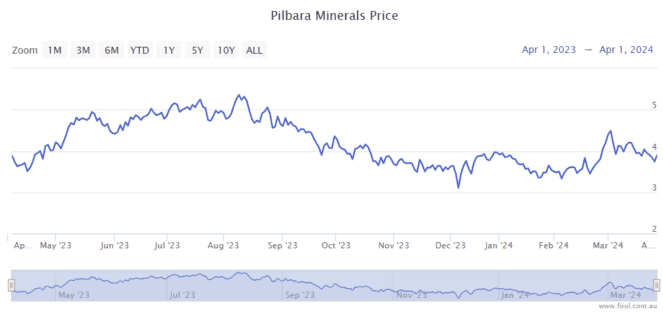

The Pilbara Minerals Ltd (ASX: PLS) share price went down by around 9% in March 2024. Is the outlook more optimistic for the ASX lithium share?

There are two key parts of the story for Pilbara Minerals in the shorter term – how much lithium (spodumene concentrate) it produces and what price it gets for that production.

Production is growing

In the first half of FY24, the business delivered a 4% increase in its production to 320.2kt.

The company is aiming for a 70% increase in production as it constructs two projects.

The first project is the P680 expansion, the primary rejection facility is operational while the crushing and ore-sorting facility is under construction.

Pilbara Minerals' second project is the P1000 expansion which aims to take the production to 1mt per annum. Earthworks and foundations have commenced.

Growth of production will hopefully be supportive of the Pilbara Minerals share price.

The company recently announced two expanded offtake agreements, growing its supply relationship with leading battery chemical companies Ganfeng Lithium and Chengxin Lithium. Between those two companies, they have customers that include Volkswagen, Hyundai, Tesla, BYD, CATL, Umicore, LG Chem and BMW.

In the calendar years 2025 and 2026, those two companies could take between 410k to 460k of spodumene concentrate.

Lithium price

The FY24 first-half's financial performance was impacted by lower lithium prices – the realised price (CIF China) was down 67% to US$1,645 per tonne.

Is there going to be a recovery of the lithium price? It's difficult to say – a key part of the situation will be supply and demand.

Pilbara Minerals revealed numbers from Benchmark Mineral Intelligence which showed there were 13.8 million global electric vehicle sales in 2023 and this is predicted to grow to an estimated 36.1 million in 2028 and 59.1 million in 2033.

The annual lithium demand is projected to grow at a compound annual growth rate (CAGR) of 24% between 2023 and 2028. Of course, supply is also growing, with Pilbara Minerals adding to that.

Pilbara Minerals recently accepted a pre-auction offer for a 5,000 dry metric tonne (dmt) lithium spodumene concentrate cargo ahead of a scheduled digital auction of the Battery Material Exchange (BMX). The offer equated to an approximate price of US$1,200 per dmt on a SC6.0 China equivalent basis.

The company is going to review a variety of sales avenues including offtake contracts, closed tenders, auctions and other commercial opportunities.

UBS, a broker, recently suggested the average realised for the 2024 calendar year could be US$600 per tonne. It still sees the market in a surplus, though shrinking. Due to that, UBS has a sell rating on Pilbara Minerals shares.

But, of course, it's possible that the lithium price could positively surprise if demand is stronger than the pessimist expectations. In the longer term, Pilbara Minerals may be able to get exposure to more of the lithium supply chain.