I've owned National Australia Bank Ltd (ASX: NAB) shares for many years now. In fact, NAB was one of the first ASX 200 shares I ever bought. But this March, I'm seriously considering selling my NAB stock.

Normally, I'm an investor who hates selling my shares. For me, selling doubles the mental efforts of stock market investing. It's hard enough to find a company that you'd like to buy as well as the right share price to buy it at. And adding the worry over what price you'd sell at is an unnecessary increase in mental stress in my view.

Instead, I try to emulate the Warren Buffett maxim that "our favourite holding period is forever".

However, this doesn't always go to plan. I've had to sell many of my past investments before, usually due to miscalculations of a company's intrinsic quality on my behalf.

I don't believe I've made a mistake in buying and owning NAB shares for the many years that I have. I've enjoyed some decent capital appreciation on my NAB stock since my first purchase. As well as the generous, fully franked dividend income one expects from an ASX 200 bank share, of course.

Why am I considering selling my NAB stock then?

So my increasing discomfort with owning NAB stock right now stems from valuation concerns. The NAB share price has had a stellar few months. As recently as June last year, this ASX 200 bank was going for around $25 a share.

In the past few weeks though, those same shares have crashed through a series of new 52-week highs, most recently last Friday's $35.12. That means that from June 2023 to March 2024, I've enjoyed a gain of almost 40%. Plus dividends.

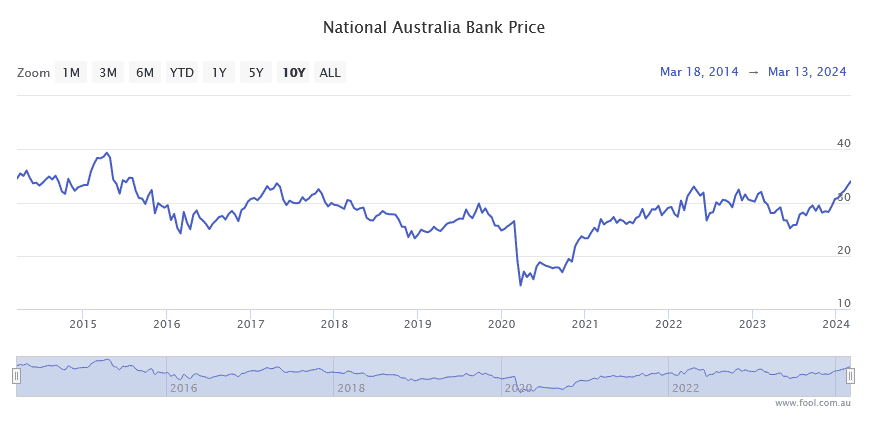

That is a highly unusual return for an ASX bank stock. It's quite common for most ASX banks to spend years sitting at the same share price. Check that out for yourself below:

Every time NAB stock has hit new 52-week highs in the past, it has, more often than not, come down to earth. Sometimes dramatically so. Could this time be different? Possibly. But I doubt it.

NAB, like all ASX banks, is a cyclical share. Investors have enjoyed far more meaningful returns in the past from dividends than capital growth.

So if I sell NAB shares this March, and then buy them back at a future point for a lower share price (and higher starting dividend yield), I'm guessing I'd probably be better off than just holding them.

As I began by stating, I don't like selling my ASX shares. But NAB's new highs have certainly got me questioning that wisdom.