This is a historic month for Australians.

For the first time in living memory, the Reserve Bank of Australia will hand down a scheduled interest rate decision that's not on the first Tuesday of the month.

The central bank is now running on a reformed calendar, which means the board will reveal its judgement at 2:30pm this Tuesday.

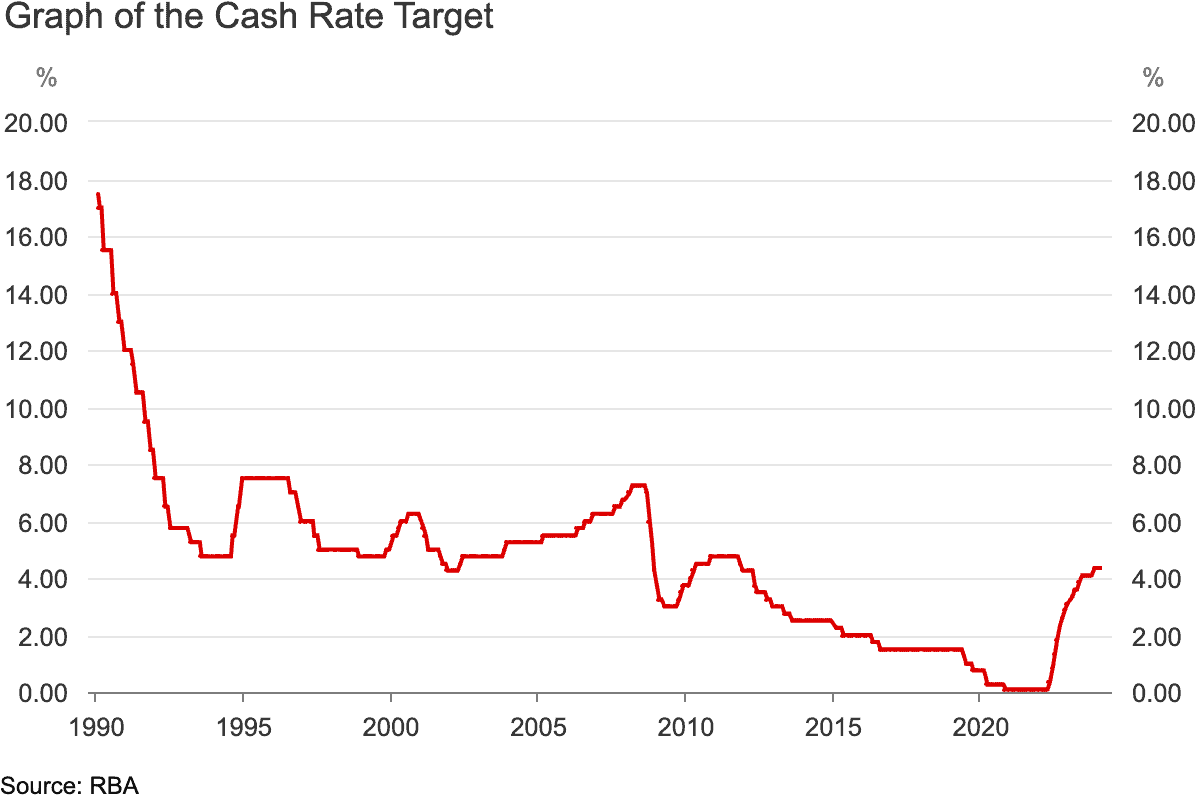

It's fair to say share markets and mortgage holders alike are waiting keenly for rate relief after a tough couple of years.

So what do the experts think will happen?

Interest rates guessing game

According to a survey of economists conducted by comparison site Finder, all 41 experts are tipping that the Reserve Bank will leave interest rates on hold on Tuesday.

So with Tuesday's decision seemingly a foregone conclusion, the next question is when will the rates come down?

That is where the experts start disagreeing.

While rate rises might be done, QIC chief economist Matthew Peter reckons the RBA will still be cautious about inflation in the coming months.

"Elevated migration, coming tax cuts and ongoing wage increases will stop the RBA from easing back on monetary policy until later this year."

Some have gone even further, with a quarter of the economists tipping rate cuts won't come until next year or beyond.

July tax cuts could replace rate cuts

Corinna Economic Advisory economist Saul Eslake pointed out that the coming stage 3 tax cuts could act as relief for consumers, so that the Reserve Bank will not have to touch rates.

"Australian households will, on 1st July, be getting income tax cuts which, in terms of their impact on aggregate household cash flows, are equivalent to two 25 basis point rate cuts, which households in the Euro area, UK, Canada, US and NZ will not be getting."

Bendigo and Adelaide Bank Ltd (ASX: BEN) chief economist agreed.

"The stage 3 tax cuts are a welcome first step in the need for broad based tax reform.

"They will provide some modest fiscal stimulus that makes a rate cut this year less likely, but still should allow rate cuts in 2025."

This is why, in many ways, the RBA governor's press conference on Tuesday afternoon will be more important for stocks than the actual rate decision.

The market is desperate to hear what the central bank's outlook and intentions are, so the words of Michele Bullock could really rock ASX shares either way.