This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

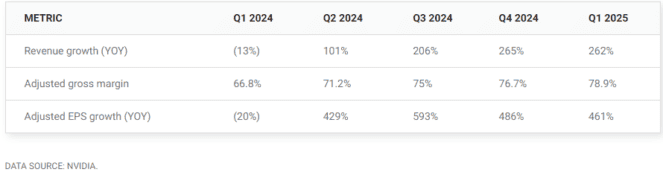

Nvidia's (NASDAQ: NVDA) stock jumped 9% to a new all-time high on May 23, after the company posted its latest earnings report. In the first quarter of fiscal 2025, which ended on April 28, the chipmaker's revenue surged 262% year over year to $26.0 billion and exceeded analysts' estimates by $1.5 billion. Its adjusted earnings surged 461% to $6.12 per share and also cleared the consensus forecast by $0.54.

Those growth rates were explosive, but does Nvidia's stock still have room to run after rallying about 2,720% over the past five years? Let's review the four reasons to buy Nvidia's stock — as well as the four reasons to sell it — to decide.

The key numbers

Back in fiscal 2023, which ended in January of that year, Nvidia's revenue flatlined as its adjusted EPS fell 25%. Its sales of gaming GPUs cooled off as PC shipments declined in a post-pandemic market, and the macro headwinds curbed its sales of data center chips. But in fiscal 2024, its revenue and adjusted EPS surged 126% and 288%, respectively.

That abrupt acceleration was driven by the rapid expansion of the artificial intelligence (AI) market. Nvidia's data center GPUs are used to process complex AI tasks, and the market's demand for those chips quickly outstripped its available supply. Nvidia generated 87% of its revenue from its data center chips in the first quarter of fiscal 2025.

Nvidia also announced a 10-for-1 stock split that will take effect on June 7. The split won't alter Nvidia's valuations, but it might attract some interest from smaller retail investors while boosting the stock's liquidity through more options trading.

The four reasons to buy Nvidia

The bulls still love Nvidia for four reasons. First, they believe it will continue to dominate the AI market with its data center GPUs. The global AI market could still expand at a compound annual growth rate (CAGR) of 37% from 2023 to 2030, according to Markets and Markets, and Nvidia could be the simplest way to profit from that secular boom.

Second, its first mover's advantage in the AI space gives it tremendous pricing power. Its top-tier H100 GPUs cost more than $40,000, and it can keep raising those prices to boost its gross margin. Third, Nvidia's gaming business, 10% of its first-quarter revenue, is gradually recovering as the PC market stabilizes.

Lastly, Nvidia's stock still looks reasonably valued relative to its growth potential. From fiscal 2024 to fiscal 2027, analysts expect its revenue to grow at a CAGR of 43% as its EPS increases at a CAGR of 49%.

Based on those estimates, Nvidia's stock trades at just 41 times forward earnings. Advanced Micro Devices (AMD -3.77%), which is growing at a much slower rate and has less exposure to the AI market, trades at 46 times forward earnings.

The four reasons to sell Nvidia

Meanwhile, the bears are skeptical about Nvidia for four reasons. First, they believe Nvidia will lose its first mover's advantage in the data center GPU market as more competitors carve up the market. AMD's new Instinct data center GPUs already cost less than Nvidia's top-tier GPUs, and tech giants such as Microsoft, Alphabet's Google, and Meta Platforms have all been developing their own in-house AI chips to reduce their long-term dependence on Nvidia.

Second, U.S. regulators recently barred Nvidia from shipping its top-tier AI GPUs to China. That pressure could drive Chinese chipmakers to accelerate their development of comparable AI accelerators. If those efforts are successful, Chinese companies could eventually flood the global market with cheaper AI chips and crush Nvidia's gross margins.

Third, Nvidia's insiders sold about twice as many shares as they bought over the past 12 months. That cooling insider sentiment suggests that Nvidia could be running out of room to run as the market hovers near its all-time highs. Last but not least, the recent buying frenzy in AI chips could eventually lead to a supply glut if the market finally cools off.

The strengths still outweigh the weaknesses

Nvidia faces some long-term challenges, but I believe its strengths still clearly outweigh its weaknesses. Its business is still firing on all cylinders, its margin is expanding, and its stock still looks reasonably valued. Therefore, it's not too late to accumulate more shares of Nvidia if you believe the AI market will continue flourishing over the next few decades.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.