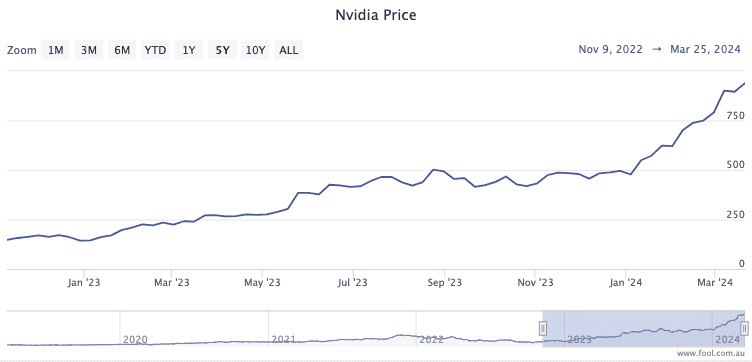

There's not much argument that the world's hottest stock in the past year or so has been Nvidia Corp (NASDAQ: NVDA).

The shares for the US company have rocketed 539% since early January 2023, on the back of the hype around artificial intelligence (AI).

Funnily enough, Nvidia itself doesn't produce any AI.

The Californian business makes computer chips that its customers need to power all the intensive computing needed to run intelligent algorithms.

In other words, Nvidia is selling the "picks and shovels" — or the tools — needed to make the coolest tech that everyone wants.

Now, if you feel like you missed the boat on Nvidia shares, you need not worry.

There are plenty of other companies that could benefit from the AI revolution in a similar way, even here in Australia.

The tech stock in 'outstanding position' to cash in on AI hype

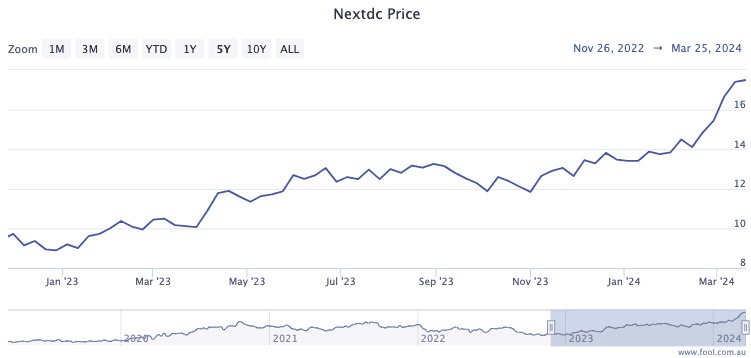

One example looking like an excellent buy right now is NextDC Ltd (ASX: NXT).

As a data centre provider, the Australian company is even further up the supply chain than Nvidia. It's providing the facilities to house the computers.

The NextDC share price has already doubled since the start of last year, but many professionals are predicting there is plenty more where that came from.

The recent half-year results were warmly received, with the stock hitting all-time highs.

Chief executive Craig Scroggie acknowledged the contribution artificial intelligence was making to the booming business.

"As demand continues to be bolstered by the broad adoption of new technologies such as generative AI, the business remains in an outstanding position to support customer growth requirements across the enterprise, government and hyperscale verticals."

NextDC also has a second long-term tailwind that it's riding on, in cloud computing.

All this has led to a remarkable 14 of 17 analysts naming the stock as a buy, according to broking platform CMC Invest.

Moomoo market strategist Jessica Amir last month named NextDC as one of the stocks she would buy and hold onto until the next leap year.

"Positioned to capture [and] generate AI opportunities," she said.

"Half of its revenue is from NSW and ACT — huge potential to expanding capacity and geographically — and it's doing that."