Telstra Group Ltd (ASX: TLS) shares are down 1.2% today, trading for $3.78 apiece.

That puts the S&P/ASX 200 Index (ASX: XJO) telco down 5.5% since the closing bell on 14 February.

Telstra reported its half year results on 15 February. Despite some solid financial metrics and a boost to the fully franked interim dividend, Telstra shares closed down 2.3% on the day.

Among the highlights of the half year was a 1.2% increase in total income, which reached $11.7 billion. And the company's net profit after tax was up 11.5% to $1.0 billion.

That came as welcome news to passive income investors, with management increasing the interim dividend by 5.9% from the prior year to 9 cents per share. This represents the highest interim dividend payout since 2018.

Eligible shareholders can expect that cash to hit their bank account next week, on 28 March.

Atop the final dividend of 8.5 cents per share, paid on 28 September, that equates to a full-year payout of 17.5 cents per share.

That sees Telstra shares currently trading at a fully franked yield of 4.6%.

So, how are these ASX 200 investors earning more than 6.5%?

How these passive income investors boosted the yield from their Telstra shares

The secret to these passive income investors' success is in their timing.

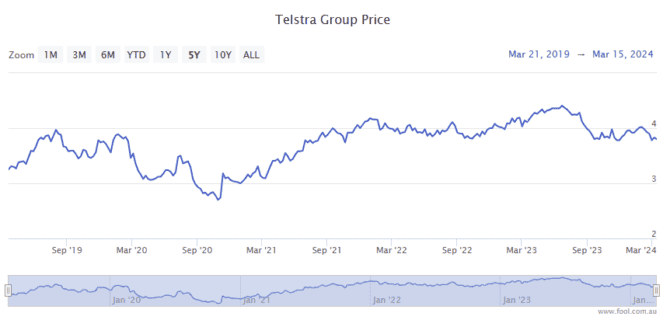

Namely, buying Telstra shares after the company was hit by both the COVID pandemic and a series of bushfires in 2020, which damaged a lot of valuable infrastructure.

Now, trying to time the market and buy stocks at their lows is tricky on the best of days. You might find yourself buying a stock that has much further to fall yet. Or you might miss the real bottom and end up watching a stock rebound from its lows without owning any.

But well-advised or just plain lucky ASX investors who bought Telstra shares on 30 October 2020 could have picked them up for just $2.68 apiece.

These investors will have received the same 17.5 cents per share in dividends Telstra has paid out (or shortly will pay out) over the past 12 months.

Meaning they're earning a juicy 6.5% yield from those shares.