It may surprise the average punter, but only $12,000 can send you on your way to receiving thousands of dollars of annual passive income.

Allow me to use reliable ASX dividend stock Woodside Energy Group Ltd (ASX: WDS) as an example.

Put a little bit on Woodside stock

Assume that you use your $12,000 to buy a batch of Woodside shares.

Currently 10 out of 17 analysts surveyed on broking platform CMC Invest reckons the ASX energy giant is a buy.

We all know past performance is never an indicator of the future. But just to demonstrate the power of compounding, let's use the numbers we have.

Woodside shares currently hand out an excellent 7.1% fully franked dividend yield.

Then conservatively assume there will be zero capital gain in the coming years, and that the distributions are the only source of returns.

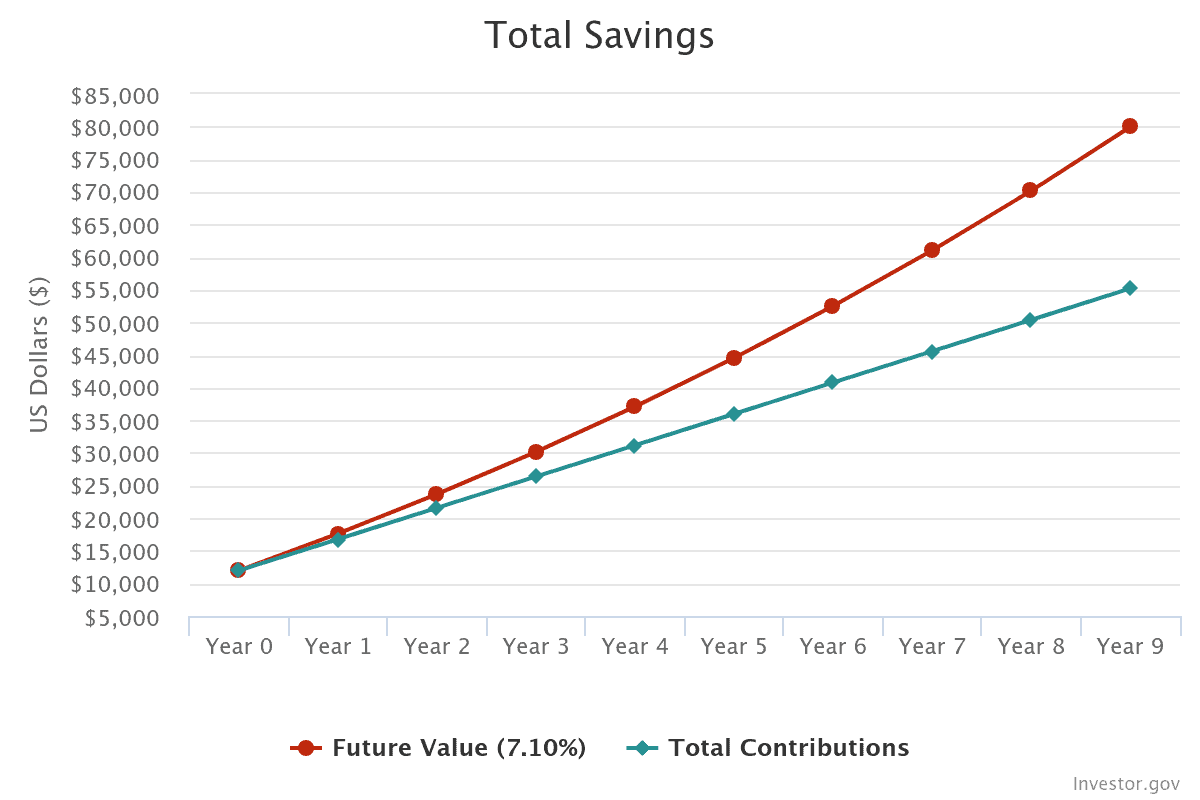

If you can keep those shares growing at 7.1% per year while adding in $400 monthly, chunky passive income is not too far away.

Then reinvest for 9 years

Nine years of that investment regime will see the nest egg grow to $79,981.

After that, instead of reinvesting the dividends, just put the cash in your bank account.

That means from that point you pocket an average of $5,678 of passive income each year.

How good is that!

The point of this hypothetical was to show how starting with just a small amount to invest can quickly grow to an income generating machine.

In reality, you will want to diversify your portfolio, rather than buy only Woodside shares.

Fortunately, there are plenty of excellent shares out there that can deliver you a 7% yield, or 7% growth — or even more.

And don't forget, the above scenario was based on your shares not seeing any capital gains over those nine years.

If you manage the portfolio properly, that will also be unlikely.

Good luck out there.