This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The "Magnificent Seven" stocks of Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, Apple, and Nvidia (NASDAQ: NVDA) capture much of the attention in the red-hot artificial intelligence (AI) space.

Among this exclusive club, Nvidia might just be the most important. The company specializes in high-performance graphics processing units (GPUs) that are used for a variety of applications across the generative AI spectrum.

Unprecedented demand for Nvidia's chips and data center services has fueled a new wave of growth for the company. With shares up over 220% in the last year, many investors probably think they've missed the boat.

But what if I told you that I think Nvidia's story is just getting started? Let's dive into why now is still a great time to consider Nvidia for your portfolio.

Chips and data centers are the name of the game, but...

Earlier this year, Nvidia CEO Jensen Huang proclaimed that "accelerated computing and generative AI have hit the tipping point."

Indeed, not only are business leaders scrambling to keep up with the latest breakthroughs in artificial intelligence, but they are figuring out in real time how exactly AI best serves their needs. For now, Nvidia seems to be the engine powering all sorts of applications in the AI realm thanks to its GPUs and data center services.

NVDA Revenue (Quarterly) data by YCharts

2023 was a milestone year for Nvidia. The company grew revenue 126% year over year to $60.9 billion. Meanwhile, both net income and free cash flow rose nearly sixfold year over year.

These results are undoubtedly impressive. But savvy investors understand that this level of growth isn't sustainable in the long run. Existing competitors in the chip space include Intel and Advanced Micro Devices -- both of which stand to benefit from the secular themes fueling the overall accelerated computing market.

Moreover, Meta Platforms, Amazon, and even Microsoft have been rumored to be working on their own line of training and inferencing chips, which could pose a threat to Nvidia over time.

This dynamic has Ark Invest CEO Cathie Wood suggesting that Nvidia could end up like Cisco Systems after the dot-com crash in the early 2000s. While that is an interesting viewpoint, I see it as unlikely. Nvidia has already quietly invested in several aspects of artificial intelligence beyond its core chip operation.

In essence, I see these as early indications that Nvidia is laying the foundation to build a full-spectrum AI solution.

...Nvidia has more up its sleeve

Given Nvidia's rising profits, the company has achieved an enviable level of financial flexibility over the competition. It has been aggressively investing in other areas within the AI landscape including robotics and enterprise software.

Earlier this year, Nvidia joined Intel, OpenAI, and Amazon co-founder Jeff Bezos in a $675 million funding round for a humanoid robotics start-up called Figure AI. This is an interesting move, and one that I think is currently underestimated.

Believe it or not, there are several companies developing humanoid robots. Tesla's Optimus bot and Boston Dynamics are probably the best-known examples of this technology.

The general idea is that these bots will be deployed in various settings across manufacturing, warehousing logistics, and even retail. As such, robotics has the potential to completely reshape the labor force. It's no wonder Goldman Sachs is forecasting that humanoid robotics will be a $38 billion market by next decade. Nvidia has a unique opportunity to play a critical role in the further development of humanoid robotics from both a software and hardware aspect.

Another area where Nvidia quietly makes inroads is enterprise software. While data centers and compute networking account for the bulk of Nvidia's revenue today, the company also has a budding software services business.

Over the last few months, investors learned that Nvidia is an investor in voice-recognition software company SoundHound AI. While AI-powered voice technology may seem like a niche market, Statista estimates that it could be worth as much as $50 billion by 2029.

In addition to SoundHound AI, Nvidia is also an investor in Databricks -- a $43 billion privately held start-up that competes with big data analytics company Palantir Technologies as well as cloud data warehousing enterprise Snowflake.

Lastly, an under-the-radar opportunity for Nvidia could be in the healthcare space. Danish pharmaceutical company Novo Nordisk -- which makes Ozempic -- recently announced that it is building a supercomputer to help pioneer a new frontier in the medical landscape. And guess what? The supercomputer will be relying heavily on Nvidia chips.

Is now a good time to invest in Nvidia stock?

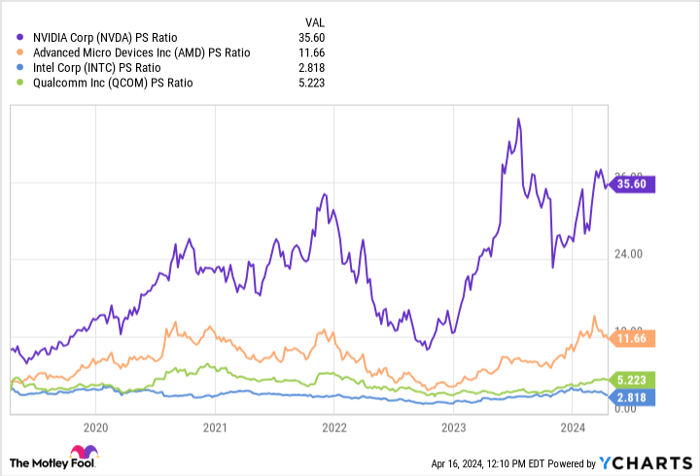

The chart below benchmarks Nvidia against a peer set of other leading chipmakers on a price-to-sales (P/S) basis. Nvidia's P/S of 35.6 is by far the highest in this cohort. This makes sense given how much the stock has run over the last year.

NVDA PS Ratio data by YCharts

But at the end of the day, investors should be wondering why Nvidia's valuation has soared relative to its peers. The themes explored above showcase that, for now, Nvidia is the undisputed leader in the AI chip space. And while competition will likely come at some point, Nvidia is already hedging its bets -- looking to expand beyond GPUs and data center services.

While Nvidia stock is a bit pricey, I see the premium as well worth it. As the AI narrative continues to play out, I wouldn't be surprised to see Nvidia making noticeable progress in other areas as well. I think the company's growth story is just beginning, and see now as a terrific opportunity to scoop up some shares and hold for the long run.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.