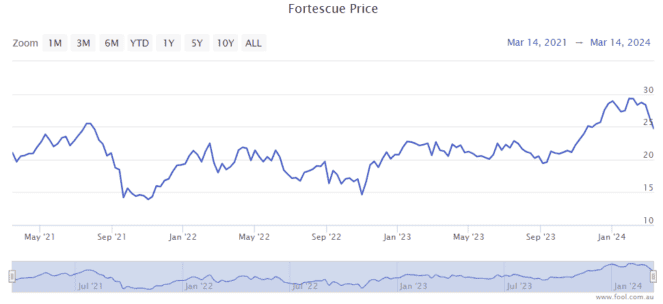

Fortescue Metals Group Ltd (ASX: FMG) shares have done very well for shareholders in recent years.

Thanks to the huge dividends, the ASX iron ore share has delivered an average return per annum of around 21% over the last three years.

There are two main areas that will impact the company's outlook.

Iron ore

The company is one of the largest iron ore miners in the world, so changes in the iron ore price can significantly impact its profit.

The iron ore price has dropped heavily, to under US$110, after being above US$140 per tonne in January 2024. This is the lowest it has been in seven months, according to Trading Economics. That would explain the recent fall of the Fortescue share price.

Trading Economics said the fall of the iron ore price was because of subdued demand in China, due to seemingly cautious steelmakers. Trading Economics suggested the steelmakers are "hesitant to restock due to sluggish production resumption". Steel inventory is reportedly higher than a year ago, reflecting weaker demand by users of steel.

The fall is because of subdued demand in China, as steelmakers look to be cautious and are "hesitant to restock due to sluggish production resumption", with steel inventory higher than a year ago, reflecting "weak downstream demand".

On top of that, the recent "National People's Congress in China failed to provide any significant support for the property market, and a slow start to the construction season is further dampening steel demand", according to Trading Economics.

It's very difficult to predict what's going to happen with the iron ore price – the last four years have shown how volatile things can be.

Commonwealth Bank of Australia (ASX: CBA) analysis suggests the iron ore price could fall below US$100 per tonne in the short term, according to reporting by the Australian Financial Review.

However, CBA also thinks the iron ore price could rebound as a result of higher infrastructure-related demand and offset the weaker property-related demand in China.

CBA is expecting the iron ore price to be between US$100 per tonne to US$110 per tonne during 2024.

However, the further into the future we go, the harder it is to predict.

The iron ore price makes a big difference to Fortescue's profitability.

UBS suggests that Fortescue could make net profit after tax (NPAT) of US$4.9 billion in FY24, US$6.06 billion in FY25, US$4.6 billion in FY26 and US$3.8 billion in FY27.

In other words, UBS is predicting lower profit in future years amid an expected growing amount of production from Africa, which could impact the iron ore price.

Green energy

The business is working hard to create a global portfolio of energy projects that produce green hydrogen. As time goes on, this segment could have a greater impact on the Fortescue share price.

It has achieved a final investment decision on the Phoenix Hydrogen Hub in the USA, and the Gladstone PEM50 project in Queensland, Australia.

The Phoenix hydrogen hub is expected to start commercial operation in mid-2026, so within three years, the company expects to be producing green hydrogen.

The Holmaneset project is on a good course following a €204 million grant from the European Union.

Fortescue has a goal to produce 15 million tonnes of green hydrogen per annum by 2030. So, three years from now will represent roughly halfway.

The company also aims to decarbonise its mining operations by 2030, so in three years, it will need to have made roughly 50% progress towards this goal.

Valuation

Based on the UBS estimates, the Fortescue share price is valued at 7 times FY24's estimated earnings and under 13 times FY27's estimated earnings.

In FY24, it could pay a grossed-up dividend yield of 11.3% and 5.1% in FY27.