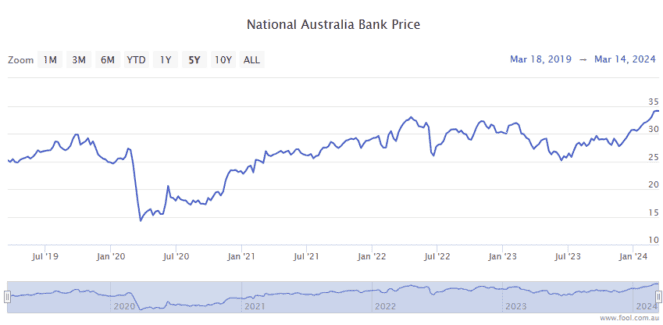

National Australia Bank Ltd (ASX: NAB) shares have been on a tear over the past year.

That's despite the S&P/ASX 200 Index (ASX: XJO) bank stock coming under some pressure this week following a rating downgrade for all the big four Aussie banks from Macquarie.

NAB shares notched a more than five-year closing high last Friday, 8 March, ending the day trading for $35.11 apiece.

Even after the past week's retrace to $33.53 a share at market close this Friday, the big bank's stock is up an impressive 21% in a year.

That handily outpaces the 10% gains posted by the ASX 200 over this same time.

And it doesn't include the two fully franked dividends NAB delivered over the year.

Management pleased passive income investors by upping the full-year payout by more than 10% from the prior year to $1.67 a share.

That sees NAB shares trading at a fully franked trailing yield of 5.0%.

So, how are these passive income investors earning more than twice as much?

How are these passive income investors earning more from NAB shares?

Investors who swallowed their fears in the wake of the early 2020 Covid-fuelled market meltdown and bought ASX dividend shares near the lows tend to have done very well.

It's not always easy following British banker Baron Rothschild's famous advice to buy stocks at a bargain "when there is blood in the streets".

And, to be sure, getting the timing right is no easy trick.

Investors who get it wrong could be buying into a stock that's poised for further steep losses. Or they may wait too long for what they believe is the market bottom, only to find their favourite ASX 200 dividend shares charging higher before they've hit the buy button.

But investors who bought NAB shares on 27 March 2020, when the bank stock closed the day trading for $15.12 a share, certainly have some bragging rights.

Indeed, passive income investors who bought NAB stock on that day will be earning a fully franked yield of 11.1% from those shares.

They'll also have enjoyed a 122% share price increase over that time!

As always, whether you're targeting NAB shares or other leading ASX dividend stocks for passive income, be sure to do your research first.

If you're uncomfortable with that, or simply don't have the time, reach out for some expert advice.