can be patient for that data collection and process to play out could do well by being in Nvidia stock before that sector takes off.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.