ASX small-cap shares are enjoying a nice run at the moment.

No doubt the prospect of interest rates peaking and even coming down this year has helped the cause.

This week DNR Capital portfolio manager Sam Twidale named three small-cap stocks that his team is loving right now:

Sales, cash and expansion. What more could you want?

In a DNR video, Twidale said that a big takeaway from last month's reporting season was the bullishness for some consumer discretionary stocks.

"That's an area we've been adding to in our emerging companies fund. It's been a core overweight.

"We've seen some great opportunities to buy some good quality businesses where the market's got some short-term concerns around the outlook."

And the pick of the lot, which his team has been buying regularly over the past year, is Lovisa Holdings Ltd (ASX: LOV).

"I think the result really sort of put to bed some concerns there that the market had [with] sales more resilient than the market was expecting.

"Also the margins came in better than expected, showing very good cost control, strong cash flow, strong balance sheet, and really brought the focus back onto the store rollout potential."

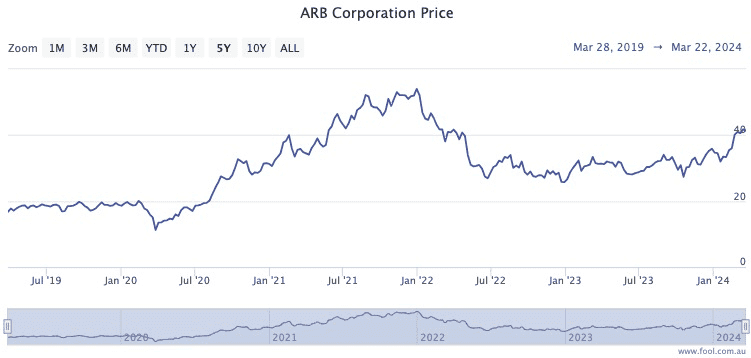

The small cap on the comeback trail

After a pretty ordinary couple of years, 4WD accessories merchant ARB Corporation Ltd (ASX: ARB) had a turnaround reporting season.

"Again, that business is really benefiting from its strong market leadership," said Twidale.

"The company now has sales better than expected [and] a very strong order backlog."

Similar to Lovisa, Twidale felt margins reported better than expected, and ARB exercised decent pricing power and cost control.

"The company's really benefiting from that fixed cost leverage, benefiting from the economies of scale and the efficiencies that they're getting."

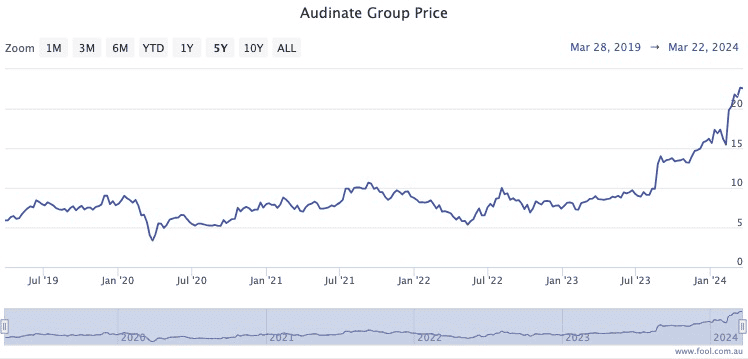

Small-cap disruptors shining bright

Technology was another boom area to come out of earnings season, according to Twidale.

"We're seeing what's happening overseas with the impact of AI and there's some great companies here for investors to get exposure to with a lot of disruption happening."

A great example of businesses cashing in on this structural change is Audinate Group Ltd (ASX: AD8).

"That company's really disrupting the professional AV industry, helping them convert from analog to digital based signals over networks.

"And that company really is consolidating that market leadership position that they have. The result really highlighted that."

Twidale noted that Audinate now has almost 7 million devices in the real world with its networking protocol embedded.

"There's an opportunity to leverage that install base with a software opportunity on top," he said.

"We continue to like these businesses, which have a long runway for growth. They're reinvesting a high return on invested capital, and we think that puts them in an attractive position, long-term, to deliver that capital growth for investors."