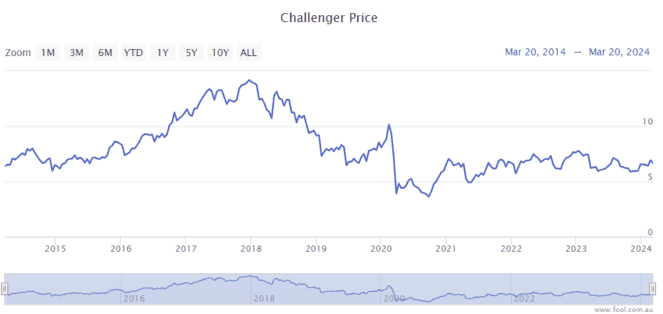

The Challenger Ltd (ASX: CGF) share price is almost exactly where it was a decade ago. But, it has suffered a lot of volatility during that time. I think it now has a better outlook than I thought.

Challenger is an investment management outfit focused on providing customers with "financial security for a better retirement." It is the largest provider of annuities in Australia.

There are three key reasons why I think Challenger shares could do well as an investment.

Image source: Getty Images

Higher interest rates

For me, this is the key difference compared to a few years ago.

There is generally a relationship between central bank interest rates and the return that Challenger offers on some of its key annuities. It's understandable why some people wouldn't want to sign up to a long-term/lifetime annuity if the rate is low.

With the Reserve Bank of Australia (RBA) cash rate now a lot higher than it has been for a long time, Challenger is seeing good demand for its lifetime annuity. In the FY24 first-half result, lifetime annuity sales increased 190% to $1.1 billion.

The Challenger Life business saw earnings before interest and tax (EBIT) increase 15% to $302 million, and the pre-tax return on equity (ROE) increased 330 basis points to 18.1%.

I think we've entered a new period in which interest rates will remain much higher than they were in the 2010s.

The HY24 result saw normalised net profit before tax (NPBT) grow by 16% to $290 million, while group assets under management (AUM) increased by 18% to $117 billion. Normalised net profit after tax (NPAT) rose 20% to $201 million.

The company expects normalised NPBT to be in the top half of the $555 million to $605 million guidance range.

According to the estimate on Commsec, the Challenger share price is valued at 12x FY24's estimated earnings, which seems like a good valuation consideration profit is expected to grow, and it's exposed to useful tailwinds.

Retirement tailwinds

There are a number of significant trends in the retirement sector.

Challenger referred to Deloitte research that shows Australian superannuation assets are expected to increase from $3.5 trillion today to at least $9 trillion in the next 20 years. There are mandatory (and increasing) contributions, while earnings and contributions are helping the compounding.

The company said that 2.5 million Australians were moving to the retirement phase over the next 10 years, suggesting that the ageing population was a useful tailwind.

Around two thirds of Australian retirees are reportedly concerned with a rising cost of living, and Challenger can help address that worry.

Challenger has a market share of around 88% of annuities in Australia, and that market has grown at a compound annual growth rate (CAGR) of 6% over the past three years.

Plus, the Australian government is progressing a range of reforms to enhance the retirement phase.

Dividend

Challenger has gotten back to growing its dividend for shareholders, which is useful for long-term investors.

According to the estimates on Commsec, the company is projected to pay an annual dividend per share of 25.1 cents in FY24, which would be a grossed-up dividend yield of 5.4%. In FY26, it could pay a grossed-up dividend yield of 6.2% in FY26, according to the projection.

If it can couple a rising dividend with a growing Challenger share price, then it may perform well for shareholders. Having said that, past experience says it won't be a smooth ride.