Can lightning hit twice in the same spot?

The old cliche suggests it doesn't, but scientifically lightning certainly can and does strike twice in the same place.

If you're on the scientists' side, it might be time to consider buying Santos Ltd (ASX: STO).

Curious? Read on.

The ASX 200 marriage that never was

Late last year, the oil and gas giant explored whether it would merge with its larger S&P/ASX 200 Index (ASX: XJO) rival Woodside Energy Group Ltd (ASX: WDS).

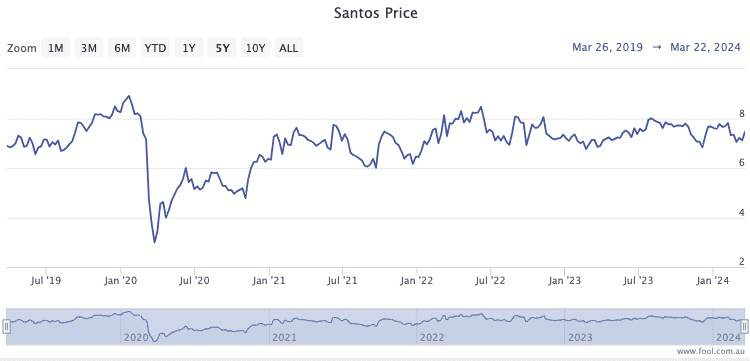

The Santos share price had been stagnant for the past half-decade, and this deal was meant to be the light at the end of the tunnel for its long-suffering shareholders.

The price-to-earnings (P/E) ratio sits at half of Woodside's.

Unfortunately, last month the merger talks were terminated. Neither side has publicly revealed the reasons the deal fell over.

The Santos share price immediately sank 8% when that news came.

Then just to rub salt into the wound, the shares plunged again after its 2023 full year result failed to impress investors.

Both underlying net profit after tax (NPAT) and free cash flow from operations headed 42% for the year.

Ouch.

Could the romance be rekindled?

Despite these events, Shaw and Partners senior investment advisor Jed Richards right now thinks Santos is the far stronger buy than Woodside.

"The future growth prospects pipeline is far stronger for Santos than Woodside Energy, in my view," Richards told The Bull.

And he reckons the Woodside marriage story is not over yet.

"Santos has positioned itself well over the past few years to be an attractive addition for Woodside.

"Although the last round of negotiations hasn't resulted in a merger, I expect this strategy will be addressed again in the future."

It seems Richards is not the only professional keen on Santos right now.

According to broking platform CMC Invest, 13 out of 17 analysts currently rate the energy stock as a buy.