With the market optimistic about the economy and interest rates, there are plenty of excellent buys at the moment on the S&P/ASX 200 Index (ASX: XJO).

However, there are four specific stocks that one expert is warning investors to cross the street to avoid.

"The recent bank stock rally looks overdone," Wilsons equity strategist Rob Crookston said in a memo to clients.

"Valuation multiples have risen significantly, and are now stretched relative to historical norms."

Let's explore the reasons why these ASX 200 shares seem so expensive now.

'Valuations are disconnected from fundamentals'

Crookston said that the stock prices for the major banks are now out of sync with their business outlook.

"Current valuations are disconnected from fundamentals, given the tepid (+2%) earnings growth expected over the next 2 years."

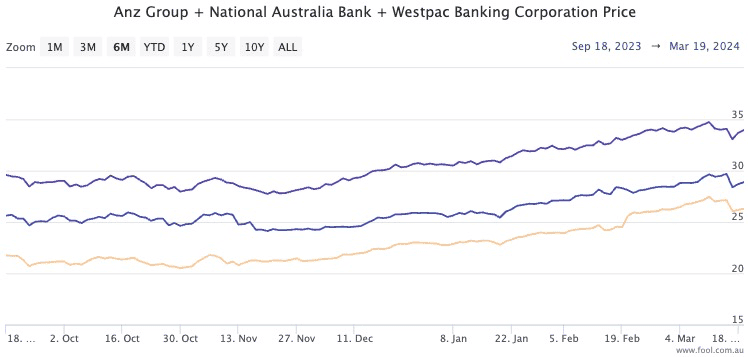

All four stocks have rocketed over the past six months:

- Westpac Banking Corp (ASX: WBC) share price up 26%

- National Australia Bank Ltd (ASX: NAB) up 20%

- Commonwealth Bank of Australia (ASX: CBA) up 17%

- ANZ Group Holdings Ltd (ASX: ANZ) up 15%

Crookston noted that the market seemed to be bidding these upwards because of an expectation that earnings will grow over the next 12 to 24 months.

But to him, that thesis just does not hold.

"Our analysis of historical trends and current consensus estimates suggests limited upside to forward earnings, even with the possibility of a soft landing and interest rate cuts in the next 12 to 18 months."

Industry trends aren't optimistic

All four ASX 200 shares are now flying above where they were just before the COVID-19 crash back in February 2020.

In a competitive market, Crookston is worried about the long-term trend for the banking industry.

"Over the past two decades, the return on equity (ROE) of major banks has declined substantially, largely explaining the decrease in the price-to-book ratios."

Australian banks also look expensive compared to comparable foreign peers.

"While CBA has a lower ROE (13.3%) relative to JP Morgan Chase & Co (NYSE: JPM) (14.9%), it trades on a 58% premium on a price-to-book basis.

"While the historically resilient Australian economy and the concentrated nature of the domestic banking sector deserves a premium, this is excessive."

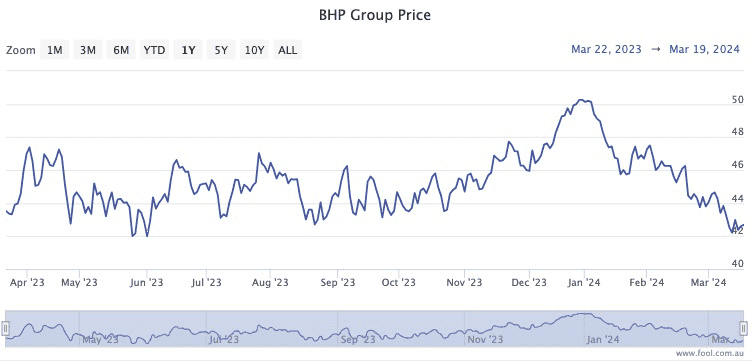

Crookston's team has indeed put their money where their mouths are, recently selling their Westpac shares in order to buy into BHP Group Ltd (ASX: BHP).

"The recent pullback in the iron ore miners presents a good opportunity to lighten our sector underweight by adding to BHP."