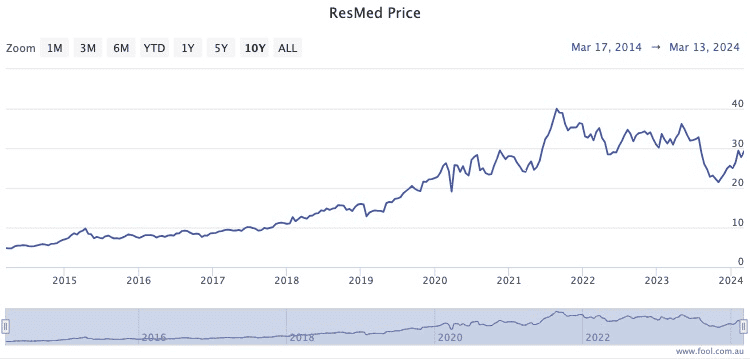

Resmed CDI (ASX: RMD) has been a staple in many ASX stock portfolios for decades now.

And it has rewarded the faith handsomely, becoming a 6-bagger over the past ten years.

It's a stunning 19-bagger if you go back 20 years.

Of course, the catch is that those investors who bought in March 2004 or 2014 would not have known with 100% certainty that their investment would become so successful.

That's the nature of investing in shares. You buy them when they're cheaper to take on the risk that the story could turn sour — or become a wild triumph.

There is one ASX stock at the moment that I think has the potential to become the next ResMed.

While I can't tell you whether it will have become a 6-bagger in 2034, it currently has a fighting chance to be much higher compared to now.

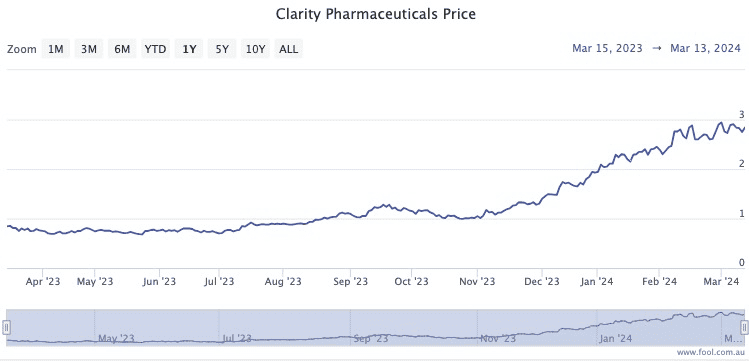

This ASX stock has tripled in a year

Like ResMed, Clarity Pharmaceuticals Ltd (ASX: CU6) also plays in the healthcare field but is involved in developing products for prostate cancer.

Already this year the stock price has rocketed just shy of 30%. The shares have more than tripled in the past year.

That's all due to favourable results coming from testing of its copper therapies on prostate cancer patients.

Back in January, Frazis Capital portfolio manager Michael Frazis was full of praise for the Sydney biotech.

"This is the most exciting company I've come across in Australia lately."

Providing hope for a bleak situation

Even though prostate cancer is common, the fact remains treatments can be soul-destroying for patients.

"Treatment involves radical prostatectomy to remove 'the true heart of the male', hormone therapy, and traditional radiotherapy and chemotherapy," said Frazis in a memo to clients.

"These come with a bleak list of side effects: incontinence, impotence, loss of interest in sex, and depression."

Clarity is one of a bunch of companies seeking to improve this situation.

"The hope is that the next generation of radiopharmaceuticals will be able to differentiate between harmless and metastatic disease, limit unnecessary treatments, catch any recurrence, and ultimately cure prostate cancer without such bleak side effects."

Admittedly the $717 million company is sparsely covered by professional investors at the moment.

But broking platform CMC Invest shows at least Jefferies and Wilsons rating Clarity Pharmaceuticals as a buy currently.