The Lovisa Holdings Ltd (ASX: LOV) stock price is at one of those age-old junctions in the investment world. Shares in the jewellery chain have moved like a bat out of hell these past six months, giving investors some pause for thought.

Ultimately, the dilemma sits within the million-dollar question… can a company's shares still be worth buying after a massive rally? It's a question that toys with the human psyche, breathing life into the psychological bias known as the 'anchoring effect'. And, of course, no one wants to be caught buying at the top.

Six months ago, Lovisa shares could be purchased for under $18.50. Fast forward to today, Lovisa stock is now perched at $31.23 apiece, rising 70% in half a year.

Does the recent rally prevent Lovisa from being added to my shopping cart? Or is there an argument for buying Lovisa stock in April?

Let's dive in.

It looks fundamentally expensive

Studying the fundamentals is a good place to start when deciding whether to invest in a company.

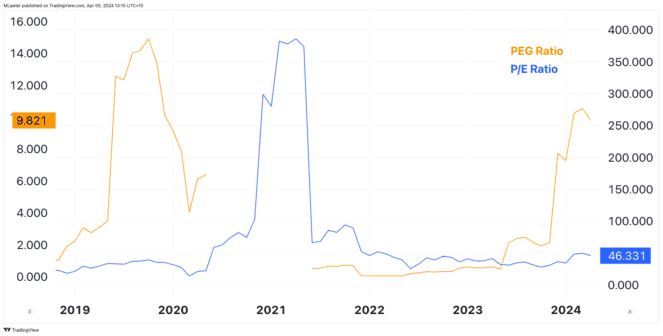

When I check Lovisa, there's no denying it appears expensive. The company's profits have grown, but not as much as the share price. As such, the price-to-earnings (P/E) ratio has expanded to around 47 times earnings — its highest multiple since March 2022.

Lovisa's PEG ratio is also at a 52-month high (four years and four months). Essentially, this means investors are paying a hefty premium for a relatively modest expected earnings per share (EPS) growth rate, as shown below.

There's also the risk of consumer spending taking a whack. February's retail trade data showed a 4.2% increase month-on-month for the 'clothing, footwear, and personal accessory retailing' segment.

However, the strength of the economy is leading some economists to believe interest rate cuts will be delayed until next year. That could mean greater financial pressure on Aussie households towards the end of the year as cash surpluses run dry.

I'd still buy Lovisa stock for its long-term potential

A lot of time and effort is poured into trying to work out when a company's shares are 'cheap' or 'expensive'. Too much time, in my honest opinion.

And yes, valuation is important to an extent. There is such a thing as paying too much for a stock. But, its importance arguably pales in comparison to the quality of the business and its management. This is a point that legendary investor Terry Smith has made before, stating:

People spend almost their entire effort thinking about whether something's cheap or expensive or highly rated or lowly rated, which I guess is a better way of expressing it, and far too little deciding whether it's a high-grade business that they really want to own that can compound in value.

Perhaps Lovisa stock is a little 'expensive' right now. At a higher level, though, it remains a quality business with great growth potential as it expands internationally. Whether I buy Lovisa stock at $31, $40, or $20 seems trivial to me when applying a long-term investing lens.